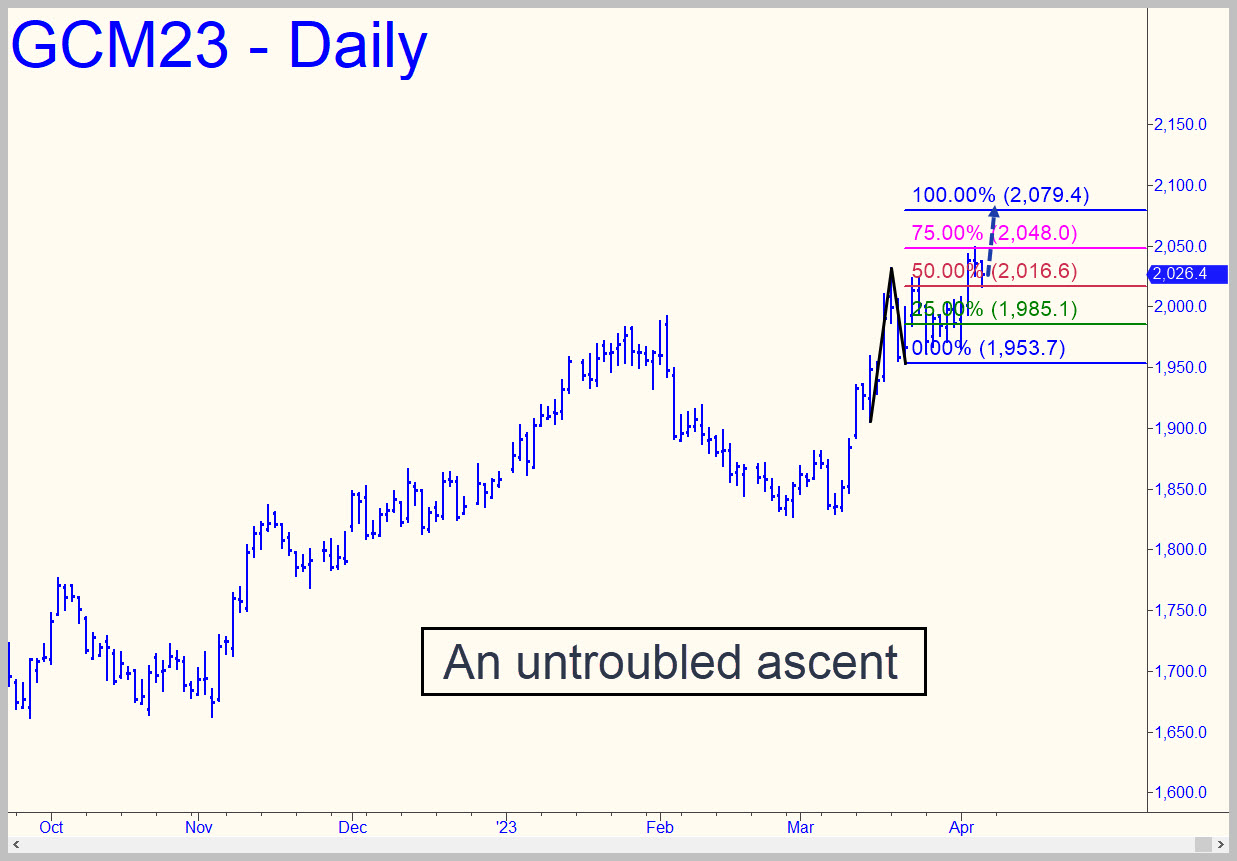

We’ve been using the 2079.40 target shown as a minimum upside objective, but there’s a yellow flag out at the moment because Friday’s high at 2049.20 precisely coincided with Hidden Pivot resistance levels associated with two bullish patterns, including the one targeted on 2079.40. The pattern has already enabled a ‘mechanical’ buy at the green line that could have been worth as much as $6400 per contract. A second such signal would occur on a pullback to 1985.10, stop 1953.60, but I’ll suggest tuning to the chat room if the opportunity gets close, since theoretical entry risk exceeds $3000 per contract. ______ UPDATE (Apr 11, 9:52 p.m. EDT): The futures look all but certain to achieve the 2029.50 target of this pattern, but the picture would brighten still move if this thrust can take out the 2031 peak to the left without pausing for breath. _______ UPDATE (Apr 12, 5:49 p.m.): The rally accomplished what we’d asked of it, then gold did its by-now-obligatory Daily Dive. A score more of them will not change the fact that this is a bull market and that all upside targets provided here for the foreseeable future will be achieved more or less exactly, if sometimes tortuously.

We’ve been using the 2079.40 target shown as a minimum upside objective, but there’s a yellow flag out at the moment because Friday’s high at 2049.20 precisely coincided with Hidden Pivot resistance levels associated with two bullish patterns, including the one targeted on 2079.40. The pattern has already enabled a ‘mechanical’ buy at the green line that could have been worth as much as $6400 per contract. A second such signal would occur on a pullback to 1985.10, stop 1953.60, but I’ll suggest tuning to the chat room if the opportunity gets close, since theoretical entry risk exceeds $3000 per contract. ______ UPDATE (Apr 11, 9:52 p.m. EDT): The futures look all but certain to achieve the 2029.50 target of this pattern, but the picture would brighten still move if this thrust can take out the 2031 peak to the left without pausing for breath. _______ UPDATE (Apr 12, 5:49 p.m.): The rally accomplished what we’d asked of it, then gold did its by-now-obligatory Daily Dive. A score more of them will not change the fact that this is a bull market and that all upside targets provided here for the foreseeable future will be achieved more or less exactly, if sometimes tortuously.

GCM23 – June Gold (Last:2029.40)

Posted on April 9, 2023, 5:21 pm EDT

Last Updated April 13, 2023, 9:00 am EDT

Posted on April 9, 2023, 5:21 pm EDT

Last Updated April 13, 2023, 9:00 am EDT