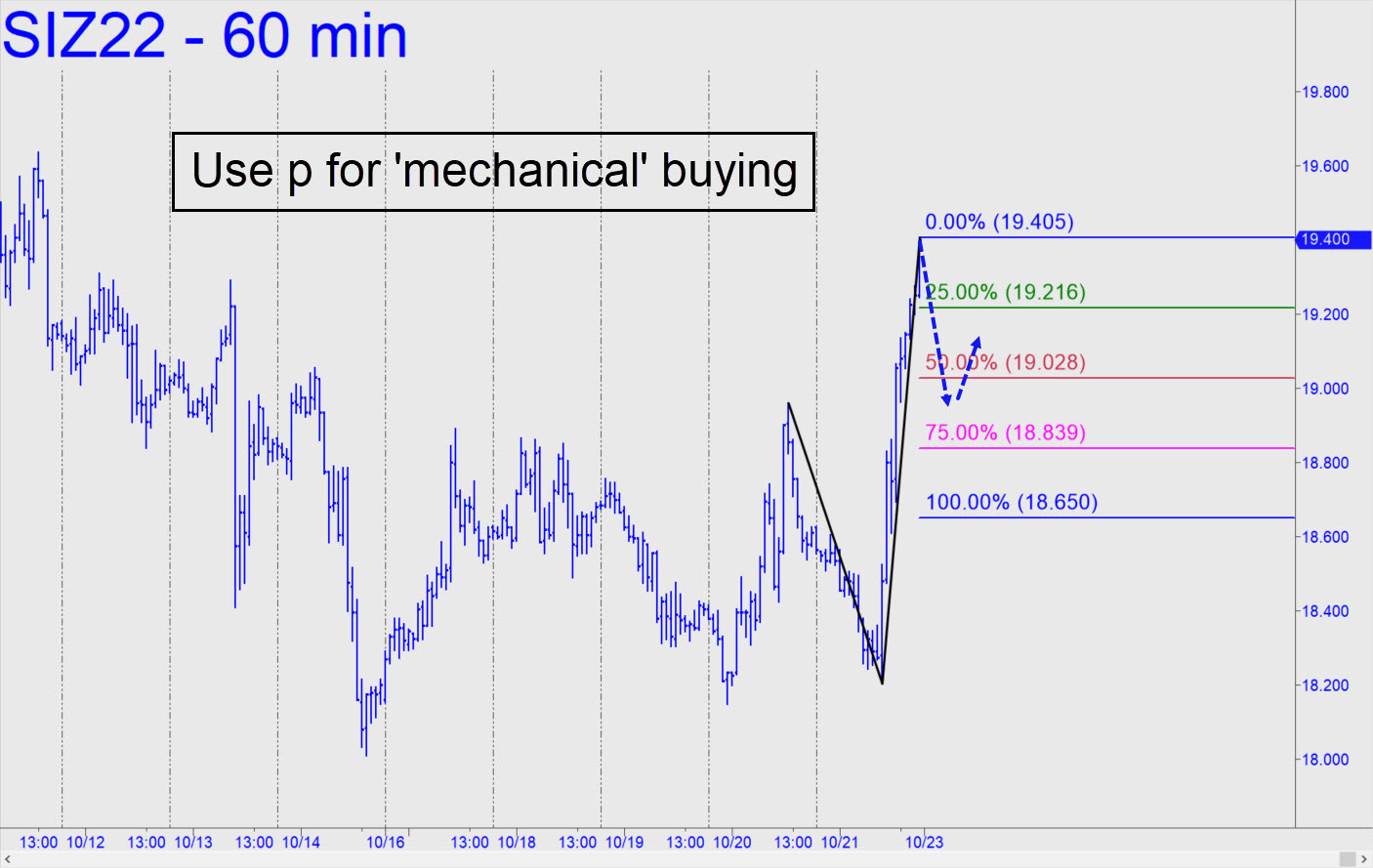

Buyers’ wilding spree on Friday was even more impressive than in gold. Accordingly, you should use the bullish ‘reverse pattern’ shown to get long with risk very tightly controlled. Buying should be done on a pullback to p=19.03, stop 18.90, much just as I’ve advised in December Gold. However, please be aware that you can cut risk even more by setting up an rABC trigger on a lesser chart, with the ‘c’ low anchored within two cents of p. The midpoint pivot shown is tentative and would change if December Silver moves higher Sunday evening, but the ‘conventional’ stop-loss would remain fixed nonetheless at 12 cents below the final p used for entry. This trade is easier than it sounds, but it is recommended only for subscribers who have been attending Wednesday tutorial sessions and understand how rABC set-ups work. _______ UPDATE (Oct 24, 5:02 p.m.): See my chatroom posts and chart from 9:55 a.m. Tuesday morning. _______ UPDATE (Oct 27, 7:24 p.m.): December Silver appears to be dragging itself kicking and screaming toward the 20.85 Hidden Pivot target shown, but what a mess!

Buyers’ wilding spree on Friday was even more impressive than in gold. Accordingly, you should use the bullish ‘reverse pattern’ shown to get long with risk very tightly controlled. Buying should be done on a pullback to p=19.03, stop 18.90, much just as I’ve advised in December Gold. However, please be aware that you can cut risk even more by setting up an rABC trigger on a lesser chart, with the ‘c’ low anchored within two cents of p. The midpoint pivot shown is tentative and would change if December Silver moves higher Sunday evening, but the ‘conventional’ stop-loss would remain fixed nonetheless at 12 cents below the final p used for entry. This trade is easier than it sounds, but it is recommended only for subscribers who have been attending Wednesday tutorial sessions and understand how rABC set-ups work. _______ UPDATE (Oct 24, 5:02 p.m.): See my chatroom posts and chart from 9:55 a.m. Tuesday morning. _______ UPDATE (Oct 27, 7:24 p.m.): December Silver appears to be dragging itself kicking and screaming toward the 20.85 Hidden Pivot target shown, but what a mess!

SIZ22 – December Silver (Last:19.52)

Posted on October 23, 2022, 5:14 pm EDT

Last Updated October 27, 2022, 7:23 pm EDT

Posted on October 23, 2022, 5:14 pm EDT

Last Updated October 27, 2022, 7:23 pm EDT