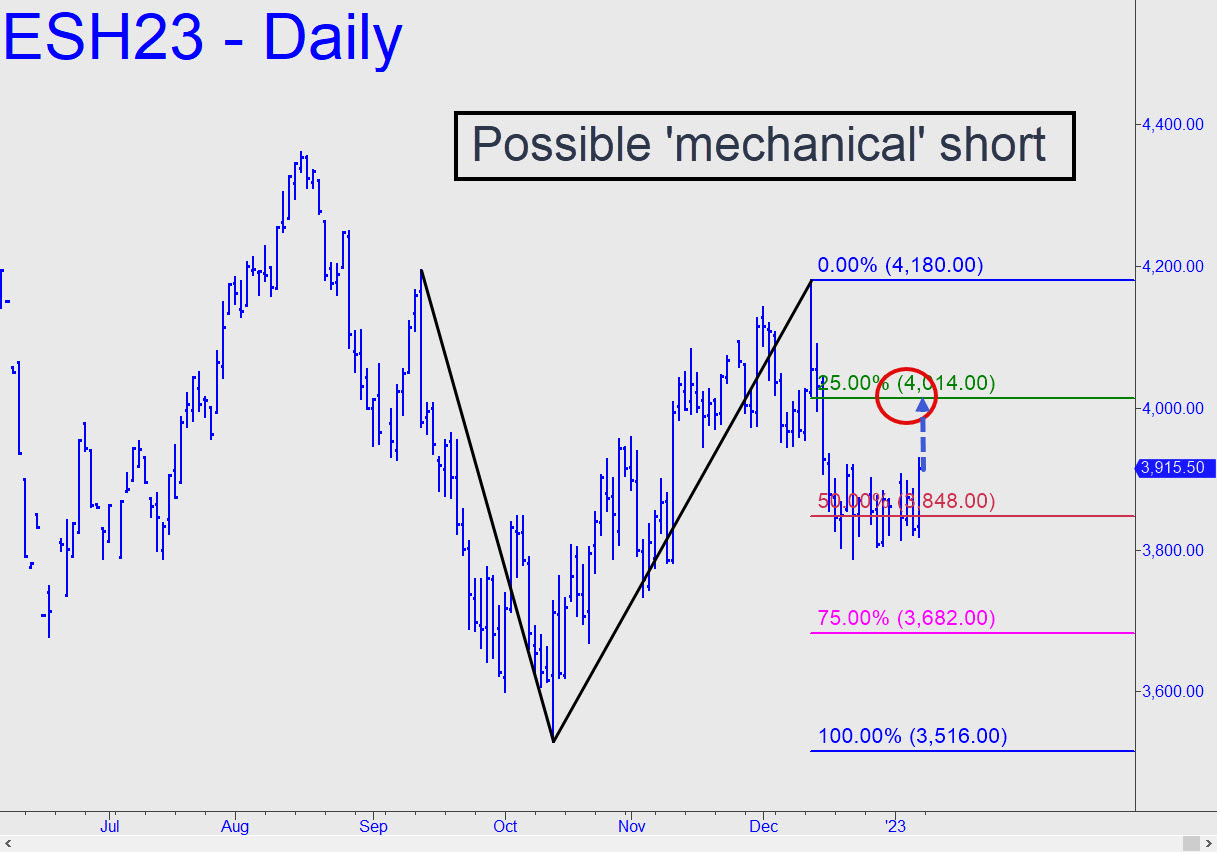

The futures spent Friday in a vicious short squeeze that itself would become short-able if it touches the green line (x=4014.00). I have my doubts the rally will get that far, but we need to take it slightly seriously anyway, since it generated an impulse leg of daily chart degree. The trade carries about $13,000 of theoretical entry risk, assuming a stop-loss at 4180.25 on four contracts. That means it should only be attempted with a ‘camouflage’ trigger. Prompt me in the chat room if ES gets there, and perhaps we will be able to improvise in real time. ______ UPDATE (Jan 12. 9:54 p.m. EST): The futures spent the entire session in full-nitwit mode, with wild swings greeting news of moderating inflation. Since no one on Earth has the foggiest idea what this means or how it might affect Fed policy, I’ll avoid wasting energy pondering such questions and simply track the short trade as having filled at 4014, stop 4180.25. This will be a good test of a ‘mechanical’ entries that came from an explicitly detailed recommendation. Since the trade caught a 66-point downdraft to 3954 after the futures topped at 4020, I’ll treat the short as having been half-covered at a middling 3974. That leaves us with two contracts and a 4054 basis. Let me know in the chat room how you handled the trade, since that might allow me to tighten my guidance. For now, bid 3950 to cover a third contract, o-c-o with a stop-loss on both of the remaining contracts at 4022.

The futures spent Friday in a vicious short squeeze that itself would become short-able if it touches the green line (x=4014.00). I have my doubts the rally will get that far, but we need to take it slightly seriously anyway, since it generated an impulse leg of daily chart degree. The trade carries about $13,000 of theoretical entry risk, assuming a stop-loss at 4180.25 on four contracts. That means it should only be attempted with a ‘camouflage’ trigger. Prompt me in the chat room if ES gets there, and perhaps we will be able to improvise in real time. ______ UPDATE (Jan 12. 9:54 p.m. EST): The futures spent the entire session in full-nitwit mode, with wild swings greeting news of moderating inflation. Since no one on Earth has the foggiest idea what this means or how it might affect Fed policy, I’ll avoid wasting energy pondering such questions and simply track the short trade as having filled at 4014, stop 4180.25. This will be a good test of a ‘mechanical’ entries that came from an explicitly detailed recommendation. Since the trade caught a 66-point downdraft to 3954 after the futures topped at 4020, I’ll treat the short as having been half-covered at a middling 3974. That leaves us with two contracts and a 4054 basis. Let me know in the chat room how you handled the trade, since that might allow me to tighten my guidance. For now, bid 3950 to cover a third contract, o-c-o with a stop-loss on both of the remaining contracts at 4022.

ESH23 – March E-Mini S&Ps (Last:3994.50)

Posted on January 8, 2023, 5:20 pm EST

Last Updated January 12, 2023, 11:21 pm EST

Posted on January 8, 2023, 5:20 pm EST

Last Updated January 12, 2023, 11:21 pm EST