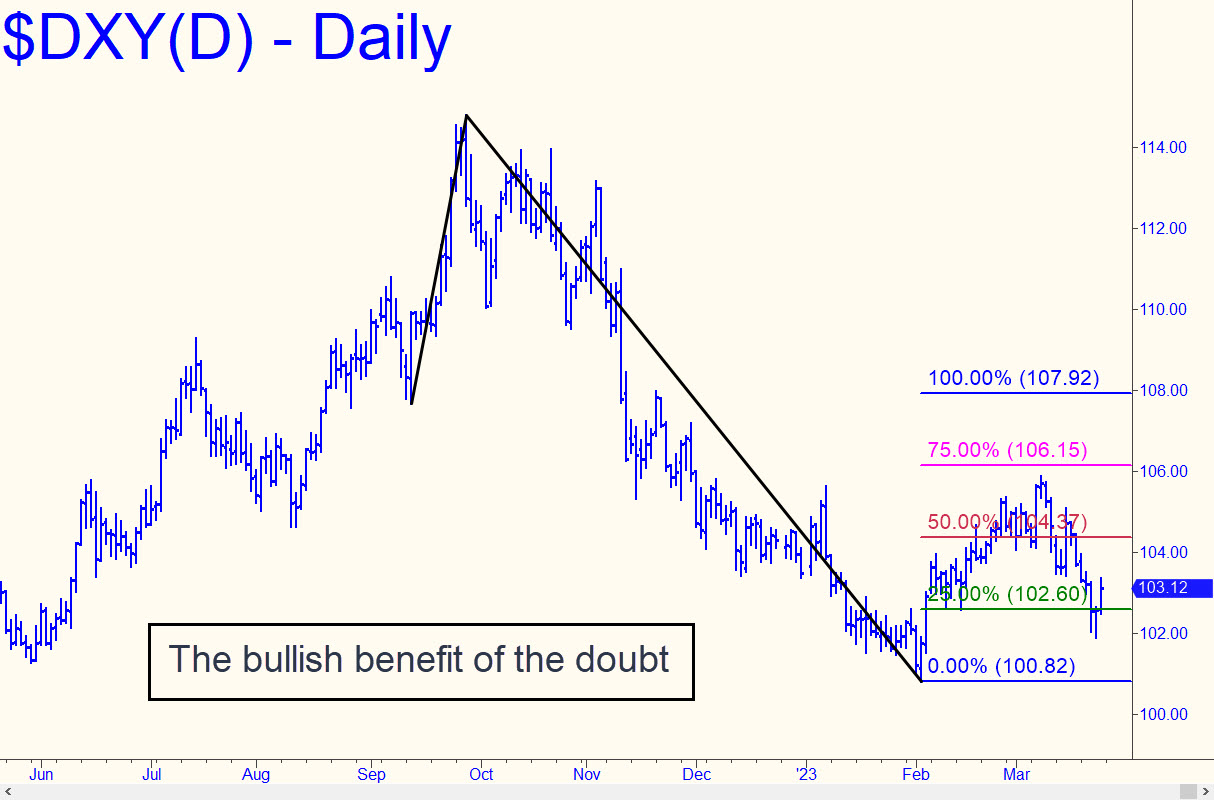

The dollar has looked like hell for the last three weeks, but I’ve given it the bullish benefit of the doubt nonetheless because DXY signaled an appealing ‘mechanical’ buy with last Wednesday’s fall to the green line (x=102.60). The implied rally target of the modest rABC pattern shown is 107.92, but that Hidden Pivot resistance would need to be slightly exceeded in order to take out a crucial external peak at 107.99 recorded last November. That would signal the likely return of the long-term bull market begun at the start of 2021 from 80.21. Alternatively, if the dollar continues to fall, it should be presumed bound for the 98.71 target shown here. This pattern also strongly implies that DXY should be ‘mechanically’ shorted at the green line (x=104.09). The bullish target at 107.92 would still be viable unless 100.82 were exceeded to the downside. (That’s the ‘c’ low of the pattern shown in the inset.)

The dollar has looked like hell for the last three weeks, but I’ve given it the bullish benefit of the doubt nonetheless because DXY signaled an appealing ‘mechanical’ buy with last Wednesday’s fall to the green line (x=102.60). The implied rally target of the modest rABC pattern shown is 107.92, but that Hidden Pivot resistance would need to be slightly exceeded in order to take out a crucial external peak at 107.99 recorded last November. That would signal the likely return of the long-term bull market begun at the start of 2021 from 80.21. Alternatively, if the dollar continues to fall, it should be presumed bound for the 98.71 target shown here. This pattern also strongly implies that DXY should be ‘mechanically’ shorted at the green line (x=104.09). The bullish target at 107.92 would still be viable unless 100.82 were exceeded to the downside. (That’s the ‘c’ low of the pattern shown in the inset.)

DXY – NYBOT Dollar Index (Last:103.12)

Posted on March 26, 2023, 7:21 am EDT

Last Updated March 25, 2023, 8:17 am EDT

Posted on March 26, 2023, 7:21 am EDT

Last Updated March 25, 2023, 8:17 am EDT