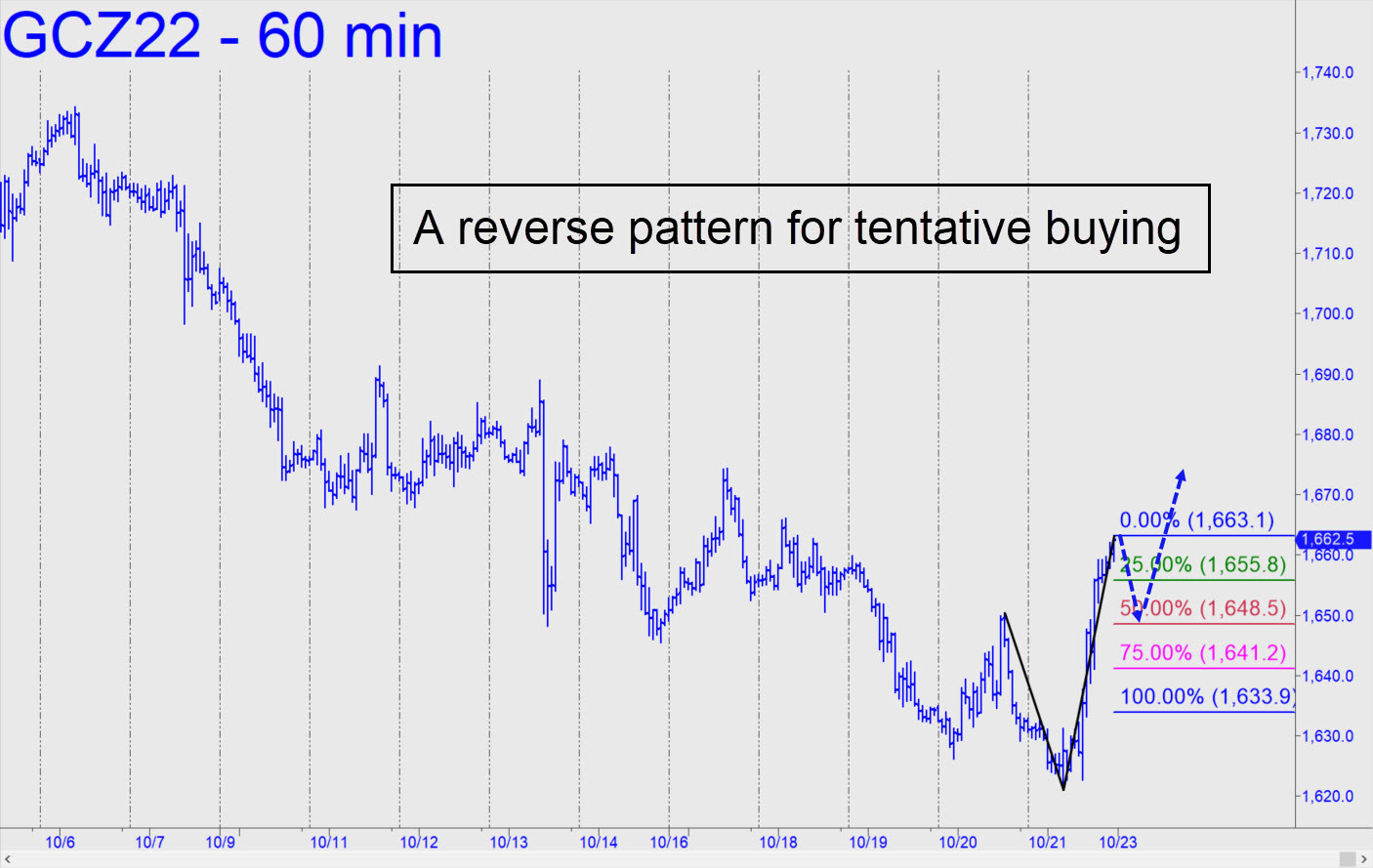

There’s no compelling reason to trust Friday’s strong upthrust, but because it was robustly impulsive on the hourly chart, we can’t afford to ignore it either. I’d suggest staking out a tentative long position using the reverse pattern shown. The point ‘c’ high is just a placeholder at the moment, and you should raise it if the futures make a higher top on Sunday night. Buying should be done at the resulting midpoint Hidden Pivot (currently at 1648.50), using either a stop-loss no wider than 1.00 point, or with an rABC pattern on the lesser bar charts that risks even less theoretically. If you want to paper-trade in order to improve your feel for reverse-pattern set-ups, please note that the conventional stop-loss lie exactly 4.90 points beneath the entry price, predicated on a rally target $10 above it. _______ UPDATE (Oct 24, 12:28 a.m. EDT): A false start and raggedy price action have altered the prospectus for this evening, offering better odds for bottom-fishing D=1646.30 of this pattern than any Hidden Pivot level above it, including the already well-chewed ‘p’. ______ UPDATE (Oct 24, 4:56 p.m.): Cancel, the trade, since the futures have been acting like they know D=1646.30 is there. A bullish bias is warranted nonetheless, but price action has been too squirrelly for me to offer day-in-advance trading guidance. _______ UPDATE (Oct 26, 11:53 p.m.): Today’s spike to the red line (p=1678.80) confirmed this bullish pattern and its D target at 1736.40. A decisive push past it in the next day or two would shorten the odds that D will be reached.

There’s no compelling reason to trust Friday’s strong upthrust, but because it was robustly impulsive on the hourly chart, we can’t afford to ignore it either. I’d suggest staking out a tentative long position using the reverse pattern shown. The point ‘c’ high is just a placeholder at the moment, and you should raise it if the futures make a higher top on Sunday night. Buying should be done at the resulting midpoint Hidden Pivot (currently at 1648.50), using either a stop-loss no wider than 1.00 point, or with an rABC pattern on the lesser bar charts that risks even less theoretically. If you want to paper-trade in order to improve your feel for reverse-pattern set-ups, please note that the conventional stop-loss lie exactly 4.90 points beneath the entry price, predicated on a rally target $10 above it. _______ UPDATE (Oct 24, 12:28 a.m. EDT): A false start and raggedy price action have altered the prospectus for this evening, offering better odds for bottom-fishing D=1646.30 of this pattern than any Hidden Pivot level above it, including the already well-chewed ‘p’. ______ UPDATE (Oct 24, 4:56 p.m.): Cancel, the trade, since the futures have been acting like they know D=1646.30 is there. A bullish bias is warranted nonetheless, but price action has been too squirrelly for me to offer day-in-advance trading guidance. _______ UPDATE (Oct 26, 11:53 p.m.): Today’s spike to the red line (p=1678.80) confirmed this bullish pattern and its D target at 1736.40. A decisive push past it in the next day or two would shorten the odds that D will be reached.

GCZ22 – December Gold (Last:1668.20)

Posted on October 23, 2022, 5:15 pm EDT

Last Updated October 26, 2022, 11:58 pm EDT

Posted on October 23, 2022, 5:15 pm EDT

Last Updated October 26, 2022, 11:58 pm EDT