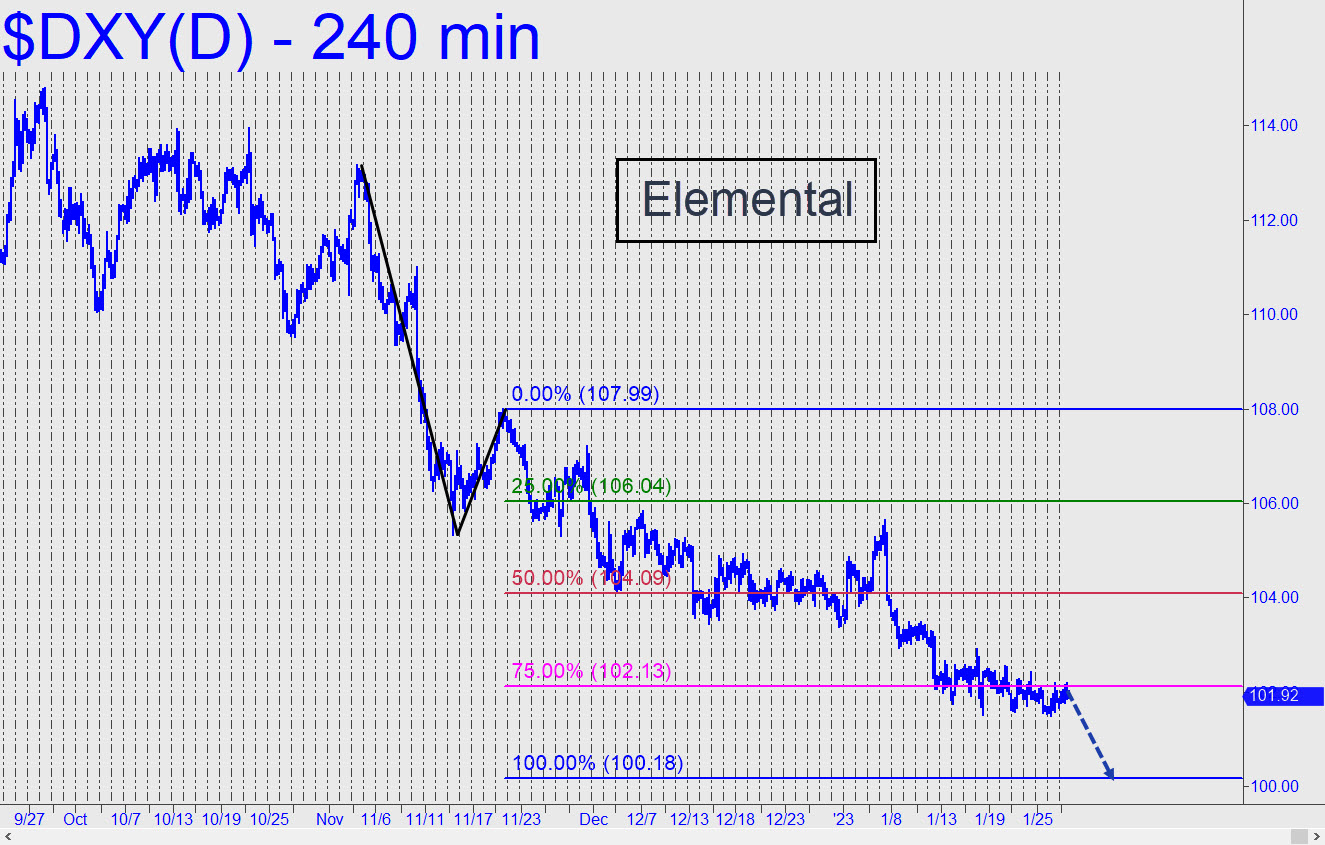

I’ve simplified the outlook with a single target at 100.18, stripping out another at 101.03 that is likely to be just a weigh station. A fall to ‘par’, if not lower, seems fated. Even if the downtrend has seemed relentless and interminable, it would amount to a relatively moderate 12.7% correction off the September high at 114.78. There is of course another possibility: If DXY heads decisively lower after testing 100, that would suggest the deflationary endgame for the global economy is farther off than I’d imagined. It is inevitable, but the most promiscuous credit stimulus in history has simply delayed it.

I’ve simplified the outlook with a single target at 100.18, stripping out another at 101.03 that is likely to be just a weigh station. A fall to ‘par’, if not lower, seems fated. Even if the downtrend has seemed relentless and interminable, it would amount to a relatively moderate 12.7% correction off the September high at 114.78. There is of course another possibility: If DXY heads decisively lower after testing 100, that would suggest the deflationary endgame for the global economy is farther off than I’d imagined. It is inevitable, but the most promiscuous credit stimulus in history has simply delayed it.

DXY – NYBOT Dollar Index (Last:101.92)

Posted on January 29, 2023, 5:09 pm EST

Last Updated January 27, 2023, 11:25 pm EST

Posted on January 29, 2023, 5:09 pm EST

Last Updated January 27, 2023, 11:25 pm EST

- February 5, 2023, 3:54 pm

Not only is the dollar not hitting the target of 100 it is about to spike higher and even 108 might actually happen in a very fast progression. January data was explosive and eye opening. Jobs, wages, china opening, and resilience of the consumer will force the FED to raise rates aggressively again, force the dollar to spike against most currencies except Chinas. Economics 101 states you never get ris of inflation once it takes hold on wage growth. Not many realizes this but 2/3/2023 was D-Day for the start of a ticking bomb where a real crash will occur. Your argument for deflation can NEVER happen in this current environment TILL we get a bust in markets and economy. Dismiss China as an inflationary thousand pound elephant? Tightest labor market here in decades?

If inflation was a bust January report was a mirage? never happened? We love to dismiss the obvious when it goes against our views.