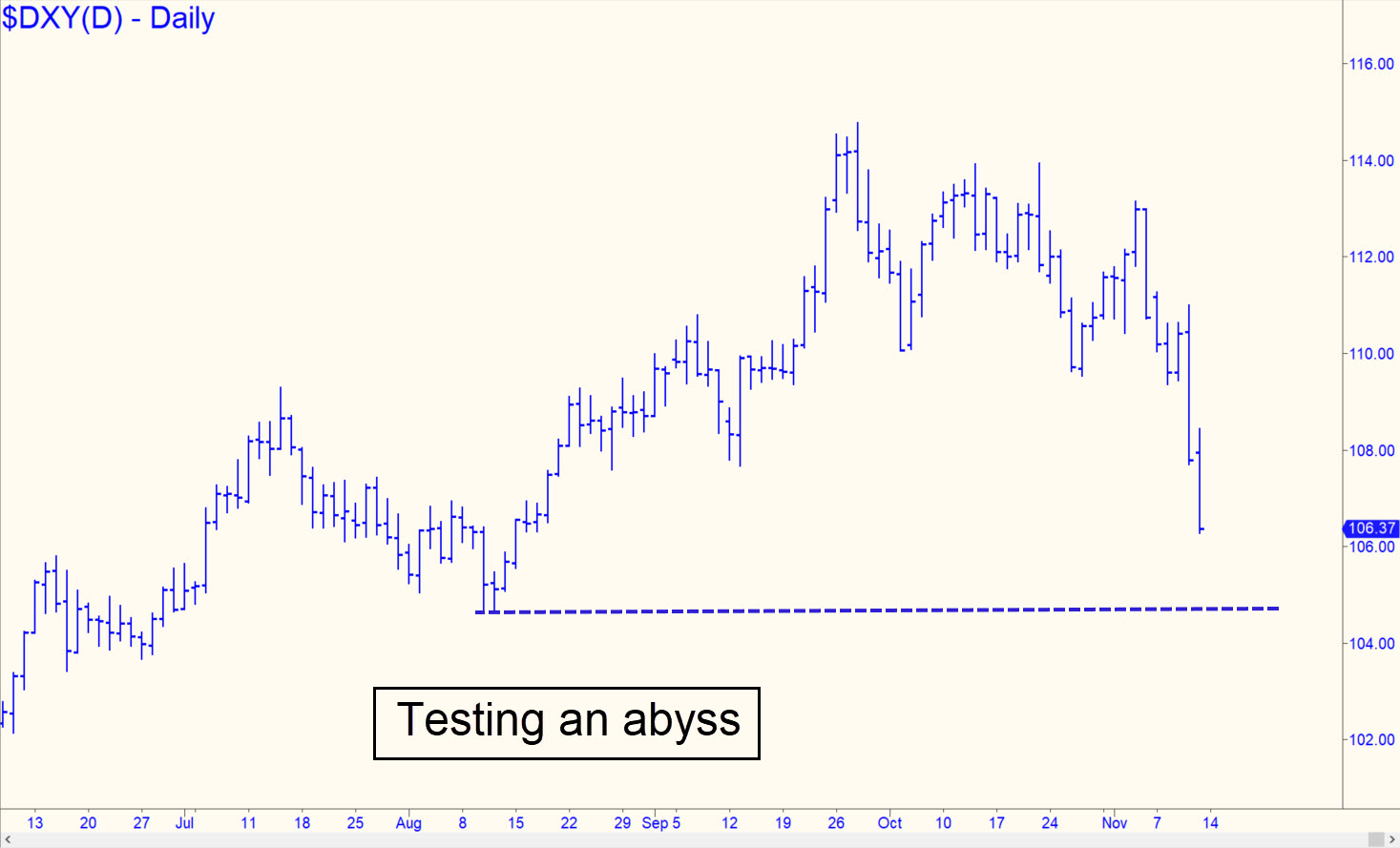

Friday’s frightening plunge to 106.28 came within a hair of triggering a ‘voodoo’ buy signal, although I can’t say I’d have been eager to act on it. It was the worst week for the dollar that even old-timers can recall, but still ‘merely’ corrective of the astounding bull leg begun in May 2021. Most immediately, if DXY takes out the low, it will be telegraphing a test of an important structural low at 104.74 recorded back in August. Beyond it lies yet another chasm with a 101.30 bottom. That would represent a correction of a little more than 50% of the 2021-22 bull.

Friday’s frightening plunge to 106.28 came within a hair of triggering a ‘voodoo’ buy signal, although I can’t say I’d have been eager to act on it. It was the worst week for the dollar that even old-timers can recall, but still ‘merely’ corrective of the astounding bull leg begun in May 2021. Most immediately, if DXY takes out the low, it will be telegraphing a test of an important structural low at 104.74 recorded back in August. Beyond it lies yet another chasm with a 101.30 bottom. That would represent a correction of a little more than 50% of the 2021-22 bull.

DXY – NYBOT Dollar Index (Last:106.38)

Posted on November 13, 2022, 5:16 pm EST

Last Updated November 11, 2022, 4:34 pm EST

Posted on November 13, 2022, 5:16 pm EST

Last Updated November 11, 2022, 4:34 pm EST

- November 15, 2022, 5:43 pm

If the Dow exceeds- rises above its’ previous high on August 12th, 2022, would that action create an enabling bull leg

implying the end of the present bear market? Failure to do so leaves the Dow looking for an abyss to plumb, ala 2007.

Thanks, Dean Ezell