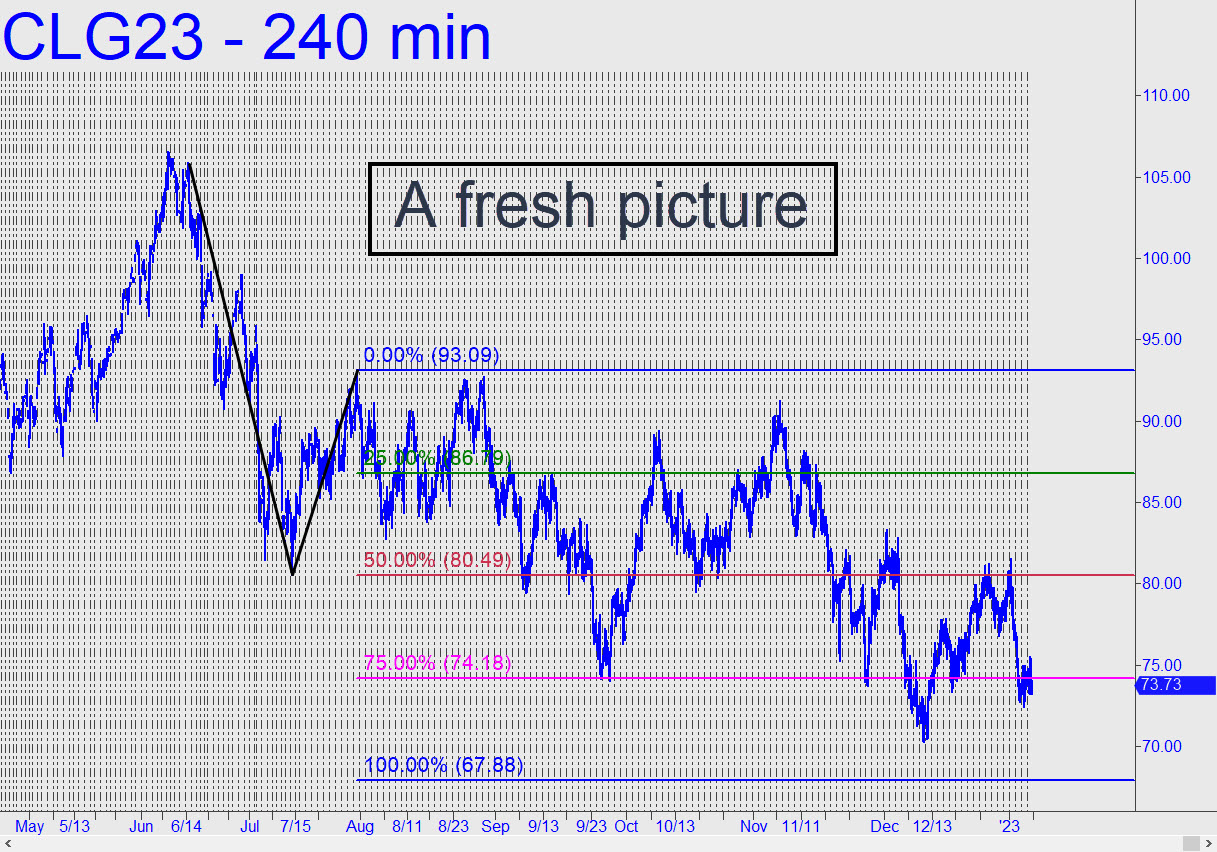

The bearish pattern shown is one we haven’t looked at before, but it might provide a better frame of reference for trading this contract than the bullish rABC we’ve been using. It shows an unfulfilled D target at 67.88 in a conventional ABCD pattern that has produced no fewer than three ‘mechanical’ shorts, all profitable. It would create yet another with a powerful rally to the green line (x=86.79). However, my gut feeling is that the better opportunity will lie in bottom-fishing if and when CLG hits the target. Some subscribers may hold a bullish call spread in USO that expires Friday. It is based on a recommendation I made in the chat room, but I am not tracking it because only one subscriber mentioned doing the trade. Check the 12:20 post for further details. _______ UPDATE (Jan 12, 11:27 p.m.): The call spread traded as high as 1.45 today, but it could max out at 2.50, five to eight times the price paid, if USO ends the week with a further rally of 1.37 or more.

The bearish pattern shown is one we haven’t looked at before, but it might provide a better frame of reference for trading this contract than the bullish rABC we’ve been using. It shows an unfulfilled D target at 67.88 in a conventional ABCD pattern that has produced no fewer than three ‘mechanical’ shorts, all profitable. It would create yet another with a powerful rally to the green line (x=86.79). However, my gut feeling is that the better opportunity will lie in bottom-fishing if and when CLG hits the target. Some subscribers may hold a bullish call spread in USO that expires Friday. It is based on a recommendation I made in the chat room, but I am not tracking it because only one subscriber mentioned doing the trade. Check the 12:20 post for further details. _______ UPDATE (Jan 12, 11:27 p.m.): The call spread traded as high as 1.45 today, but it could max out at 2.50, five to eight times the price paid, if USO ends the week with a further rally of 1.37 or more.

CLG23 – Feb Crude (Last:78.24)

Posted on January 8, 2023, 5:18 pm EST

Last Updated January 12, 2023, 11:29 pm EST

Posted on January 8, 2023, 5:18 pm EST

Last Updated January 12, 2023, 11:29 pm EST