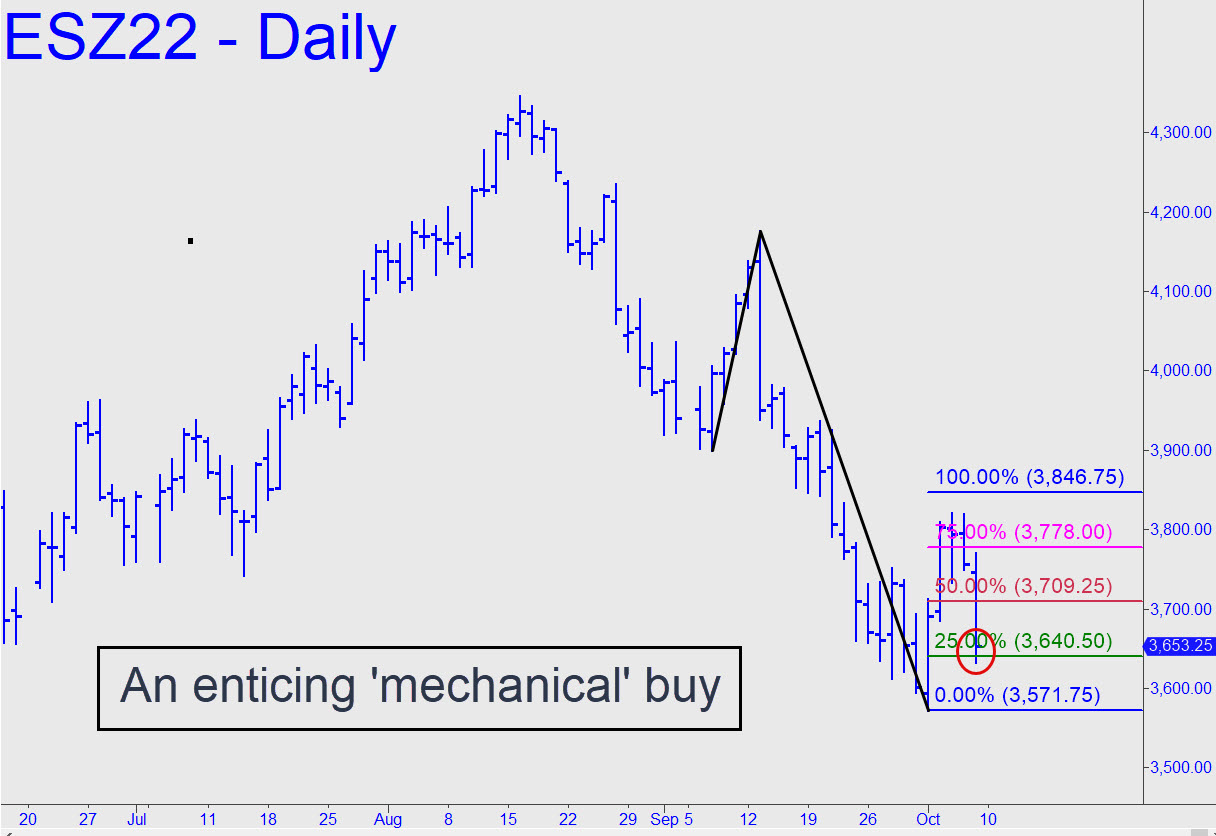

Friday’s refreshing death dive may have felt like the start of something big, but the chart suggests we’d probably have been buyers at the close. The 106-point selloff hit the green line after topping midway between p2 and D, generating a classic ‘mechanical’ buy signal that we’ve seen work again and again. This is not to say the rally we can expect on Monday will necessarily reach D=3846.75, only that getting long at the green line (stop 3571.75) would probably have been a good bet for at least a one-level ride to p=3709.25. That’s a nearly $14,000 opportunity, but we passed it up because staking out a position in the final hour of a Friday is courting trouble and not how we roll. ______ UPDATE (Oct 10, 11:06 p.m.): Although the ‘mechanical’ buy at 3640.50 (stop 3571.50) remains nominally alive, today’s dirge killed my interest in the trade early in the session. (See my post at 12:50.) For their part, sellers did nothing to brag about. They will win on Tuesday, though, unless DaBoyz can gin up some “news” to trigger off a short squeeze. ______ UPDATE (Oct 13, 5:05 p.m.): Use this pattern to make tradable sense of today’s lunatic bounce, an affront and disgrace to civilization itself. Although there is little meaning to any statistical news we read these days, traders evidently feel obliged to go nuts with it, even if no one can say whether the news will prove bullish or bearish. Today they interpreted it both ways by turns, but don’t expect the psychotic rally that ended the day to get very far, even if it exceeds D=3750.25 (corrected) in an ultimately doomed attempt to fool patient bears.

Friday’s refreshing death dive may have felt like the start of something big, but the chart suggests we’d probably have been buyers at the close. The 106-point selloff hit the green line after topping midway between p2 and D, generating a classic ‘mechanical’ buy signal that we’ve seen work again and again. This is not to say the rally we can expect on Monday will necessarily reach D=3846.75, only that getting long at the green line (stop 3571.75) would probably have been a good bet for at least a one-level ride to p=3709.25. That’s a nearly $14,000 opportunity, but we passed it up because staking out a position in the final hour of a Friday is courting trouble and not how we roll. ______ UPDATE (Oct 10, 11:06 p.m.): Although the ‘mechanical’ buy at 3640.50 (stop 3571.50) remains nominally alive, today’s dirge killed my interest in the trade early in the session. (See my post at 12:50.) For their part, sellers did nothing to brag about. They will win on Tuesday, though, unless DaBoyz can gin up some “news” to trigger off a short squeeze. ______ UPDATE (Oct 13, 5:05 p.m.): Use this pattern to make tradable sense of today’s lunatic bounce, an affront and disgrace to civilization itself. Although there is little meaning to any statistical news we read these days, traders evidently feel obliged to go nuts with it, even if no one can say whether the news will prove bullish or bearish. Today they interpreted it both ways by turns, but don’t expect the psychotic rally that ended the day to get very far, even if it exceeds D=3750.25 (corrected) in an ultimately doomed attempt to fool patient bears.

ESZ22 – Dec E-Mini S&Ps (Last:3680.25)

Posted on October 9, 2022, 5:20 pm EDT

Last Updated October 13, 2022, 11:15 pm EDT

Posted on October 9, 2022, 5:20 pm EDT

Last Updated October 13, 2022, 11:15 pm EDT