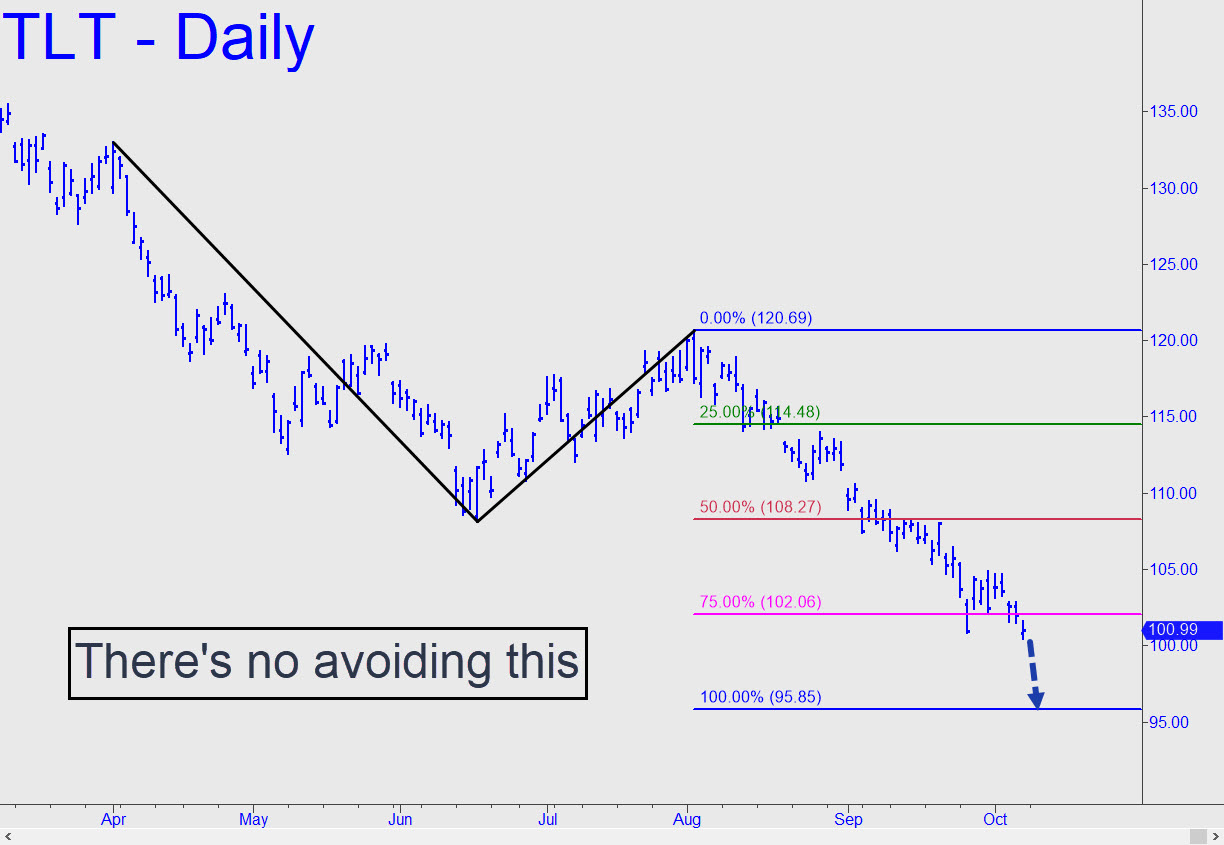

TLT, an ETF proxy for the long bond, is headed down to at least 95.85, a 5% fall from these levels. That would imply that rates on the 30-year are about to rise from a current 3.84% to 3.91%. However, my long-term forecast calls for a 5% rate on the Long Bond and 4.9% on the Note, so TLT presumably has a long way to before it hits bottom. Most immediately, though, look for more slippage to the 97.72 target shown in this chart. It is all but certain to be hit, but it can also be used to bottom-fish with a tight rABC trigger. _____ UPDATE (Oct 18, 8:52 p.m.): TLT’s dip beneath the 97.72 target precipitated an outpouring of interest in the chat room that I would never have imagined existed. This latest show of weakness has not much depleted our supply of downside targets, the next of which lies at 95.85 (as noted above). That Hidden Pivot support isn’t likely to last long either, since rates on the 30-Year have a long way to go before they reach my target at 4.9%.

TLT, an ETF proxy for the long bond, is headed down to at least 95.85, a 5% fall from these levels. That would imply that rates on the 30-year are about to rise from a current 3.84% to 3.91%. However, my long-term forecast calls for a 5% rate on the Long Bond and 4.9% on the Note, so TLT presumably has a long way to before it hits bottom. Most immediately, though, look for more slippage to the 97.72 target shown in this chart. It is all but certain to be hit, but it can also be used to bottom-fish with a tight rABC trigger. _____ UPDATE (Oct 18, 8:52 p.m.): TLT’s dip beneath the 97.72 target precipitated an outpouring of interest in the chat room that I would never have imagined existed. This latest show of weakness has not much depleted our supply of downside targets, the next of which lies at 95.85 (as noted above). That Hidden Pivot support isn’t likely to last long either, since rates on the 30-Year have a long way to go before they reach my target at 4.9%.

TLT – Lehman Bond ETF (Last:98.32)

Posted on October 9, 2022, 5:10 pm EDT

Last Updated October 18, 2022, 8:52 pm EDT

Posted on October 9, 2022, 5:10 pm EDT

Last Updated October 18, 2022, 8:52 pm EDT