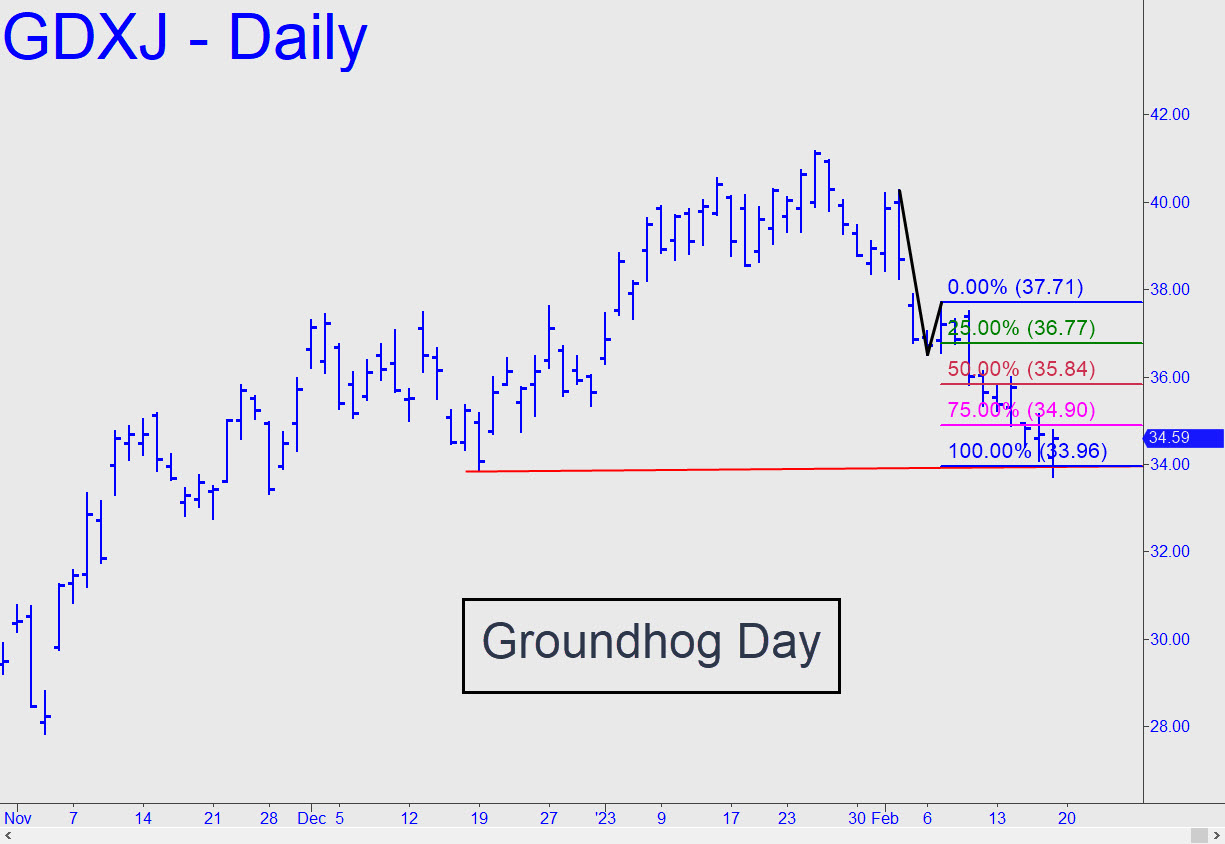

Uh-oh. Looks like the groundhog saw his shadow. Friday’s breach of the ‘D’ Hidden Pivot support at 33.96 was bearish, although not necessarily fatal. It also stopped out a key low at 33.89 from December, generating an impulse leg of daily-chart degree and the presumption of a rally that is merely corrective. The outlook would brighten somewhat if GDXJ can achieve 36.00, exceeding a mildly challenging peak from last week. Since the small dip beneath December’s low would have stopped out many bulls and lightened the profit-taking load on the rebound, we should hope its feistiness continues for at least another day or two. _______ UPDATE (Feb 22, 3:55 p.m.): A chat room denizen said he thought GDXJ might be bottoming right here, but I doubt it. My response to him was as follows: “Wishful thinking, perhaps, in that GDXJ pattern, S_____. Here’s a more realistic pattern that has bearishly breached a perfectly good D support: https://bit.ly/3Es5HB2 Another minor ‘D’ at 33.16 is holding so far (A=37.71 on 2/7), but if it gives way the next stop on the southbound local would be p2=31.94 (60-min, A=40.27 on 2/2; B=34.89 on 2/24).”

Uh-oh. Looks like the groundhog saw his shadow. Friday’s breach of the ‘D’ Hidden Pivot support at 33.96 was bearish, although not necessarily fatal. It also stopped out a key low at 33.89 from December, generating an impulse leg of daily-chart degree and the presumption of a rally that is merely corrective. The outlook would brighten somewhat if GDXJ can achieve 36.00, exceeding a mildly challenging peak from last week. Since the small dip beneath December’s low would have stopped out many bulls and lightened the profit-taking load on the rebound, we should hope its feistiness continues for at least another day or two. _______ UPDATE (Feb 22, 3:55 p.m.): A chat room denizen said he thought GDXJ might be bottoming right here, but I doubt it. My response to him was as follows: “Wishful thinking, perhaps, in that GDXJ pattern, S_____. Here’s a more realistic pattern that has bearishly breached a perfectly good D support: https://bit.ly/3Es5HB2 Another minor ‘D’ at 33.16 is holding so far (A=37.71 on 2/7), but if it gives way the next stop on the southbound local would be p2=31.94 (60-min, A=40.27 on 2/2; B=34.89 on 2/24).”

GDXJ – Junior Gold Miner ETF (Last:33.40)

Posted on February 19, 2023, 5:16 pm EST

Last Updated February 22, 2023, 9:51 pm EST

Posted on February 19, 2023, 5:16 pm EST

Last Updated February 22, 2023, 9:51 pm EST