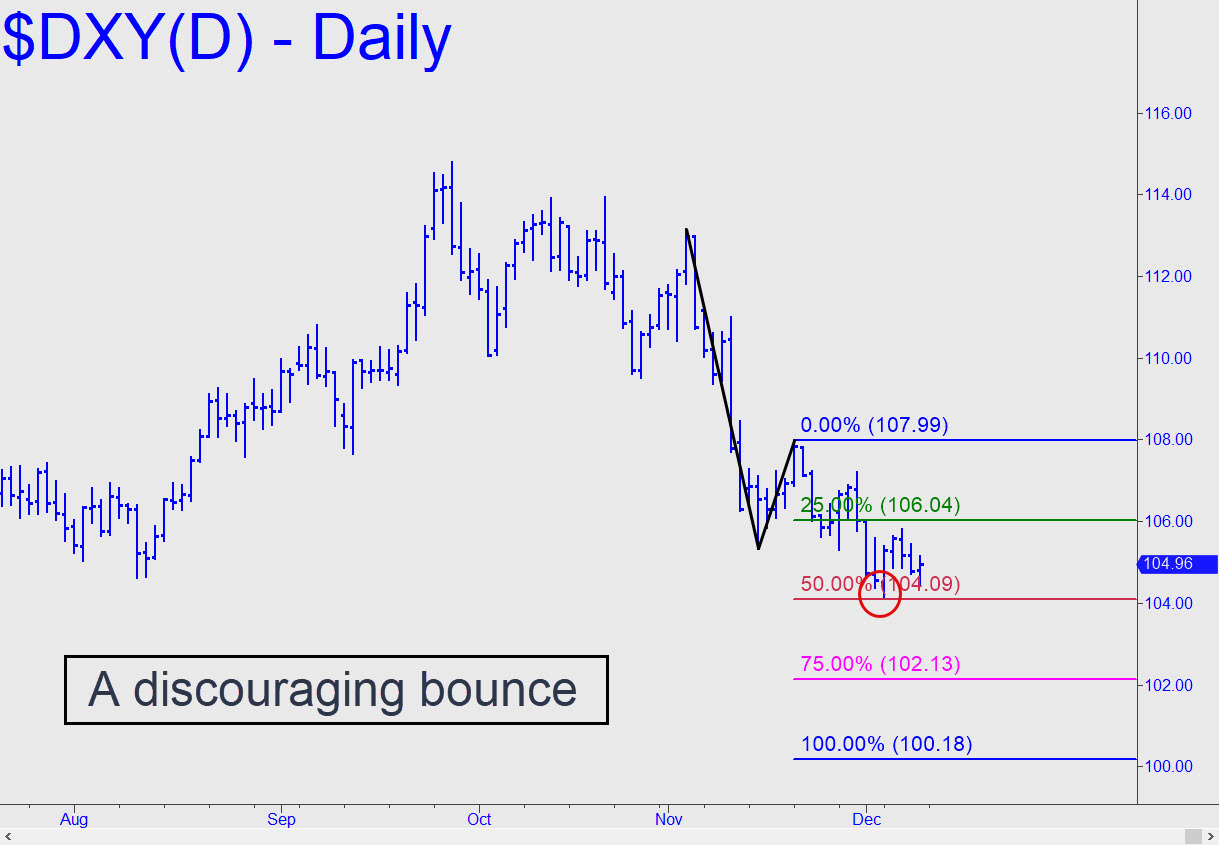

The dollar’s weak bounce from p=104.09 implies that still lower prices are likely. Considering that the midpoint pivot lies just beneath a key low at 104.64 recorded back in August, the rally should have been stronger, since many bulls would have been stopped out when the breakdown occurred. We’ll monitor the expected breach of the 104.09 Hidden Pivot, since, if it gets crushed, that would portend more slippage to as low as D=100.18. That would represent a still-moderate 12% correction from September’s 114.78 high — not too bad considering the steepness of the rally that saw the Dollar Index rise from 89.21 to 114.78 between early 2021 and October 2022.

The dollar’s weak bounce from p=104.09 implies that still lower prices are likely. Considering that the midpoint pivot lies just beneath a key low at 104.64 recorded back in August, the rally should have been stronger, since many bulls would have been stopped out when the breakdown occurred. We’ll monitor the expected breach of the 104.09 Hidden Pivot, since, if it gets crushed, that would portend more slippage to as low as D=100.18. That would represent a still-moderate 12% correction from September’s 114.78 high — not too bad considering the steepness of the rally that saw the Dollar Index rise from 89.21 to 114.78 between early 2021 and October 2022.

DXY – NYBOT Dollar Index (Last:104.96)

Posted on December 11, 2022, 5:11 pm EST

Last Updated December 9, 2022, 9:51 pm EST

Posted on December 11, 2022, 5:11 pm EST

Last Updated December 9, 2022, 9:51 pm EST