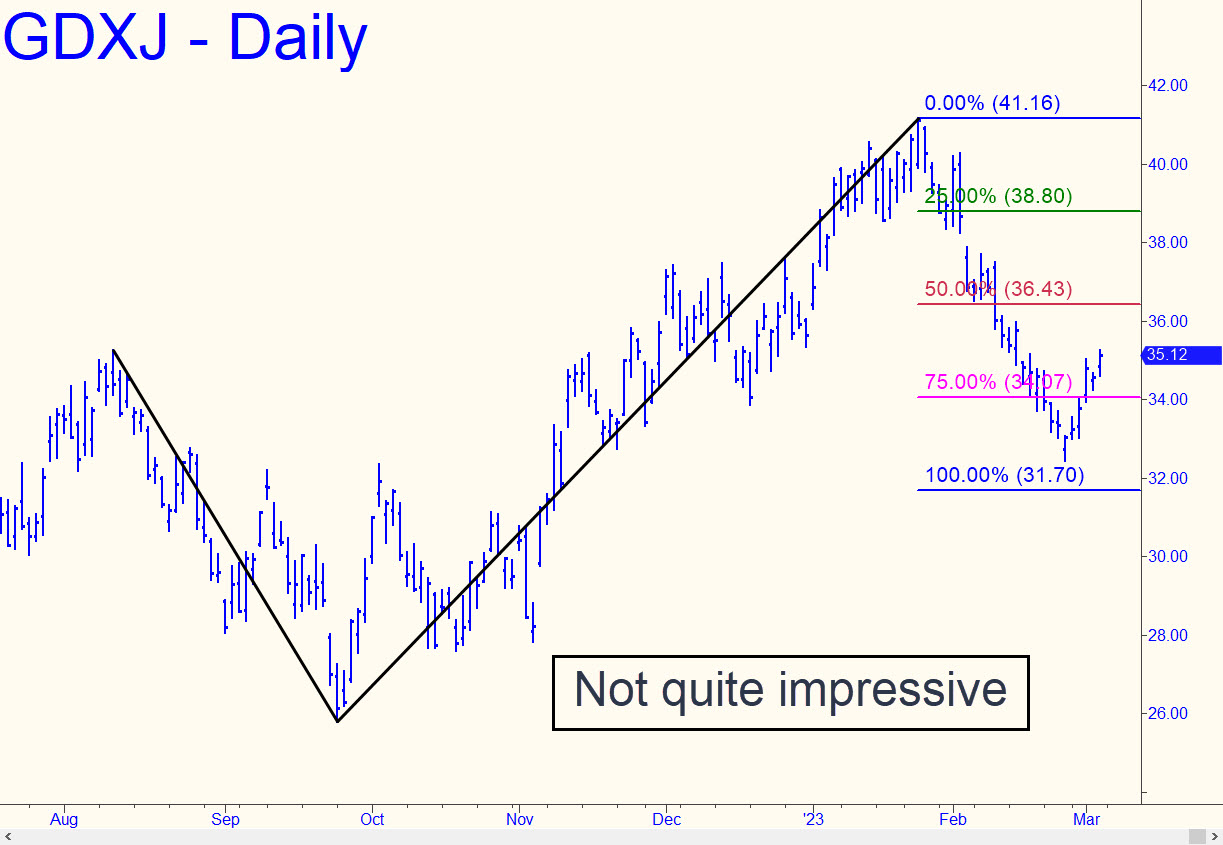

Since GDXJ’s rally met all the conditions I’d imposed on it last week, it’s time to throw more cold water on the bullish idea. The bearish case rests on the question of whether downside D=31.70, narrowly missed on the last bout of weakness, will ultimately be achieved. Regardless, a quick run-up now to x=38.80 would offer an excellent opportunity to get short ‘mechanically’. The implied relapse shouldn’t necessarily be expected to fulfill the downside D, however, and I doubt that it will. I remain skeptical in any event that the bounce that began from Feb 24’s bottom at 32.46 will get legs. I’d feel somewhat different about this if the third of my three conditions, a push above an ‘external’ peak at 35.15, had not required a one-day pullback and a running start. That is timid price action, and it suggests bulls don’t yet have the moxie to blitz doubters.

Since GDXJ’s rally met all the conditions I’d imposed on it last week, it’s time to throw more cold water on the bullish idea. The bearish case rests on the question of whether downside D=31.70, narrowly missed on the last bout of weakness, will ultimately be achieved. Regardless, a quick run-up now to x=38.80 would offer an excellent opportunity to get short ‘mechanically’. The implied relapse shouldn’t necessarily be expected to fulfill the downside D, however, and I doubt that it will. I remain skeptical in any event that the bounce that began from Feb 24’s bottom at 32.46 will get legs. I’d feel somewhat different about this if the third of my three conditions, a push above an ‘external’ peak at 35.15, had not required a one-day pullback and a running start. That is timid price action, and it suggests bulls don’t yet have the moxie to blitz doubters.

GDXJ – Junior Gold Miner ETF (Last:35.12)

Posted on March 5, 2023, 5:16 pm EST

Last Updated March 8, 2023, 8:07 pm EST

Posted on March 5, 2023, 5:16 pm EST

Last Updated March 8, 2023, 8:07 pm EST