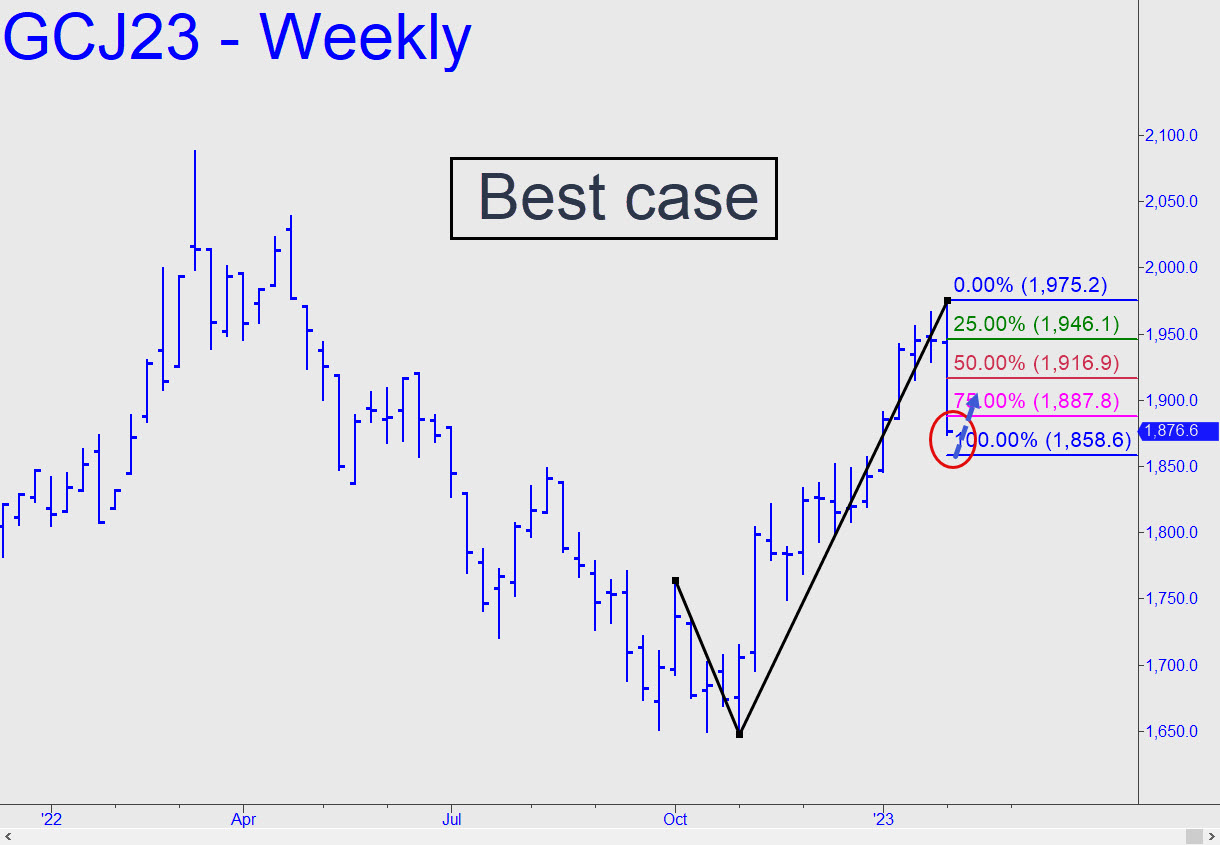

The 1858.60 downside target of the reverse pattern shown is probably the best we can hope for, given the way bullion’s personal Darth Vader crushed gold on Friday for no great reason. (Okay, it was getting a tad overbought, all right?) You can bottom-fish there with a tightly stopped ‘camo’ trigger crafted from the 5-minute chart, but if the trade gets stopped out be ready for more slippage to at least 1824.70 or even 1774.50 if any lower. Those Hidden Pivot supports are derived from a larger reverse pattern using A=1848.40 on 8/12. _______ UPDATE (Feb 14, 4:03 p.m.): Although I still expect the April contract to continue falling to at least p2=1824.70, or possibly to 1774.50 (see above), today’s bounce from the D target of a smaller pattern raises the possibility that a bottom is in. Here’s the chart. _______ UPDATE (Feb 17, 8:55 a.m. ET): The overnight low came within $3 of the touted minimum downside target of 1824.70 — close enough be considered fulfilled. A further drop to my worst-case number, 1774.50, is NOT a foregone conclusion, as the tout implies, although it would be if the futures relapse and crush p2=1824.70. However, a relapse could conceivably do no worse than bring the April contract down to a low that would more precisely fulfill the forecast. For my own trading purposes, the $3 gap is sufficient to negate rABC bottom-fishing, at least for the moment.

The 1858.60 downside target of the reverse pattern shown is probably the best we can hope for, given the way bullion’s personal Darth Vader crushed gold on Friday for no great reason. (Okay, it was getting a tad overbought, all right?) You can bottom-fish there with a tightly stopped ‘camo’ trigger crafted from the 5-minute chart, but if the trade gets stopped out be ready for more slippage to at least 1824.70 or even 1774.50 if any lower. Those Hidden Pivot supports are derived from a larger reverse pattern using A=1848.40 on 8/12. _______ UPDATE (Feb 14, 4:03 p.m.): Although I still expect the April contract to continue falling to at least p2=1824.70, or possibly to 1774.50 (see above), today’s bounce from the D target of a smaller pattern raises the possibility that a bottom is in. Here’s the chart. _______ UPDATE (Feb 17, 8:55 a.m. ET): The overnight low came within $3 of the touted minimum downside target of 1824.70 — close enough be considered fulfilled. A further drop to my worst-case number, 1774.50, is NOT a foregone conclusion, as the tout implies, although it would be if the futures relapse and crush p2=1824.70. However, a relapse could conceivably do no worse than bring the April contract down to a low that would more precisely fulfill the forecast. For my own trading purposes, the $3 gap is sufficient to negate rABC bottom-fishing, at least for the moment.

GCJ23 – April Gold (Last:1836.60)

Posted on February 5, 2023, 5:17 pm EST

Last Updated February 17, 2023, 9:46 am EST

Posted on February 5, 2023, 5:17 pm EST

Last Updated February 17, 2023, 9:46 am EST