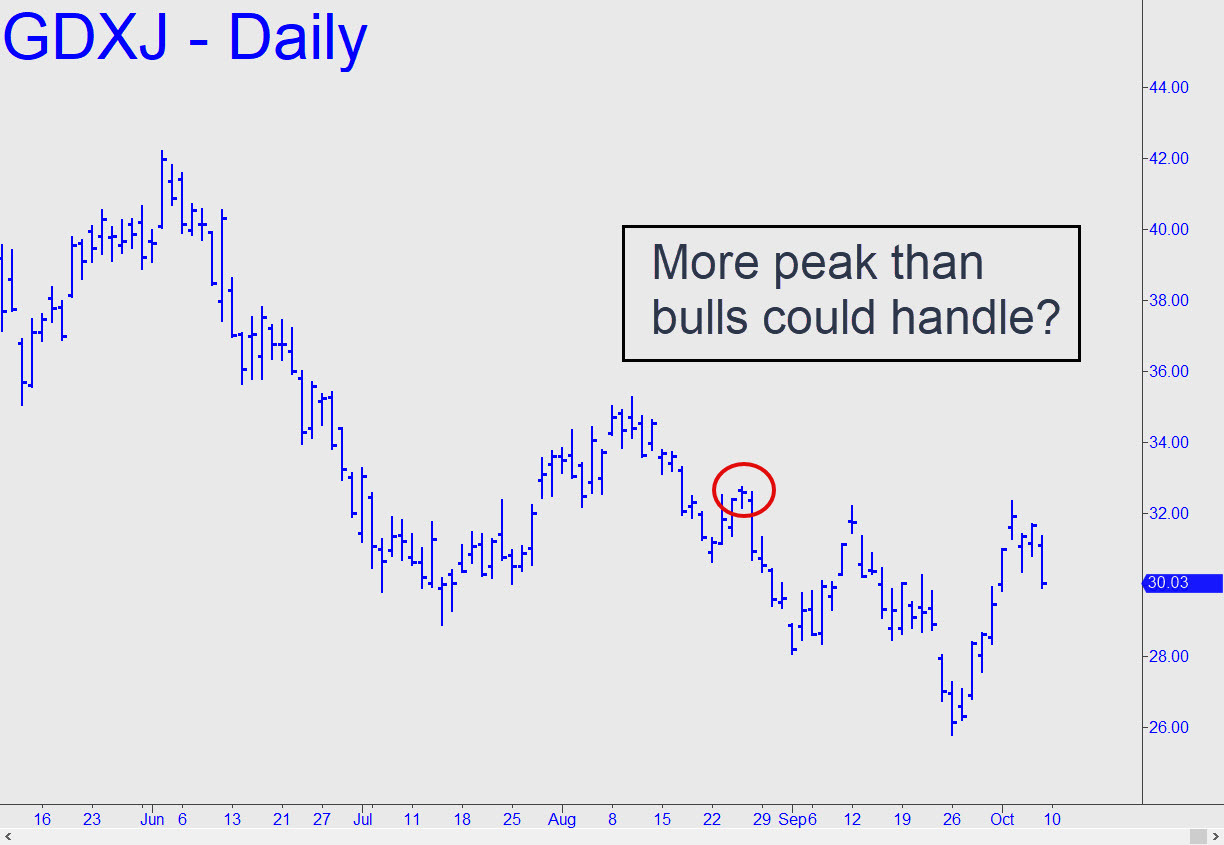

The sound of one hand clapping was all that bulls deserved at last week’s high. Although the exhaustion spike on Tuesday exceeded a challenging ‘external’ peak, buyers elected not to take on a second that lay just inches above it. We’ll give them the benefit of the doubt nonetheless, since the two-week surge begun from 25.80 was nominally impulsive on the daily chart, and because the surge featured some deftly engineered short-squeeze gaps on the way up. For now, let’s kick back and observe price action on the lesser charts. If Friday’s sell-off continues, exceeding 29.71 (15-min, a=32.35 on 10/4), that would imply bears are in charge, at least for the near term. ______ UPDATE (Oct 14): GDXJ is close to creating yet another gratuitous hump on the intraday charts, presumably bound for a test of late September’s 25.80 low. If you trade this vehicle, here’s a chart with a 26.83 target

The sound of one hand clapping was all that bulls deserved at last week’s high. Although the exhaustion spike on Tuesday exceeded a challenging ‘external’ peak, buyers elected not to take on a second that lay just inches above it. We’ll give them the benefit of the doubt nonetheless, since the two-week surge begun from 25.80 was nominally impulsive on the daily chart, and because the surge featured some deftly engineered short-squeeze gaps on the way up. For now, let’s kick back and observe price action on the lesser charts. If Friday’s sell-off continues, exceeding 29.71 (15-min, a=32.35 on 10/4), that would imply bears are in charge, at least for the near term. ______ UPDATE (Oct 14): GDXJ is close to creating yet another gratuitous hump on the intraday charts, presumably bound for a test of late September’s 25.80 low. If you trade this vehicle, here’s a chart with a 26.83 target

GDXJ – Junior Gold Miner ETF (Last:27.74)

Posted on October 9, 2022, 5:08 pm EDT

Last Updated October 14, 2022, 10:38 pm EDT

Posted on October 9, 2022, 5:08 pm EDT

Last Updated October 14, 2022, 10:38 pm EDT