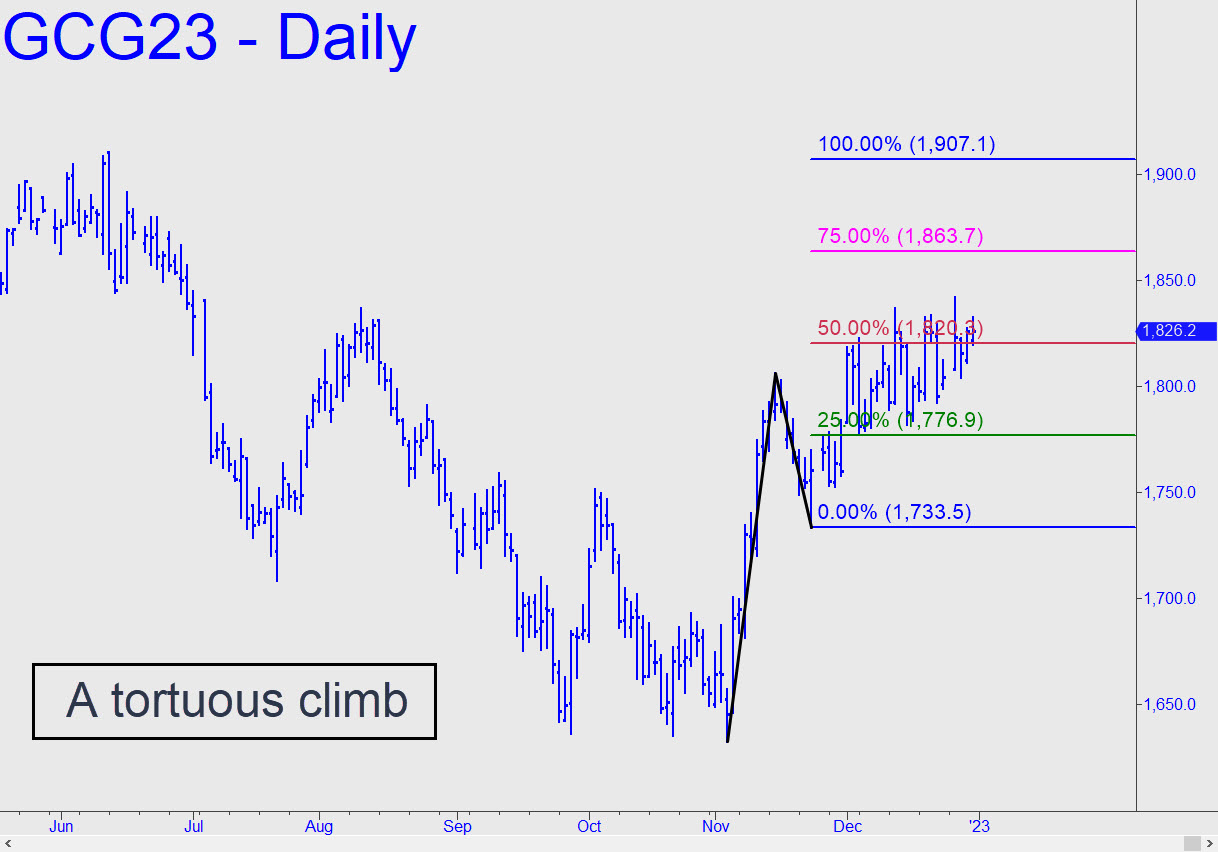

March Gold’s tortuous climb to a 1907.10 Hidden Pivot target continued last week in the accustomed way: an impressive leap followed by exhaustive backing and filling, The futures have signaled only one ‘mechanical’ buy at the green line, and it went on to produce a theoretical profit of about $2,200 per contract. A second such signal if gold relapses would be worth bottom-fishing, although my gut feeling is that the implied trek to D would be a messy, tedious slog, assuming the target is achieved, Although that still seems likely, it is not a given because of the difficulty the March contract has had surmounting midpoint resistance. ______ UPDATE (Jan 6, 11:24 p.m.): No change. Feb Gold remains on track for a run-up to at least 1907.10, a Hidden Pivot target that has kept us confidently on the right side of the trend for more than a month. Let’s keep our fingers crossed and hope that bulls blow the ‘D’ target to smithereens when they first connect with it. _______ UPDATE (Jan 12, 11:47 p.m.): This morning’s lunatic leap came within a split hair (i.e., 0.50) of fulfilling the longstanding target at 1907.10. Anyone who shorted there should have taken a partial profit on the subsequent $19 dive. The shallow pullback so far suggests bulls are not finished,

March Gold’s tortuous climb to a 1907.10 Hidden Pivot target continued last week in the accustomed way: an impressive leap followed by exhaustive backing and filling, The futures have signaled only one ‘mechanical’ buy at the green line, and it went on to produce a theoretical profit of about $2,200 per contract. A second such signal if gold relapses would be worth bottom-fishing, although my gut feeling is that the implied trek to D would be a messy, tedious slog, assuming the target is achieved, Although that still seems likely, it is not a given because of the difficulty the March contract has had surmounting midpoint resistance. ______ UPDATE (Jan 6, 11:24 p.m.): No change. Feb Gold remains on track for a run-up to at least 1907.10, a Hidden Pivot target that has kept us confidently on the right side of the trend for more than a month. Let’s keep our fingers crossed and hope that bulls blow the ‘D’ target to smithereens when they first connect with it. _______ UPDATE (Jan 12, 11:47 p.m.): This morning’s lunatic leap came within a split hair (i.e., 0.50) of fulfilling the longstanding target at 1907.10. Anyone who shorted there should have taken a partial profit on the subsequent $19 dive. The shallow pullback so far suggests bulls are not finished,

GCG23 – February Gold (Last:1899.40)

Posted on January 2, 2023, 5:17 pm EST

Last Updated January 12, 2023, 11:45 pm EST

Posted on January 2, 2023, 5:17 pm EST

Last Updated January 12, 2023, 11:45 pm EST