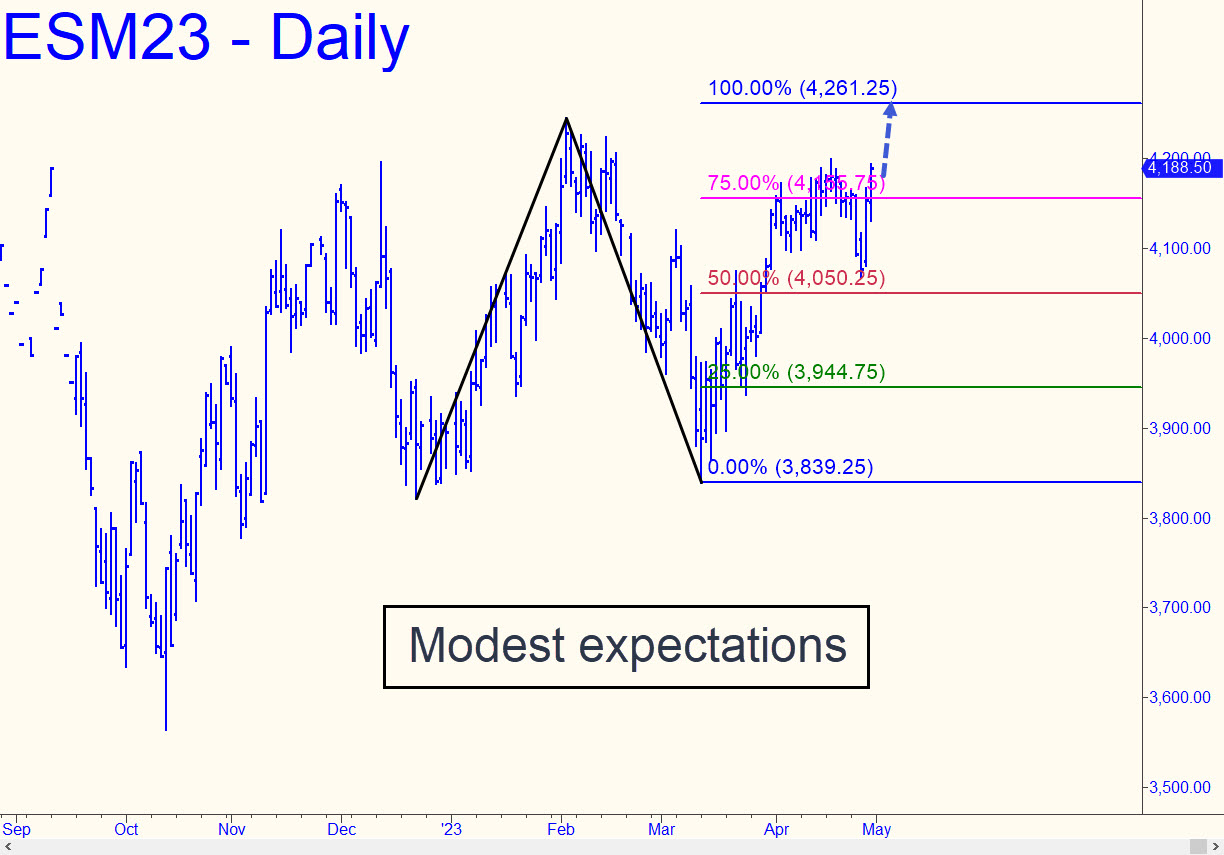

I’ve drawn a moderately bullish pattern with a 4261.25 rally target that lies 75 points above Friday’s close. I’ll recommend extra caution if shorting there because the target was sired by three possible ‘fathers’ — i.e., the three closely spaced lows at the start of the move. If the futures blow past D, that would warrant sliding ‘A’ down to October’s bottom and shifting ‘B’ one peak to the left. The resulting target is 4453.25, the most bullish number I’m comfortable billboarding at the moment. Here’s the chart. Pivoteers might be interested to know that my justification for the larger pattern hinges on the subtlety of the ‘B’ high having slightly surpassed the circled ‘external’ peak. That makes A-B legitimately impulsive, and therefore capable in theory of hurling the futures as high as 4453.25. ______ UPDATE (May 4, 5:40 p.m.): A downtrend turned tortuous looks bound for this 4026.50 target. Let’s see if sellers have enough gumption left after today’s messy tussle to get there.

I’ve drawn a moderately bullish pattern with a 4261.25 rally target that lies 75 points above Friday’s close. I’ll recommend extra caution if shorting there because the target was sired by three possible ‘fathers’ — i.e., the three closely spaced lows at the start of the move. If the futures blow past D, that would warrant sliding ‘A’ down to October’s bottom and shifting ‘B’ one peak to the left. The resulting target is 4453.25, the most bullish number I’m comfortable billboarding at the moment. Here’s the chart. Pivoteers might be interested to know that my justification for the larger pattern hinges on the subtlety of the ‘B’ high having slightly surpassed the circled ‘external’ peak. That makes A-B legitimately impulsive, and therefore capable in theory of hurling the futures as high as 4453.25. ______ UPDATE (May 4, 5:40 p.m.): A downtrend turned tortuous looks bound for this 4026.50 target. Let’s see if sellers have enough gumption left after today’s messy tussle to get there.

ESM23 – June E-Mini S&P (Last:4074.50)

Posted on April 30, 2023, 5:25 pm EDT

Last Updated May 4, 2023, 5:40 pm EDT

Posted on April 30, 2023, 5:25 pm EDT

Last Updated May 4, 2023, 5:40 pm EDT