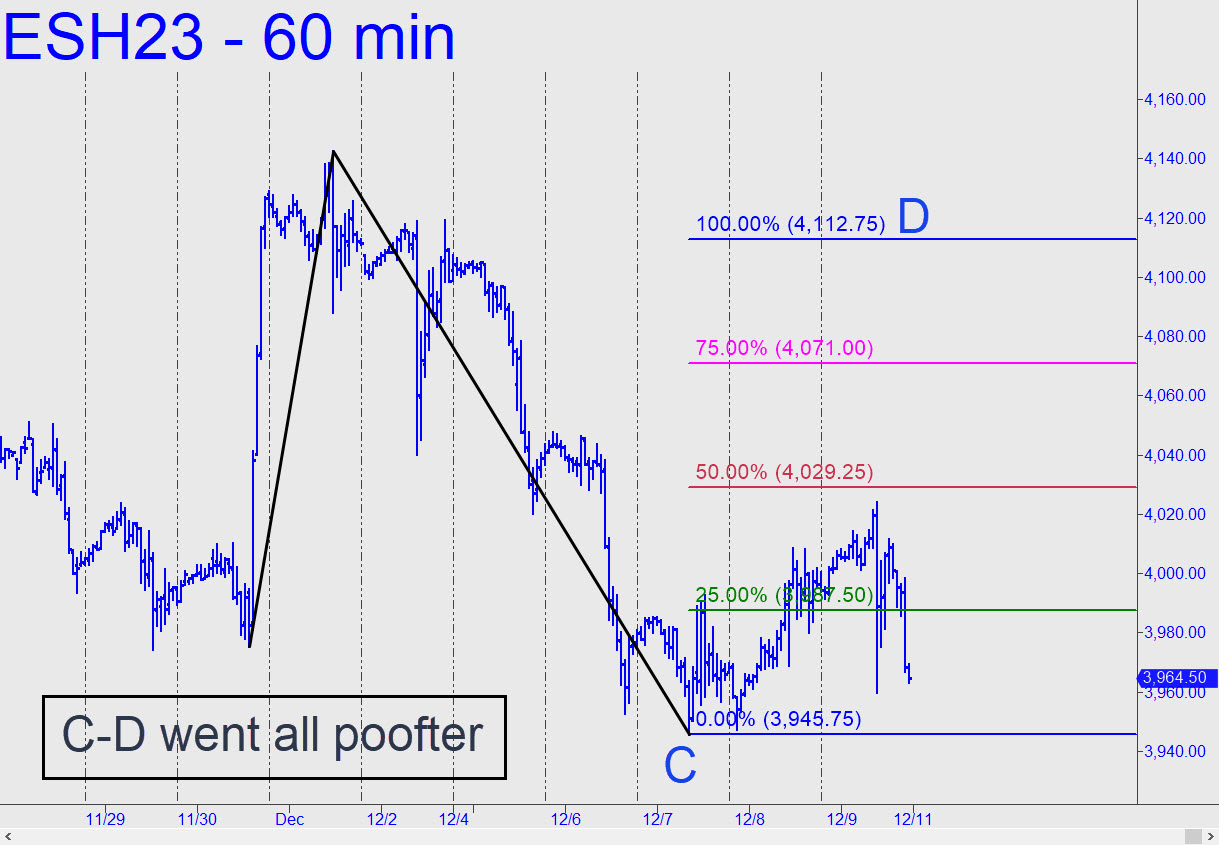

After stumbling out of the gate last Sunday evening, DaBoyz just couldn’t get it going. It was two steps up, four steps back all week before they threw in the towel on Friday with exhaustion selling in the final hour. The intraday high had missed p=4029.25 by more than a smidgen, implying more weakness lies ahead. If I’d lowered my expectations at the opening, I might have seen this juicy reverse-pattern short come into focus. Oh well. If the futures take out last week’s lows, I’d wait until they fall to at least 3863, a voodoo number, before attempting to bottom-fish. _______ UPDATE (Dec 12, 9:37): Not a bad trick, getting this hoax to waft 60 points higher with nary a bullish buyer in sight. It was all short-covering, and it failed to surpass even a single ‘external’ peak. That would require a print above last Monday’s 4047 peak. Let’s see if bears are sufficiently unnerved to supply the necessary lift. My guess st the moment is yes, although I doubt the rally will breach the next significant external peak, 4119.25. Since we should never have to guess about such things, here’s a chart that can not only tell us everything we need to know, but also enable us to profitably trade the move however high it goes. _____ UPDATE (Dec 13, 10:45 p.m.): What the heck was that all about??? We’d wanted the faked death dive portion of the day to touch our ‘mechanical’ bid at the green line (4022.44). Although I’d said in the chat room that the six-point gap wasn’t close enough to x to do the trade, it would have qualified based on the new, mainly visual standard I am using to judge such opportunities. In any event, the 4245.25 target remains viable as a short-term price objective. ______ UPDATE (Dec 14, 6:08 p.m.): This afternoon’s slapstick changed nothing — other than triggering the ‘mechanical’ buy at 4020.44, stop 3945. If you did the trade, please let me know in the chat room so I can determine whether to establish a tracking position. Odds have not diminished that D=4245.25 will be reached. ______ UPDATE (Dec 15, 9:29 a.m.): I was just asked in the chat room whether I am still confident in the 4245 rally target. I replied that my confidence has fallen: “The extent of the weakness has surprised me. It seems dangerous, since the timing will make nearly everyone mistakenly think it’s related to Powell’s speech and Fed policy. The weakness is ‘organic’. Watch for a turn from 3963, however, well above the 3945 stop-loss. The pattern associated with that target is gnarly enough to be undetected by the algos, let alone the droolers: https://bit.ly/3W6s4mb. _______ UPDATE (Dec 16, 12:24 pa.m.): This gnarly pattern is too compelling to have produced so feeble a bounce. More weakness lies ahead, presumably to at least 3848.00 over the very near term. That is the midpoint pivot, on the daily chart, associated with A=4194.25 on 9/13. For the record, D lies at 3516, the worst I could see for a period that usually brings expectations of a Santa rally.

