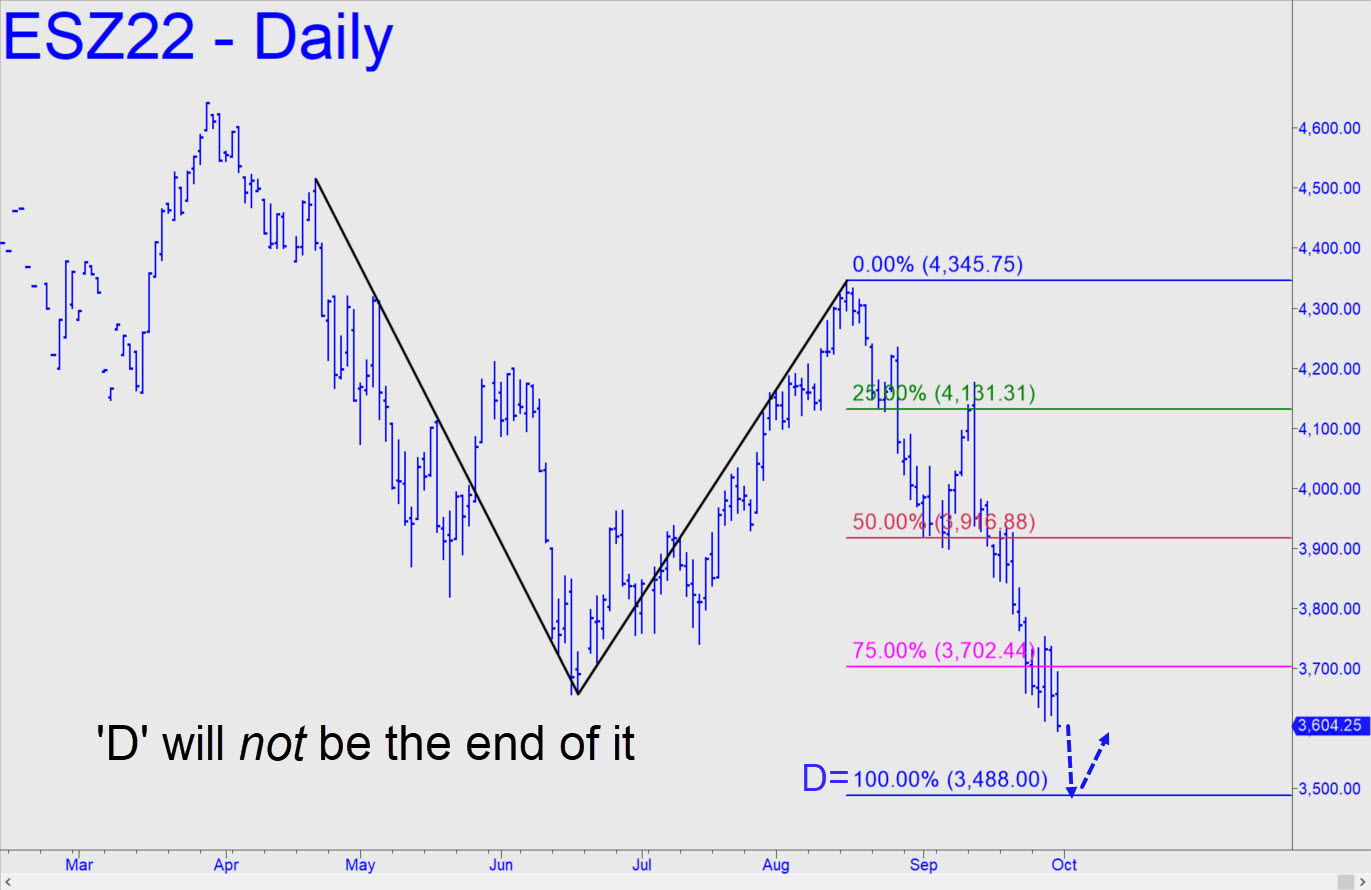

The December contract is headed lower than the 3488.00 target shown, but it still looks like an opportune spot to try bottom-fishing, given the precise bounce from p=3916.88. Sliding the pattern’s point ‘A’ high up to either of two alternatives shown in the chart yields additional downside targets at, respectively, 3401.75 and 3362.00, That last Hidden Pivot support is my worst case for October. However, there is little likelihood the Mother of All Bears will not take a breather at one of those levels, notwithstanding the fact that my expectation is for the S&Ps eventually to fall far beneath the pandemic low at 2174.00. That would represent a further slide of 40% on top of the 25% that has already occurred, but I doubt the bear market will be so kind, since it will be correcting a 30-year spreed of malinvestment. _______ UPDATE (Oct 3, 6:18 p.m.); The 3712 peak of today’s powerful short squeeze precisely achieved the D target of this reverse pattern before the futures eased into the close. If they push above the peak tonight or tomorrow, that would activate this bigger reverse pattern, with a 3846.75 target. Notice that its Hidden Pivot midpoint resistance is coincident with the smaller pattern’s p. That implies double resistance, and any decisive push past it should be assumed strong enough to reach p2=3778.00 at least. The pattern looks well-suited for profitable ‘mechanical’ buy set-ups. _______ UPDATE (Oct 7, 9:11 a.m.): Houston we have a problem. The prop-desk drama queens have pancaked index futures ahead of the bell on absolutely meaningless news that the economy added 263,000 “jobs”. The fact that this has occurred after the December contract missed achieving my 3846.75 target by 26 points, or 0.6%, is a sign that the bear market is about to resume with full fury.

The December contract is headed lower than the 3488.00 target shown, but it still looks like an opportune spot to try bottom-fishing, given the precise bounce from p=3916.88. Sliding the pattern’s point ‘A’ high up to either of two alternatives shown in the chart yields additional downside targets at, respectively, 3401.75 and 3362.00, That last Hidden Pivot support is my worst case for October. However, there is little likelihood the Mother of All Bears will not take a breather at one of those levels, notwithstanding the fact that my expectation is for the S&Ps eventually to fall far beneath the pandemic low at 2174.00. That would represent a further slide of 40% on top of the 25% that has already occurred, but I doubt the bear market will be so kind, since it will be correcting a 30-year spreed of malinvestment. _______ UPDATE (Oct 3, 6:18 p.m.); The 3712 peak of today’s powerful short squeeze precisely achieved the D target of this reverse pattern before the futures eased into the close. If they push above the peak tonight or tomorrow, that would activate this bigger reverse pattern, with a 3846.75 target. Notice that its Hidden Pivot midpoint resistance is coincident with the smaller pattern’s p. That implies double resistance, and any decisive push past it should be assumed strong enough to reach p2=3778.00 at least. The pattern looks well-suited for profitable ‘mechanical’ buy set-ups. _______ UPDATE (Oct 7, 9:11 a.m.): Houston we have a problem. The prop-desk drama queens have pancaked index futures ahead of the bell on absolutely meaningless news that the economy added 263,000 “jobs”. The fact that this has occurred after the December contract missed achieving my 3846.75 target by 26 points, or 0.6%, is a sign that the bear market is about to resume with full fury.

ESZ22 – Dec E-Mini S&Ps (Last:3716.00)

Posted on October 2, 2022, 5:23 pm EDT

Last Updated October 7, 2022, 9:11 am EDT

Posted on October 2, 2022, 5:23 pm EDT

Last Updated October 7, 2022, 9:11 am EDT