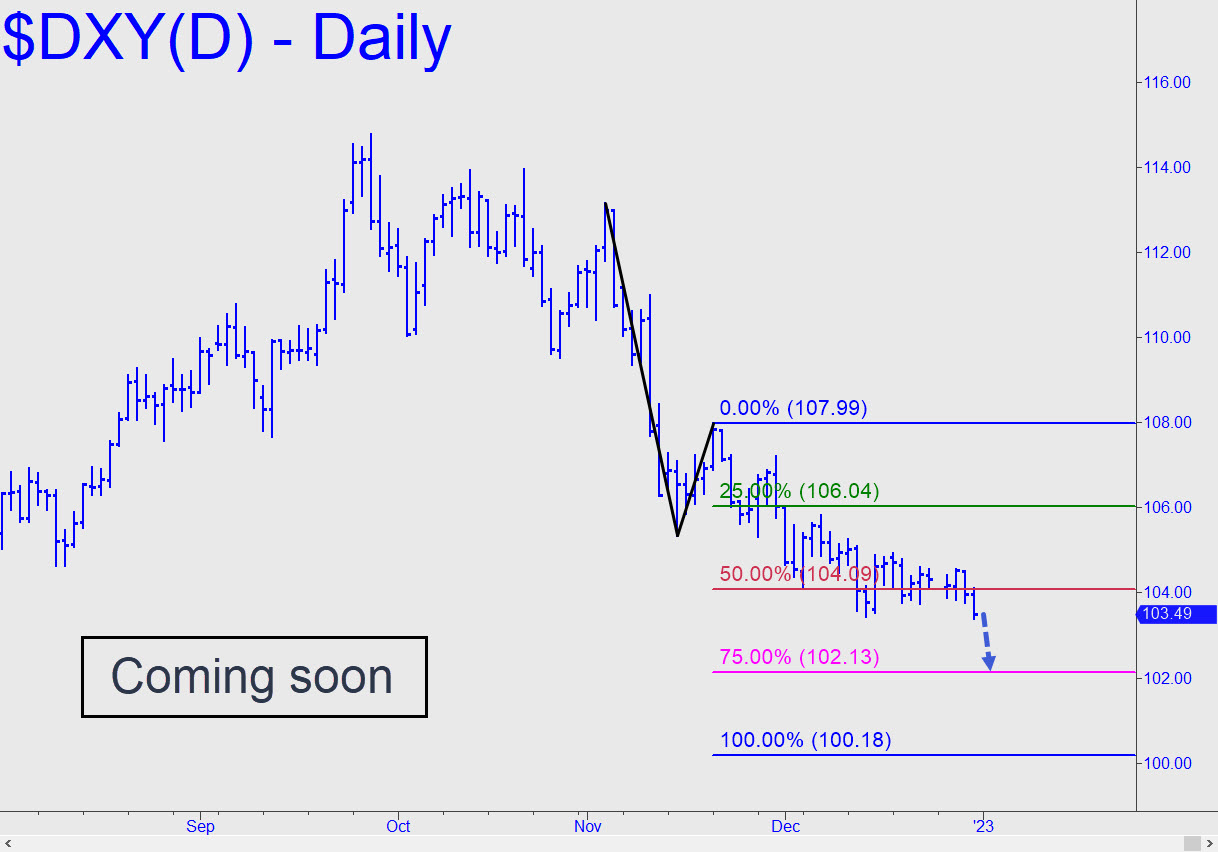

Three weeks of jitterbugging around the 104.08 midpoint Hidden Pivot support has left the Dollar Index primed for a fall to at least p2=102.13, and thence to D=100.18, a target first signaled in late November. The weakness has somewhat alleviated pressure on gold and silver and promises to contribute to their further ascent, possibly with a spike finale to an intermediate top. Presumably, it would occur above the 1908.10 peak currently forecast for the March Comex contract. ______ UPDATE (Jan 6): The Dollar Index shook us briefly out of complacency by adding an Ali Shuffle to its all-too-familiar jitterbug routine. A bull-trap rally before Friday’s opening bar reversed with such ferocity that we should infer the bearish targets above are still likely to be achieved. I’ll reconsider only if it pops above 105.81. Here’s the picture.

Three weeks of jitterbugging around the 104.08 midpoint Hidden Pivot support has left the Dollar Index primed for a fall to at least p2=102.13, and thence to D=100.18, a target first signaled in late November. The weakness has somewhat alleviated pressure on gold and silver and promises to contribute to their further ascent, possibly with a spike finale to an intermediate top. Presumably, it would occur above the 1908.10 peak currently forecast for the March Comex contract. ______ UPDATE (Jan 6): The Dollar Index shook us briefly out of complacency by adding an Ali Shuffle to its all-too-familiar jitterbug routine. A bull-trap rally before Friday’s opening bar reversed with such ferocity that we should infer the bearish targets above are still likely to be achieved. I’ll reconsider only if it pops above 105.81. Here’s the picture.

DXY – NYBOT Dollar Index (Last:103.90)

Posted on January 2, 2023, 5:10 pm EST

Last Updated January 6, 2023, 11:57 pm EST

Posted on January 2, 2023, 5:10 pm EST

Last Updated January 6, 2023, 11:57 pm EST