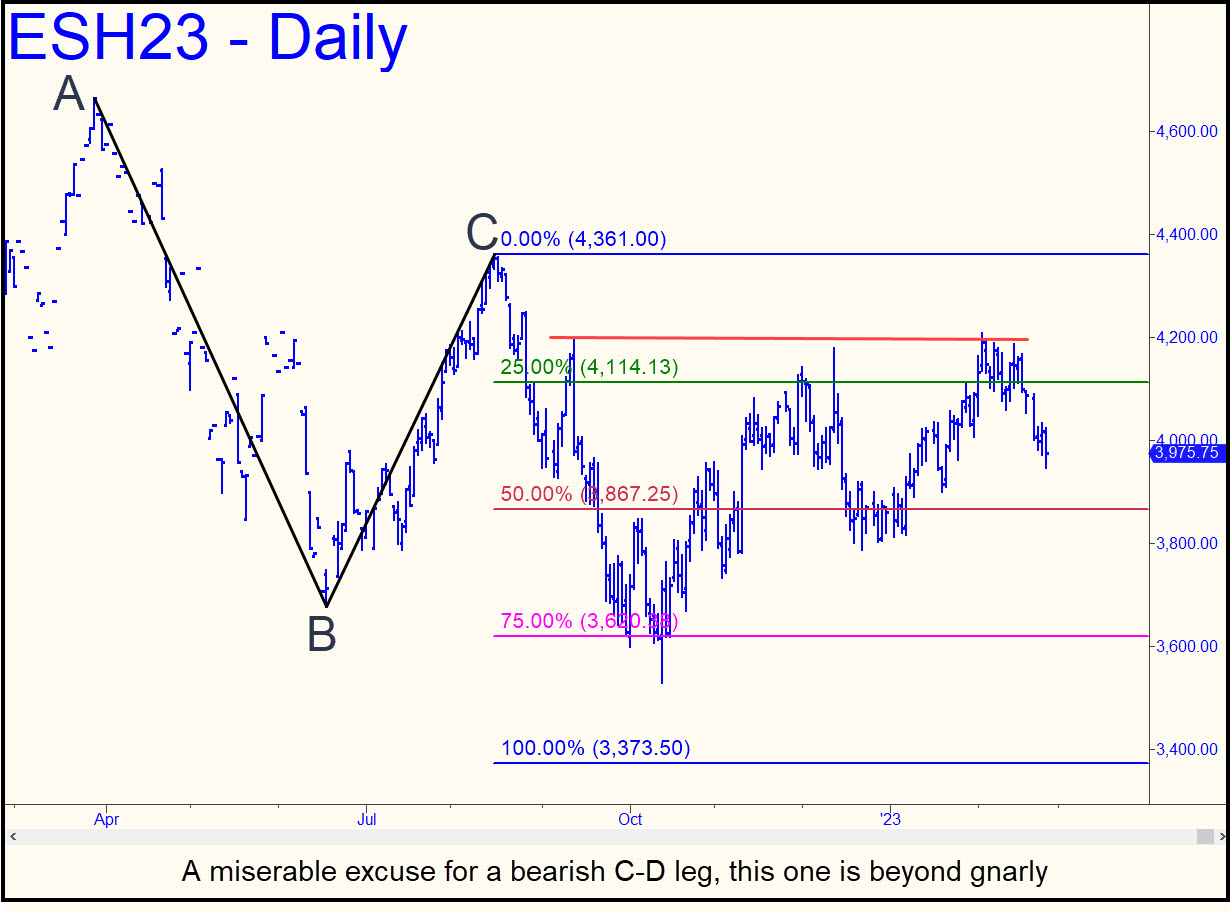

The tradeable 3796 target given here earlier can continue to serve as a minimum downside projection for the near term, but here’s a somewhat different picture with a worst-case Hidden Pivot at 3373 that would be in play if February’s so-far routine selloff gains momentum. For now, though, I am not enthusiastically on board with colleagues who are certain the bear market begun last January has resumed in earnest. In fact, bears have struggled in vain to hold this gas bag down, creating the miserable-excuse-for-a-C-D leg shown in the chart. Moreover the Feb 2 high at 4208 refreshed the bullish energy of the daily chart when it exceeded an ‘external’ peak at 4914 recorded in December. This increased the possibility that Mr Market will continue to grind bears to a bloody pulp no matter what happens in the real world. Indeed, anyone who sees a silver lining lining in today’s headlines is experiencing psychosis. For trading purposes, here’s a corrective reverse pattern that can be traded bullishly if the futures fall to the 3796 target. ______ UPDATE (Feb 28, 6:16 p.m.): Check out my instructions in the chat room this afternoon for buying put spreads in SPY. You can raise the suggested bid if the index continues to fall, or improvise a strategy using other options. Ideally, you’ll want to buy the puts on intraday rallies, which for weeks have been failing with alarming but predictable regularity. One of these times, yet another fake rally is going to fail in a big way, since the wall of worry that has kept this bear market hoax going feels just about played out. _______ UPDATE (Mar 1, 9:38 p.m.): Only one subscriber reported buying SPY puts as suggested, so I haven’t established a tracking position. I’ve told him to hang onto a few, though, since ES is about to drop to 3860, a voodoo number unlikely to be on traders’ radar. For our trading purposes, here’s a wickedly gnarly Hidden Pivot pattern that looks like it will work no matter how you choose to exploit it. Bottom-fishing at p=3905.25 could be tricky, however, since it coincides with a structural low recorded on January 19 that will have the attention of many droolers, trade-desk monkeys and the kind of ‘thinking’ machines that have brought autocorrect and pocket-dialing into the world. Previously given targets at 3796 and 3373 remain viable and can be used to trade against as well with tight ‘camo’ triggers. ______ UPDATE (Mar 2, 7:20 p.m.): It’ll take an uncorrected rally exceeding the two circled peaks in this chart to temporarily allay the suspicion that this move is just another bear-market fraud that’s not going anywhere, In the meantime, you’ll want to notice that nearly all rallies these days are being set up by timidly oversold lows to greet the day. When DaSleazeballs are actually ready to pull the plug following maximum possible distribution, index futures will not be off a piddling 20-30 points overnight — they’ll be trading slightly-to-somewhat-higher at the opening bell.

