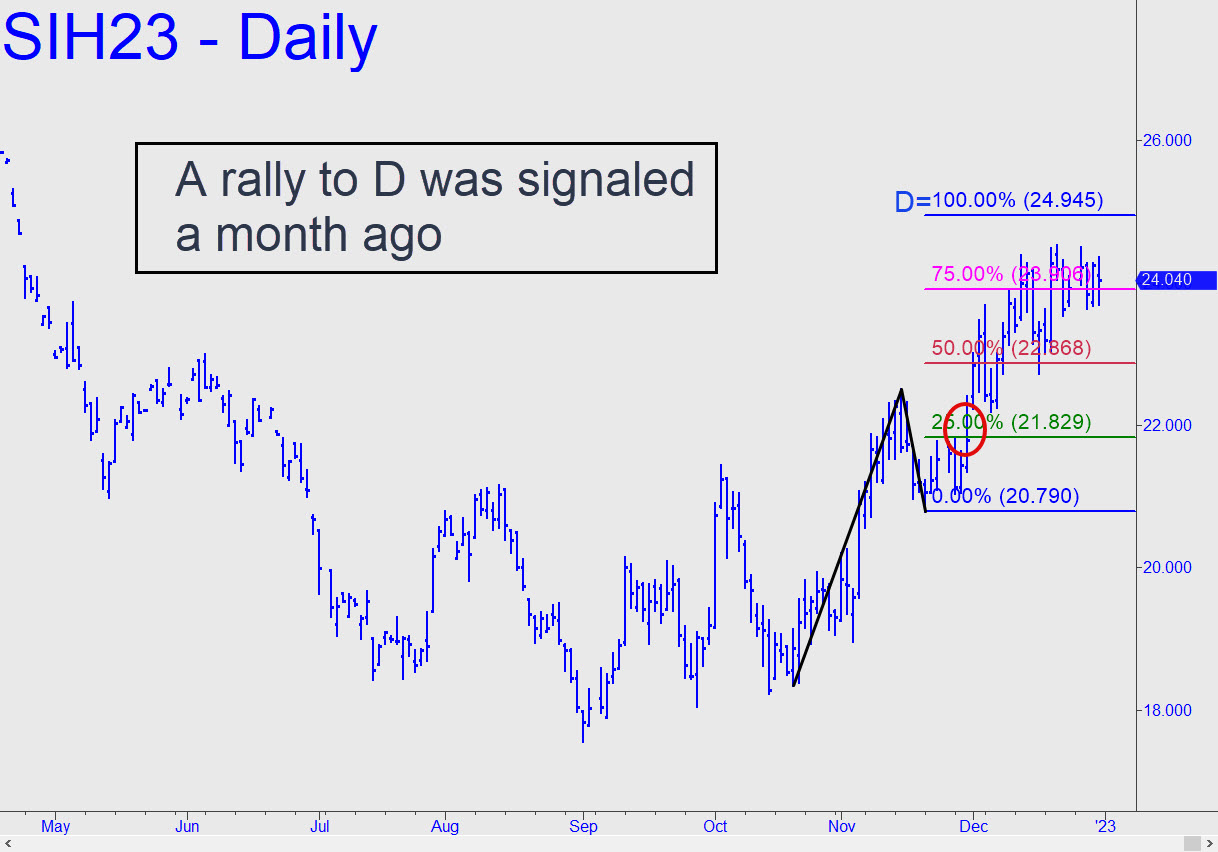

March Silver’s rally to D=24.95 was signaled a month ago and lies but one good thrust above. That will be scant consolation to bulls who just slogged through yet another week with no reward. Silver futures have outperformed gold, however, having consolidated at p2 while the latter was stuck a level lower at p. A swift pullback to the line (p=22.86) should be used as an opportunity to get long with a 22.16 stop-loss. The risk is substantial, so the trade is recommended only if you know how to cut it by around 90% with a ‘camouflage’ trigger. _______ UPDATE (Jan 4, 7:10 p.m.): The recent high at 24.78 fulfilled the target for trading purposes, although it remains theoretically viable. A ‘dynamic’ stop-loss would have taken you out of the trade at around 24.77. ________ UPDATE (Jan 6): March Silver is not likely to make a marginal new high that touches our longstanding target at 24.95 only to die there. Assuming buyers pop through it, we should expect Feb Gold to do the same when it reaches a corresponding target at 1907. The C-D leg has provided only one opportunity so far to get long ‘mechanically’, adding to the evidence that there is still considerable buying power percolating beneath the surface. Here’s the big picture.

March Silver’s rally to D=24.95 was signaled a month ago and lies but one good thrust above. That will be scant consolation to bulls who just slogged through yet another week with no reward. Silver futures have outperformed gold, however, having consolidated at p2 while the latter was stuck a level lower at p. A swift pullback to the line (p=22.86) should be used as an opportunity to get long with a 22.16 stop-loss. The risk is substantial, so the trade is recommended only if you know how to cut it by around 90% with a ‘camouflage’ trigger. _______ UPDATE (Jan 4, 7:10 p.m.): The recent high at 24.78 fulfilled the target for trading purposes, although it remains theoretically viable. A ‘dynamic’ stop-loss would have taken you out of the trade at around 24.77. ________ UPDATE (Jan 6): March Silver is not likely to make a marginal new high that touches our longstanding target at 24.95 only to die there. Assuming buyers pop through it, we should expect Feb Gold to do the same when it reaches a corresponding target at 1907. The C-D leg has provided only one opportunity so far to get long ‘mechanically’, adding to the evidence that there is still considerable buying power percolating beneath the surface. Here’s the big picture.

SIH23 – March Silver (Last:23.98)

Posted on January 2, 2023, 5:16 pm EST

Last Updated January 6, 2023, 11:33 pm EST

Posted on January 2, 2023, 5:16 pm EST

Last Updated January 6, 2023, 11:33 pm EST