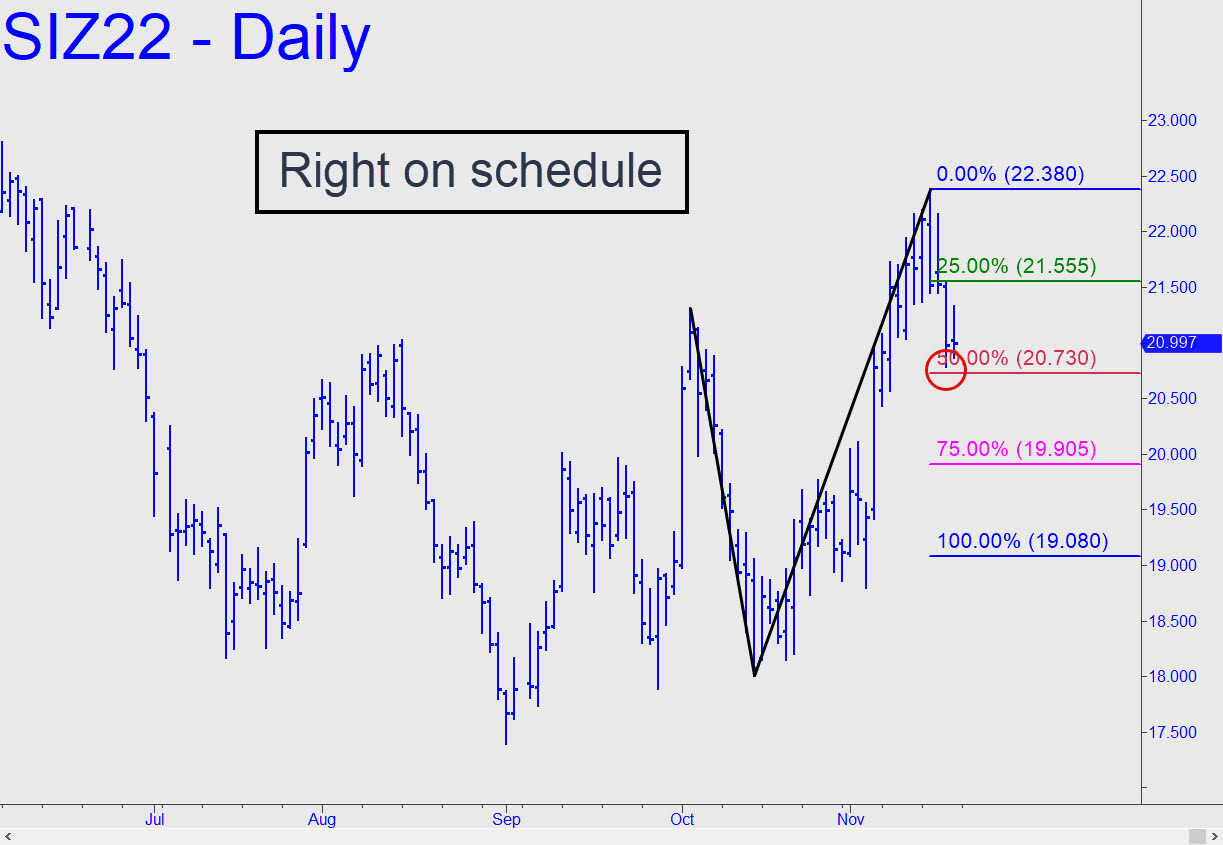

Although I expect Silver to continue moving higher, I’ve displayed a mildly bearish reverse-pattern (see inset) because it promises to work well for augmenting long positions with risk under tight control. On Thursday, for instance, sellers corrected the December contract down to the red line (p=20.73), almost triggering an enticing ‘mechanical’ buying opportunity. (It didn’t trigger, however, because the downswing missed touching p=20.730 by a hair). Let’s watch to see how the futures interact with this pattern, which could prove useful in any event. A decisive downside penetration of p early in the week could be warning of more slippage to p2=19.905, or even d=19.08. _______ UPDATE (Nov 21, 9:50 p.m.): Bottoming action at p was tricky, but there were several ways to have gotten aboard without much pain. As much as 13 cents was risked initially, but the bounce so far has delivered a profit of as much as 42 cents ($2100) per contract. Minimum price objective: 21.50. Please let me know if you hold a position based on my recommendation do I can determine whether to establish a tracking position.

Although I expect Silver to continue moving higher, I’ve displayed a mildly bearish reverse-pattern (see inset) because it promises to work well for augmenting long positions with risk under tight control. On Thursday, for instance, sellers corrected the December contract down to the red line (p=20.73), almost triggering an enticing ‘mechanical’ buying opportunity. (It didn’t trigger, however, because the downswing missed touching p=20.730 by a hair). Let’s watch to see how the futures interact with this pattern, which could prove useful in any event. A decisive downside penetration of p early in the week could be warning of more slippage to p2=19.905, or even d=19.08. _______ UPDATE (Nov 21, 9:50 p.m.): Bottoming action at p was tricky, but there were several ways to have gotten aboard without much pain. As much as 13 cents was risked initially, but the bounce so far has delivered a profit of as much as 42 cents ($2100) per contract. Minimum price objective: 21.50. Please let me know if you hold a position based on my recommendation do I can determine whether to establish a tracking position.

SIZ22 – December Silver (Last:21.09)

Posted on November 20, 2022, 5:21 pm EST

Last Updated November 21, 2022, 9:49 pm EST

Posted on November 20, 2022, 5:21 pm EST

Last Updated November 21, 2022, 9:49 pm EST