The tradeable 3796 target given here earlier can continue to serve as a minimum downside projection for the near term, but here’s a somewhat different picture with a worst-case Hidden Pivot at 3373 that would be in play if February’s so-far routine selloff gains momentum. For now, though, I am not enthusiastically on board with colleagues who are certain the bear market begun last January has resumed in earnest. In fact, bears have struggled in vain to hold this gas bag down, creating the miserable-excuse-for-a-C-D leg shown in the chart. Moreover the Feb 2 high at 4208 refreshed the bullish energy of the daily chart when it exceeded an ‘external’ peak at 4914 recorded in December. This increased the possibility that Mr Market will continue to grind bears to a bloody pulp no matter what happens in the real world. Indeed, anyone who sees a silver lining lining in today’s headlines is experiencing psychosis. For trading purposes, here’s a corrective reverse pattern that can be traded bullishly if the futures fall to the 3796 target. ______ UPDATE (Feb 28, 6:16 p.m.): Check out my instructions in the chat room this afternoon for buying put spreads in SPY. You can raise the suggested bid if the index continues to fall, or improvise a strategy using other options. Ideally, you’ll want to buy the puts on intraday rallies, which for weeks have been failing with alarming but predictable regularity. One of these times, yet another fake rally is going to fail in a big way, since the wall of worry that has kept this bear market hoax going feels just about played out. _______ UPDATE (Mar 1, 9:38 p.m.): Only one subscriber reported buying SPY puts as suggested, so I haven’t established a tracking position. I’ve told him to hang onto a few, though, since ES is about to drop to 3860, a voodoo number unlikely to be on traders’ radar. For our trading purposes, here’s a wickedly gnarly Hidden Pivot pattern that looks like it will work no matter how you choose to exploit it. Bottom-fishing at p=3905.25 could be tricky, however, since it coincides with a structural low recorded on January 19 that will have the attention of many droolers, trade-desk monkeys and the kind of ‘thinking’ machines that have brought autocorrect and pocket-dialing into the world. Previously given targets at 3796 and 3373 remain viable and can be used to trade against as well with tight ‘camo’ triggers. ______ UPDATE (Mar 2, 7:20 p.m.): It’ll take an uncorrected rally exceeding the two circled peaks in this chart to temporarily allay the suspicion that this move is just another bear-market fraud that’s not going anywhere, In the meantime, you’ll want to notice that nearly all rallies these days are being set up by timidly oversold lows to greet the day. When DaSleazeballs are actually ready to pull the plug following maximum possible distribution, index futures will not be off a piddling 20-30 points overnight — they’ll be trading slightly-to-somewhat-higher at the opening bell.

ESH23 – March E-Mini S&Ps (Last:3981.75)

Posted on February 26, 2023, 5:20 pm EST

Last Updated March 2, 2023, 7:21 pm EST

Posted on February 26, 2023, 5:20 pm EST

Last Updated March 2, 2023, 7:21 pm EST