After stumbling out of the gate last Sunday evening, DaBoyz just couldn’t get it going. It was two steps up, four steps back all week before they threw in the towel on Friday with exhaustion selling in the final hour. The intraday high had missed p=4029.25 by more than a smidgen, implying more weakness lies ahead. If I’d lowered my expectations at the opening, I might have seen this juicy reverse-pattern short come into focus. Oh well. If the futures take out last week’s lows, I’d wait until they fall to at least 3863, a voodoo number, before attempting to bottom-fish. _______ UPDATE (Dec 12, 9:37): Not a bad trick, getting this hoax to waft 60 points higher with nary a bullish buyer in sight. It was all short-covering, and it failed to surpass even a single ‘external’ peak. That would require a print above last Monday’s 4047 peak. Let’s see if bears are sufficiently unnerved to supply the necessary lift. My guess st the moment is yes, although I doubt the rally will breach the next significant external peak, 4119.25. Since we should never have to guess about such things, here’s a chart that can not only tell us everything we need to know, but also enable us to profitably trade the move however high it goes. _____ UPDATE (Dec 13, 10:45 p.m.): What the heck was that all about??? We’d wanted the faked death dive portion of the day to touch our ‘mechanical’ bid at the green line (4022.44). Although I’d said in the chat room that the six-point gap wasn’t close enough to x to do the trade, it would have qualified based on the new, mainly visual standard I am using to judge such opportunities. In any event, the 4245.25 target remains viable as a short-term price objective. ______ UPDATE (Dec 14, 6:08 p.m.): This afternoon’s slapstick changed nothing — other than triggering the ‘mechanical’ buy at 4020.44, stop 3945. If you did the trade, please let me know in the chat room so I can determine whether to establish a tracking position. Odds have not diminished that D=4245.25 will be reached. ______ UPDATE (Dec 15, 9:29 a.m.): I was just asked in the chat room whether I am still confident in the 4245 rally target. I replied that my confidence has fallen: “The extent of the weakness has surprised me. It seems dangerous, since the timing will make nearly everyone mistakenly think it’s related to Powell’s speech and Fed policy. The weakness is ‘organic’. Watch for a turn from 3963, however, well above the 3945 stop-loss. The pattern associated with that target is gnarly enough to be undetected by the algos, let alone the droolers: https://bit.ly/3W6s4mb. _______ UPDATE (Dec 16, 12:24 pa.m.): This gnarly pattern is too compelling to have produced so feeble a bounce. More weakness lies ahead, presumably to at least 3848.00 over the very near term. That is the midpoint pivot, on the daily chart, associated with A=4194.25 on 9/13. For the record, D lies at 3516, the worst I could see for a period that usually brings expectations of a Santa rally.

ESH23 – March E-Mini S&Ps (Last:3976.50)

Posted on December 11, 2022, 5:20 pm EST

Last Updated December 16, 2022, 10:26 am EST

Posted on December 11, 2022, 5:20 pm EST

Last Updated December 16, 2022, 10:26 am EST