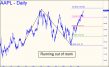

The post-covid bull market begun in the final quarter of 2020 is running out of room, at least on the daily chart. The 184.86 target shown, a Hidden Pivot resistance, is not the highest that can be projected, but it still looks capable of restraining the charge, if only for a short while. Sliding ‘A’ down to the 118.70 low recorded on March 4, 2021, produces an alternative high at 190.90, but we’ll wait to see how buyers handle D=184.86 before we raise our sights. To stretch your bullish imagination, but also to be on record with a seemingly outrageous forecast, let me introduce a 253.96 target with this weekly graph. We’ll be better able to make book if the stock exceeds 184.96 and stalls at the 189.07 midpoint. That would make 253.96 more plausible as an objective, especially if AAPL stabs through p=189.07 and closes above it the same week. ______ UPDATE (Jun 5, 2:35 p.m.): AAPL has plummeted from a spike high at 184.95 that missed my target (boldfaced above in green) by nine cents. Because the stock is the most important stock-market bellwether of them all — “the only stock that matters” — we should be alert to the possibility that the broad averages have put in a major top today. Addendum, 6:49 p.m.: I doubt it, especially since the selling was triggered by ‘news’ that was bound to affect mainly rubes, yokels, and riff-raff who trade the stock, but that’s no reason to take our eyes off a chart that is incapable of lying or even misleading._______ UPDATE (Jun 7, 5:52 p.m.): Monday’s spike on ‘goggle news’ has left AAPL top-heavy. This chart suggests the stock will need to come down into the range 170-175 range to consolidate for the next thrust toward $200.

The post-covid bull market begun in the final quarter of 2020 is running out of room, at least on the daily chart. The 184.86 target shown, a Hidden Pivot resistance, is not the highest that can be projected, but it still looks capable of restraining the charge, if only for a short while. Sliding ‘A’ down to the 118.70 low recorded on March 4, 2021, produces an alternative high at 190.90, but we’ll wait to see how buyers handle D=184.86 before we raise our sights. To stretch your bullish imagination, but also to be on record with a seemingly outrageous forecast, let me introduce a 253.96 target with this weekly graph. We’ll be better able to make book if the stock exceeds 184.96 and stalls at the 189.07 midpoint. That would make 253.96 more plausible as an objective, especially if AAPL stabs through p=189.07 and closes above it the same week. ______ UPDATE (Jun 5, 2:35 p.m.): AAPL has plummeted from a spike high at 184.95 that missed my target (boldfaced above in green) by nine cents. Because the stock is the most important stock-market bellwether of them all — “the only stock that matters” — we should be alert to the possibility that the broad averages have put in a major top today. Addendum, 6:49 p.m.: I doubt it, especially since the selling was triggered by ‘news’ that was bound to affect mainly rubes, yokels, and riff-raff who trade the stock, but that’s no reason to take our eyes off a chart that is incapable of lying or even misleading._______ UPDATE (Jun 7, 5:52 p.m.): Monday’s spike on ‘goggle news’ has left AAPL top-heavy. This chart suggests the stock will need to come down into the range 170-175 range to consolidate for the next thrust toward $200.

AAPL – Apple Computer (Last:181.07)

Posted on June 4, 2023, 5:24 pm EDT

Last Updated June 7, 2023, 5:51 pm EDT

Posted on June 4, 2023, 5:24 pm EDT

Last Updated June 7, 2023, 5:51 pm EDT