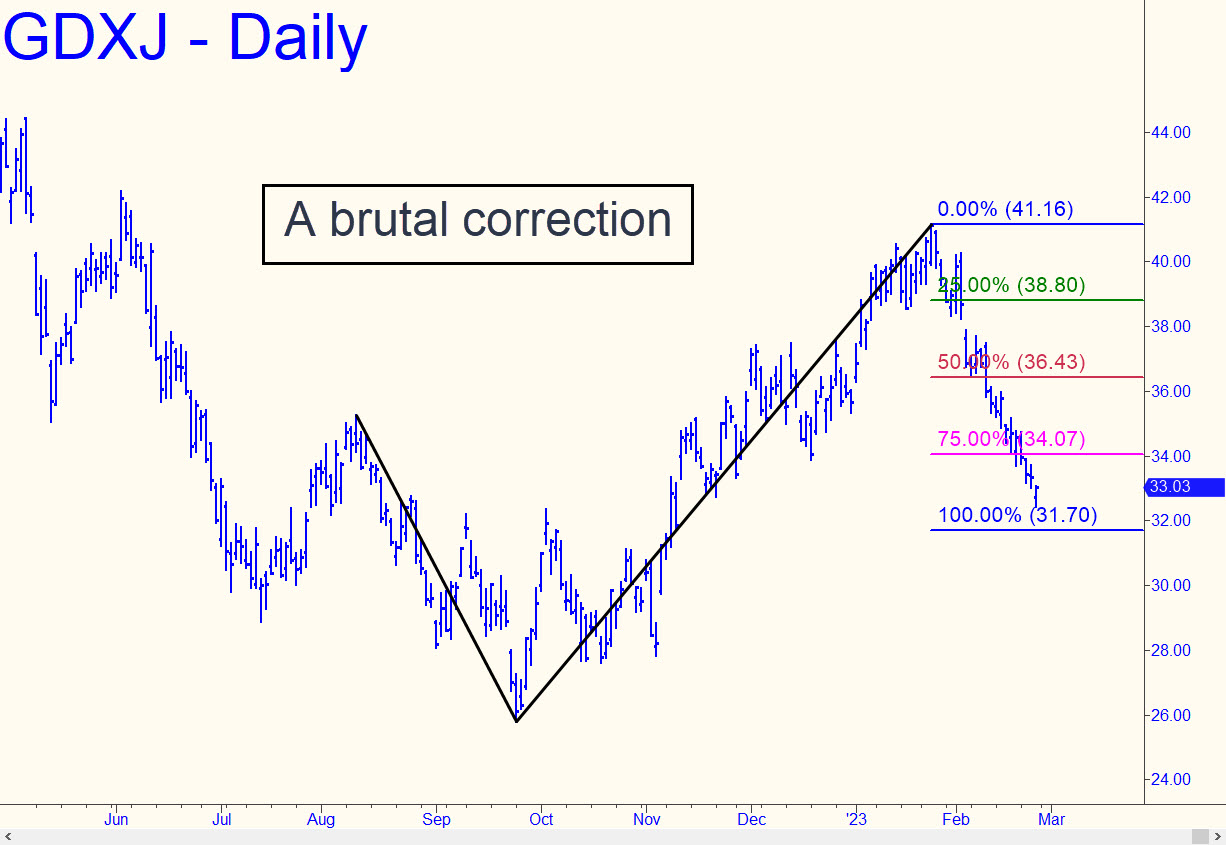

As steep and relentless as the correction from January’s peak at $41 has been, bears are going to have a tough time taking out the 31.70 Hidden Pivot support of the compelling reverse pattern shown. It can be bought speculatively with a tight stop, but be careful, since the mere exposure of this number on the Rick’s Picks home page could attract the unwanted attention of the droolers, algos and trade-desk moneys we frequently compete against. _______ UPDATE (Feb 28, 10:22 p.m.): GDXJ has generated a fresh impulse leg on each of the last three days, but there’s more work to be done if it’s going to win our confidence. For starters, it failed by an inch today to achieve the 34.10 target of this pattern, a sign that buyers are tiring. If they should get second wind, they’ll still have to push above structural resistance in the form of two peaks that lie, respectively, at 34.77 and 35.15 from mid-February. Your trading bias should be bullish, but don’t hesitate to nail down a partial profit if the opportunity should arise.

As steep and relentless as the correction from January’s peak at $41 has been, bears are going to have a tough time taking out the 31.70 Hidden Pivot support of the compelling reverse pattern shown. It can be bought speculatively with a tight stop, but be careful, since the mere exposure of this number on the Rick’s Picks home page could attract the unwanted attention of the droolers, algos and trade-desk moneys we frequently compete against. _______ UPDATE (Feb 28, 10:22 p.m.): GDXJ has generated a fresh impulse leg on each of the last three days, but there’s more work to be done if it’s going to win our confidence. For starters, it failed by an inch today to achieve the 34.10 target of this pattern, a sign that buyers are tiring. If they should get second wind, they’ll still have to push above structural resistance in the form of two peaks that lie, respectively, at 34.77 and 35.15 from mid-February. Your trading bias should be bullish, but don’t hesitate to nail down a partial profit if the opportunity should arise.

GDXJ – Junior Gold Miner ETF (Last:33.79)

Posted on February 26, 2023, 5:13 pm EST

Last Updated February 28, 2023, 10:22 pm EST

Posted on February 26, 2023, 5:13 pm EST

Last Updated February 28, 2023, 10:22 pm EST