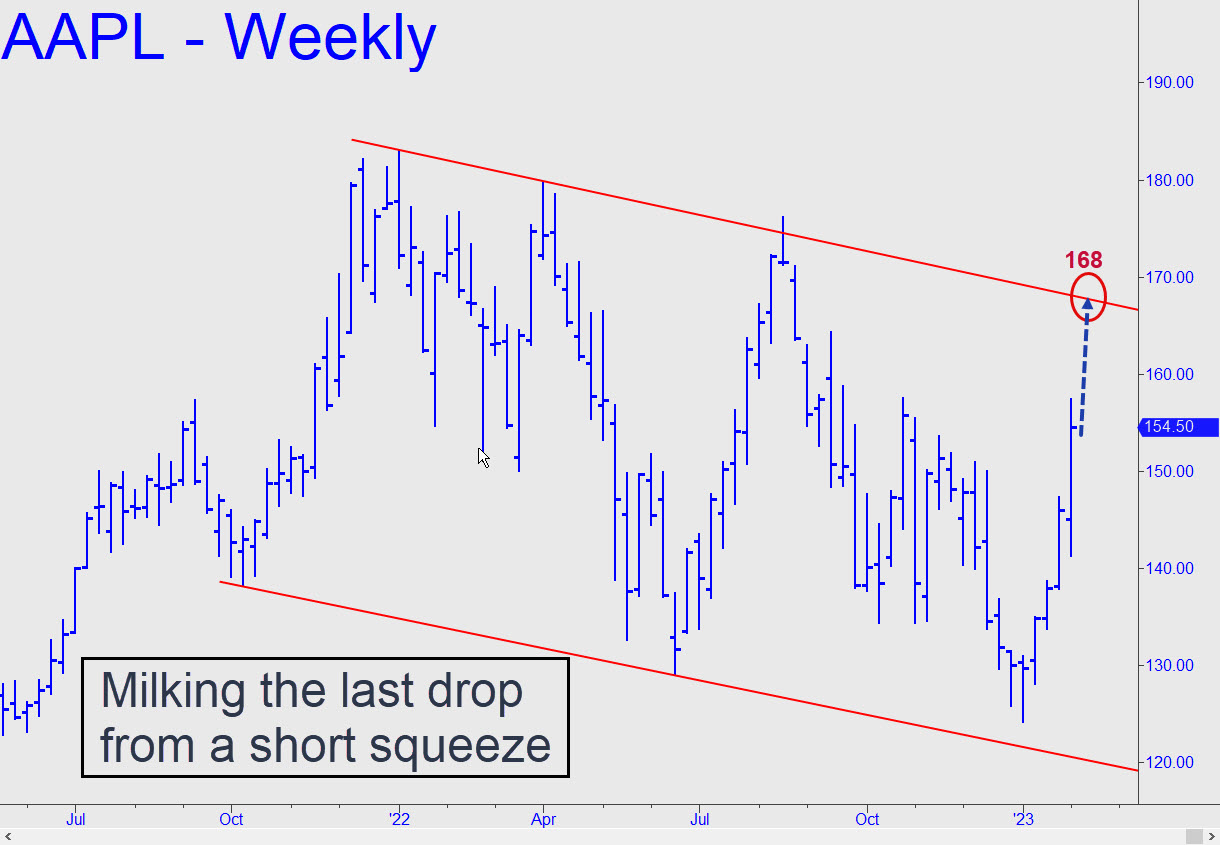

AAPL appears hellbent on reaching the top of a channel that has contained its huge ups and downs for more than a year. If the stock gets there within the next two weeks, the line’s presumptive stopping power would be felt at around 168. It’s reasonable to ask whether the rally is capable of reaching the line, but any progress above it would seem as unlikely as the emergence of a booming global economy from a debt contraction that has only recently begun. We shouldn’t assume that this is impossible, but neither should we pass up the several opportunities to get short nearly risklessly that would occur as the stock ascends toward the channel line. _____ UPDATE (Feb 15, 8:30 p.m.): Here’s a speculation for Thursday if you’ve got money burning a hole in your pocket: Buy two expiring AAPL 155 puts if the stock touches 156.30 before 11:00 a.m. ET. I estimate they’ll be trading for around 0.73. Stop yourself out if AAPL exceeds 157.38. ______ UPDATE (Feb 16, 8:51 p.m.): The stock touched 156.33 and then crashed, sending Feb 155 puts that could have been bought for as little as 0.53 to 1.90 in less than two hours. All of this happened after 2:20 p.m., when, as I’d anticipated, I was too busy to provide timely guidance. That’s why I suggested an 11:00 a.m. cutoff for the trade. Fortunately, some subscribers who ignored the clock and acted on my recommendation (see above) above were rewarded with windfall profits by day’s end. Here’s a graph of AAPL’s delightful plunge — doubtless a surprise to everyone but us.

AAPL appears hellbent on reaching the top of a channel that has contained its huge ups and downs for more than a year. If the stock gets there within the next two weeks, the line’s presumptive stopping power would be felt at around 168. It’s reasonable to ask whether the rally is capable of reaching the line, but any progress above it would seem as unlikely as the emergence of a booming global economy from a debt contraction that has only recently begun. We shouldn’t assume that this is impossible, but neither should we pass up the several opportunities to get short nearly risklessly that would occur as the stock ascends toward the channel line. _____ UPDATE (Feb 15, 8:30 p.m.): Here’s a speculation for Thursday if you’ve got money burning a hole in your pocket: Buy two expiring AAPL 155 puts if the stock touches 156.30 before 11:00 a.m. ET. I estimate they’ll be trading for around 0.73. Stop yourself out if AAPL exceeds 157.38. ______ UPDATE (Feb 16, 8:51 p.m.): The stock touched 156.33 and then crashed, sending Feb 155 puts that could have been bought for as little as 0.53 to 1.90 in less than two hours. All of this happened after 2:20 p.m., when, as I’d anticipated, I was too busy to provide timely guidance. That’s why I suggested an 11:00 a.m. cutoff for the trade. Fortunately, some subscribers who ignored the clock and acted on my recommendation (see above) above were rewarded with windfall profits by day’s end. Here’s a graph of AAPL’s delightful plunge — doubtless a surprise to everyone but us.

AAPL – Apple Computer (Last:153.69)

Posted on February 5, 2023, 5:18 pm EST

Last Updated February 16, 2023, 8:49 pm EST

Posted on February 5, 2023, 5:18 pm EST

Last Updated February 16, 2023, 8:49 pm EST