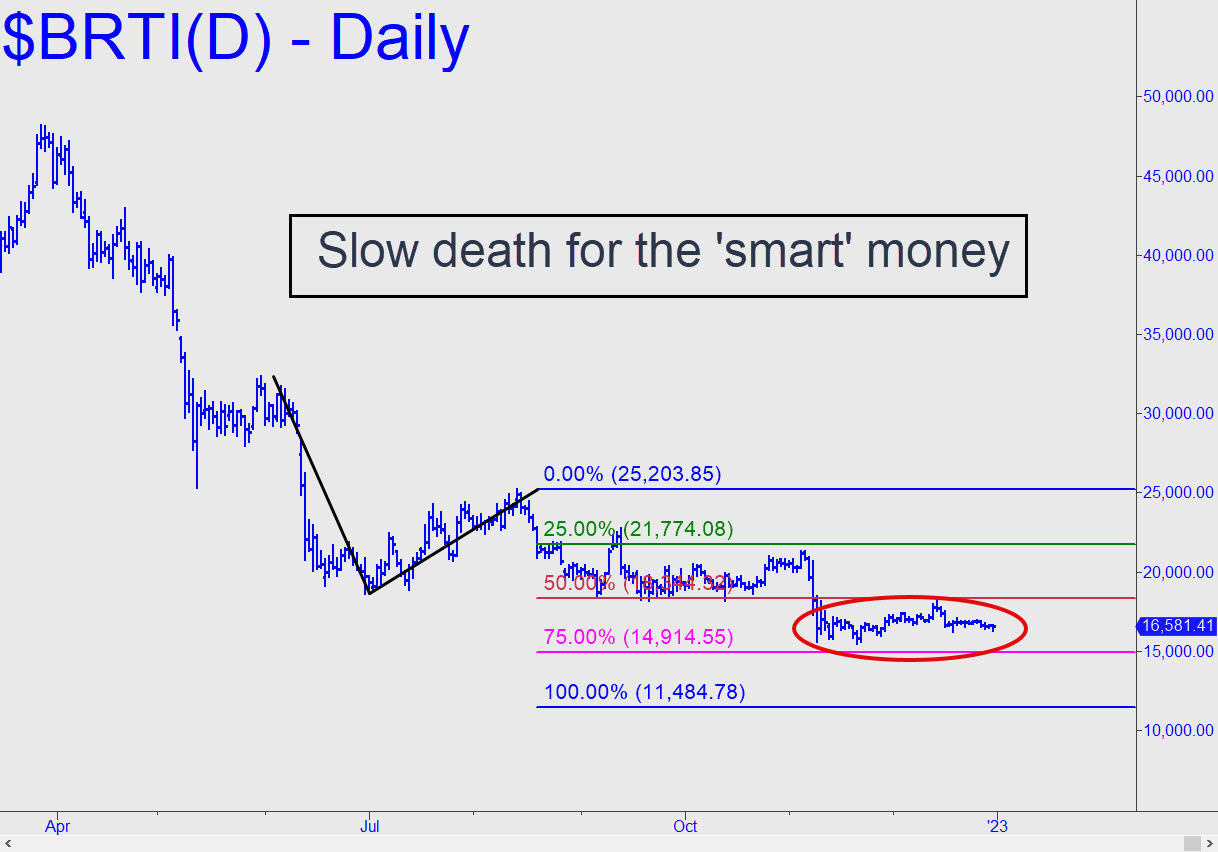

The chart shows what can happen when the so-called smart money gets trapped. Given the unnaturally tight trading range that bitcoin’s deft conspirators have maintained for nearly two months, one might believe they are capable of holding the cryptocurrency above $15,000 indefinitely. Unfortunately for them, the chart is telegraphing a fall to at least 11,484. Bitcoin’s deep-pocketed sponsors undoubtedly have been hoping to be rescued by a powerful short-squeeze, but this is looking increasingly unlikely to materialize from these levels. As ‘Trader Mike’ Schurr likes to remind us in the chat room, hope is not a strategy. The smart guys will have a better chance of propagating a short-covering panic if they allow more slippage, however painful, to the 11,484 Hidden Pivot. Even then, the reaction move would be limited by mountainous supply above $25,000 from players whose cost basis is at least twice that. More likely, in the context of an intensifying bear market in stocks that could run for years, is a washout that threatens to take bitcoin down to $5000 or lower. ______ UPDATE (Jan 9, 5:43 p.m.): Today’s volumeless waft just missed touching an important midpoint Hidden Pivot at 17,456. Buyers will need to pulverize it, however, to demonstrate their seriousness and ability to reach D=18,634. _______ UPDATE (Jan 12, 11:39 p.m.): Bertie’s doomed rally topped in an obvious spot, at the 19157 D target of this pattern, It is into serious supply now, so we shouldn’t expect today’s Whoopee Cushion squeeze to continue much higher.

The chart shows what can happen when the so-called smart money gets trapped. Given the unnaturally tight trading range that bitcoin’s deft conspirators have maintained for nearly two months, one might believe they are capable of holding the cryptocurrency above $15,000 indefinitely. Unfortunately for them, the chart is telegraphing a fall to at least 11,484. Bitcoin’s deep-pocketed sponsors undoubtedly have been hoping to be rescued by a powerful short-squeeze, but this is looking increasingly unlikely to materialize from these levels. As ‘Trader Mike’ Schurr likes to remind us in the chat room, hope is not a strategy. The smart guys will have a better chance of propagating a short-covering panic if they allow more slippage, however painful, to the 11,484 Hidden Pivot. Even then, the reaction move would be limited by mountainous supply above $25,000 from players whose cost basis is at least twice that. More likely, in the context of an intensifying bear market in stocks that could run for years, is a washout that threatens to take bitcoin down to $5000 or lower. ______ UPDATE (Jan 9, 5:43 p.m.): Today’s volumeless waft just missed touching an important midpoint Hidden Pivot at 17,456. Buyers will need to pulverize it, however, to demonstrate their seriousness and ability to reach D=18,634. _______ UPDATE (Jan 12, 11:39 p.m.): Bertie’s doomed rally topped in an obvious spot, at the 19157 D target of this pattern, It is into serious supply now, so we shouldn’t expect today’s Whoopee Cushion squeeze to continue much higher.

BRTI – CME Bitcoin Index (Last:18,865)

Posted on January 2, 2023, 5:18 pm EST

Last Updated January 12, 2023, 11:39 pm EST

Posted on January 2, 2023, 5:18 pm EST

Last Updated January 12, 2023, 11:39 pm EST