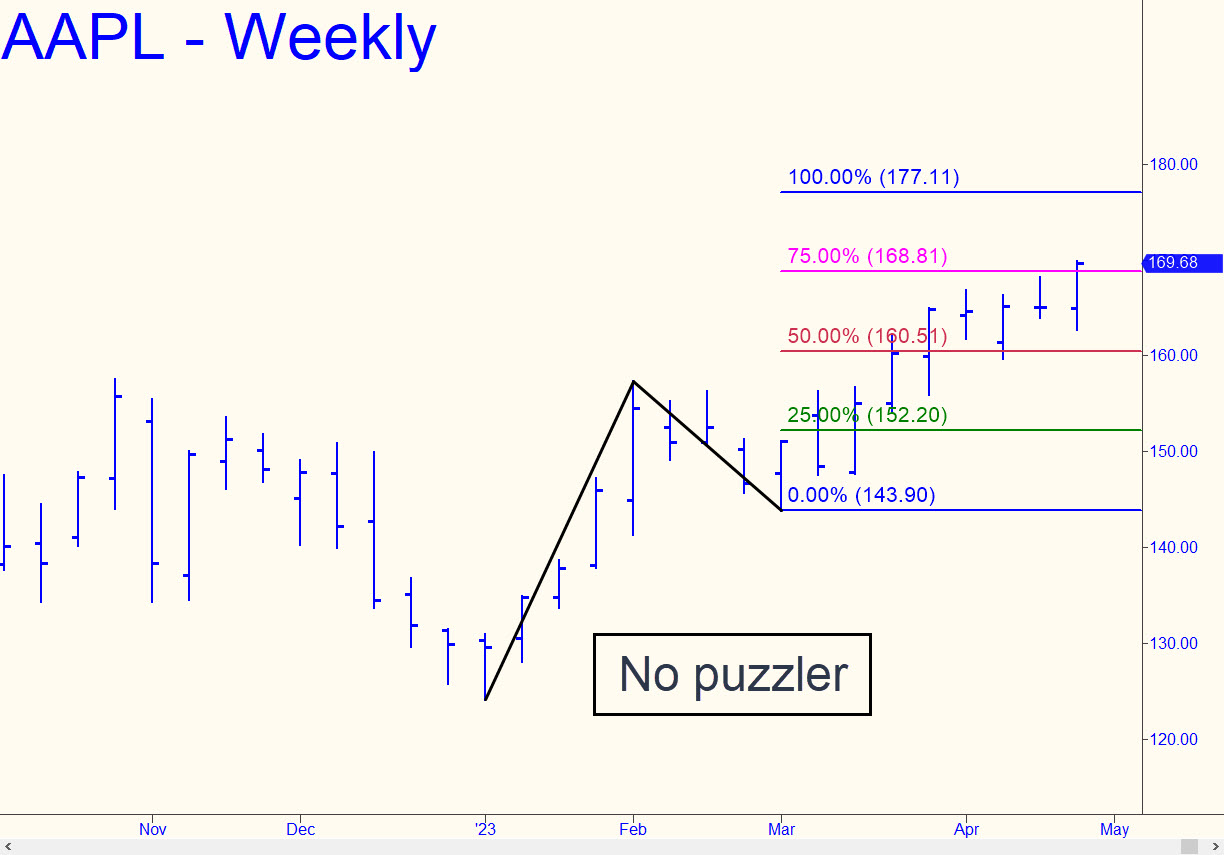

AAPL should be able to reach the 177.11 rally target easily, although that would imply a dearth of opportunities to get long ‘mechanically’ on a swoon. This is one instance where a ‘mechanical’ buy at the 160.51 red line (i.e., the midpoint Hidden Pivot) would be justified. Your bid there should be stopped at 154.87, yielding a risk/reward of 1:3 on entry that is predicated on exiting a long position at the 177.111 target.

AAPL should be able to reach the 177.11 rally target easily, although that would imply a dearth of opportunities to get long ‘mechanically’ on a swoon. This is one instance where a ‘mechanical’ buy at the 160.51 red line (i.e., the midpoint Hidden Pivot) would be justified. Your bid there should be stopped at 154.87, yielding a risk/reward of 1:3 on entry that is predicated on exiting a long position at the 177.111 target.

In this week’s commentary, I have shifted my focus to Chipotle (CMG) as a stock market bellwether. AAPL still holds primacy for this purpose, but Chipotle recently signaled the very strong likelihood of a further, 35% move to as high as 2739. If so, the patience of permabears is likely to be tested beyond all endurance. Their capitulation would correspond to a blowoff top. It would appear that the Second Great Depression that is coming with the next bear market is about to be postponed yet again. That would be a small miracle, considering that an epic collapse in residential and commercial real estate is baked in the cake for 2024.