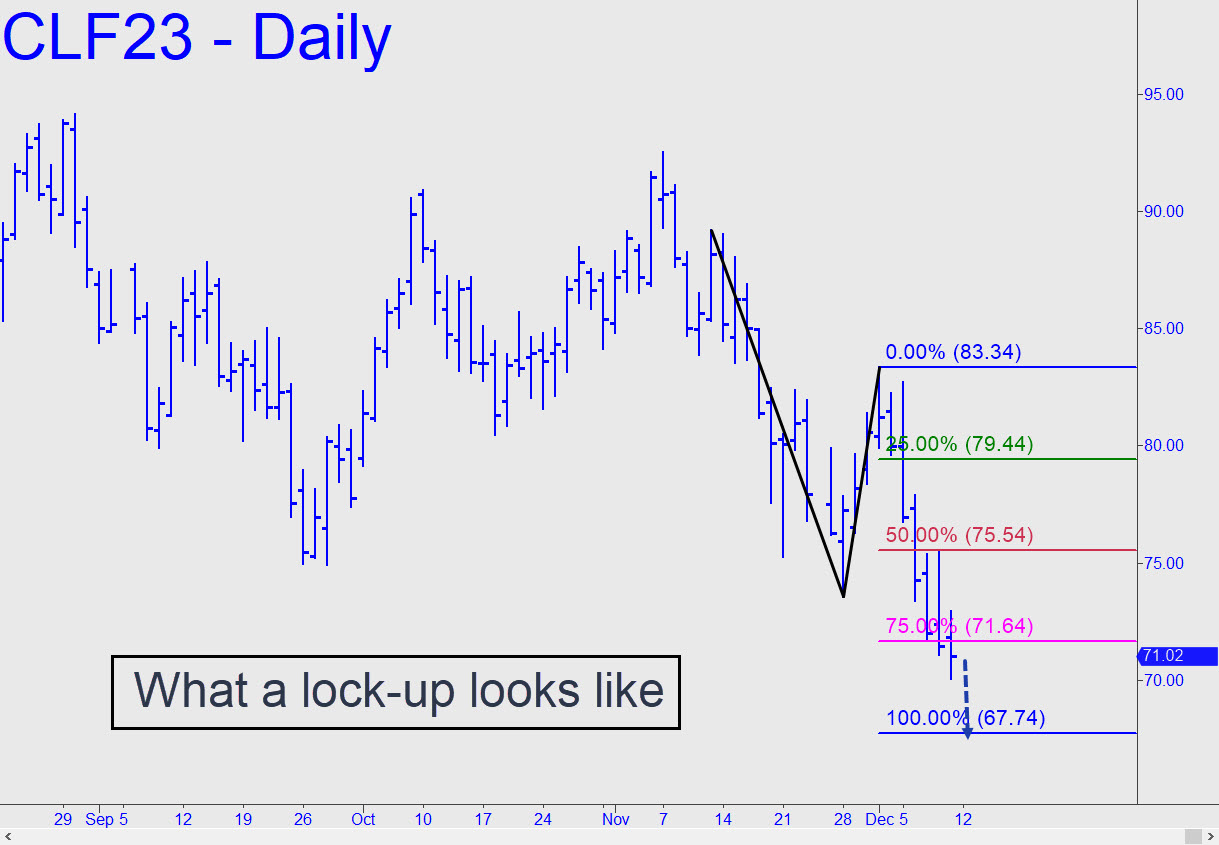

Crude futures can be pretty vicious, but if this were nearly any other vehicle, I’d suggest bottom-fishing D=67.74 with a very tight stop-loss and a truck to hold it all. Given the ease with which sellers crushed the midpoint Hidden Pivot at 75.54, the downtrend is nearly 100% certain to achieve the target. But it’s just as likely to put in a tradeable bottom very near there. However, the pattern, although quite serviceable for most other vehicles (other than the p.o.s. grains) is certain to be ‘read’ by other experienced traders. That means that bids at D are going to get stopped out a few times on the lesser charts before the inevitable reversal takes flight. We are more than up to the challenge, but be prepared to do some work. _____ UPDATE (Dec 12, 10:19 p.m.): Weeks can go by without anyone mentioning crude in the chat room. Is there any interest? Are any of you trading it? _______ UPDATE (Dec 13, 10:52 p.m.): There appears to be more interest in trading the micro-contract, so I will swap it for the full-size contract starting Sunday. I remain skeptical that this rally will be more than a flash-in-the-pan.

Crude futures can be pretty vicious, but if this were nearly any other vehicle, I’d suggest bottom-fishing D=67.74 with a very tight stop-loss and a truck to hold it all. Given the ease with which sellers crushed the midpoint Hidden Pivot at 75.54, the downtrend is nearly 100% certain to achieve the target. But it’s just as likely to put in a tradeable bottom very near there. However, the pattern, although quite serviceable for most other vehicles (other than the p.o.s. grains) is certain to be ‘read’ by other experienced traders. That means that bids at D are going to get stopped out a few times on the lesser charts before the inevitable reversal takes flight. We are more than up to the challenge, but be prepared to do some work. _____ UPDATE (Dec 12, 10:19 p.m.): Weeks can go by without anyone mentioning crude in the chat room. Is there any interest? Are any of you trading it? _______ UPDATE (Dec 13, 10:52 p.m.): There appears to be more interest in trading the micro-contract, so I will swap it for the full-size contract starting Sunday. I remain skeptical that this rally will be more than a flash-in-the-pan.

CLF23 – January Crude (Last:74.04)

Posted on December 11, 2022, 5:13 pm EST

Last Updated December 13, 2022, 10:51 pm EST

Posted on December 11, 2022, 5:13 pm EST

Last Updated December 13, 2022, 10:51 pm EST