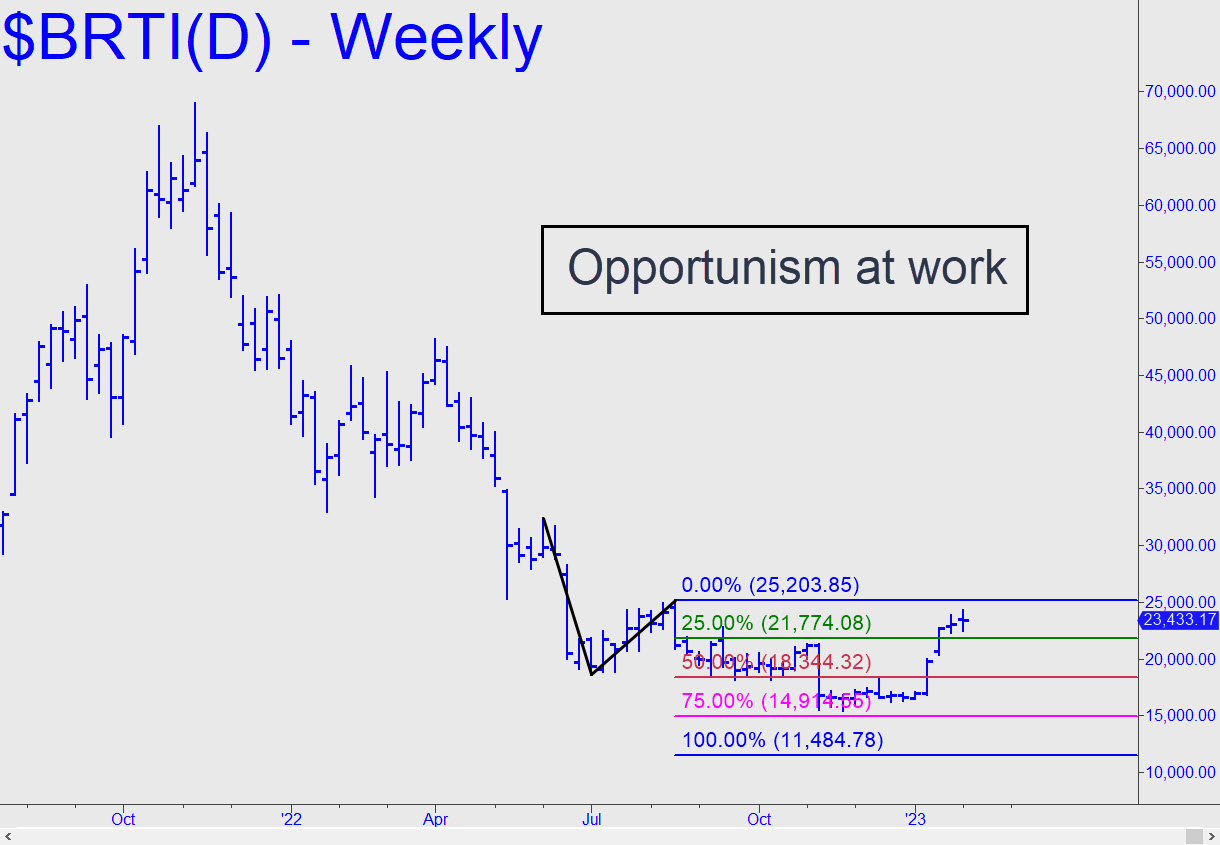

With Sam Bankman Fried’s sordid tale no longer getting airplay, the hucksters in charge of bitcoin have seized the moment to goose cryptos higher with almost no bullish buying. It remains to be seen where heavy supply will spoil the fun, but you can count on delusion-resistant pockets of it at round numbers: 25,000, 30,000, 35,000 and so on. The first is likely to give way shortly, if for no other reason than that a series of highs made there in July and August looms, a tempting bullseye on the backs of doubters. Moreover, no one would be stupid enough to get short here and now, rendering that additional source of supply moot. Nearly all of our ‘mechanical’ trades in bitcoin over the years have been profitable because this tactic is particularly well suited to exploiting vehicles that move violently. In this case, however, we’ll pass up the recent signal to get short at x=21,774 and wait for a less risky chance at ‘voodoo’ numbers that lie, respectively, near 30,000 and 40,000. Whether bitcoin gets there or not depends entirely on whether the bear rally in stocks keeps on going. When the cryptos eventually resume their fall to oblivion, however, you can bet that the first few days of the collapse will astound with their magnitude. _______ UPDATE (Feb 10): Turns out there was supply lurking at 25,000 after all — so much of it, in fact, that this flying pig barely poked its snout above 24,000 before sellers smacked it down. The high was strongly impulsive on the daily chart nonetheless, so buyers will assuredly be back when ‘news’ that could be construed as even remotely bullish for cryptos surfaces. Here’s the picture. _______ UPDATE (Feb 15, 8:43 p.m.): Once above mid-August’s peak at 25,203, BRTI’s no-supply crime spree will have an unimpeded path to at least 28,780, a voodoo number that you can bank on. _______ UPDATE (Feb 16, 8:53 p.m.): A 25,245 high, then down we went. What was that all about? Just clowns looking at themselves in the mirror, is all.

With Sam Bankman Fried’s sordid tale no longer getting airplay, the hucksters in charge of bitcoin have seized the moment to goose cryptos higher with almost no bullish buying. It remains to be seen where heavy supply will spoil the fun, but you can count on delusion-resistant pockets of it at round numbers: 25,000, 30,000, 35,000 and so on. The first is likely to give way shortly, if for no other reason than that a series of highs made there in July and August looms, a tempting bullseye on the backs of doubters. Moreover, no one would be stupid enough to get short here and now, rendering that additional source of supply moot. Nearly all of our ‘mechanical’ trades in bitcoin over the years have been profitable because this tactic is particularly well suited to exploiting vehicles that move violently. In this case, however, we’ll pass up the recent signal to get short at x=21,774 and wait for a less risky chance at ‘voodoo’ numbers that lie, respectively, near 30,000 and 40,000. Whether bitcoin gets there or not depends entirely on whether the bear rally in stocks keeps on going. When the cryptos eventually resume their fall to oblivion, however, you can bet that the first few days of the collapse will astound with their magnitude. _______ UPDATE (Feb 10): Turns out there was supply lurking at 25,000 after all — so much of it, in fact, that this flying pig barely poked its snout above 24,000 before sellers smacked it down. The high was strongly impulsive on the daily chart nonetheless, so buyers will assuredly be back when ‘news’ that could be construed as even remotely bullish for cryptos surfaces. Here’s the picture. _______ UPDATE (Feb 15, 8:43 p.m.): Once above mid-August’s peak at 25,203, BRTI’s no-supply crime spree will have an unimpeded path to at least 28,780, a voodoo number that you can bank on. _______ UPDATE (Feb 16, 8:53 p.m.): A 25,245 high, then down we went. What was that all about? Just clowns looking at themselves in the mirror, is all.

BRTI – CME Bitcoin Index (Last:23,750)

Posted on February 5, 2023, 5:02 pm EST

Last Updated February 16, 2023, 8:54 pm EST

Posted on February 5, 2023, 5:02 pm EST

Last Updated February 16, 2023, 8:54 pm EST