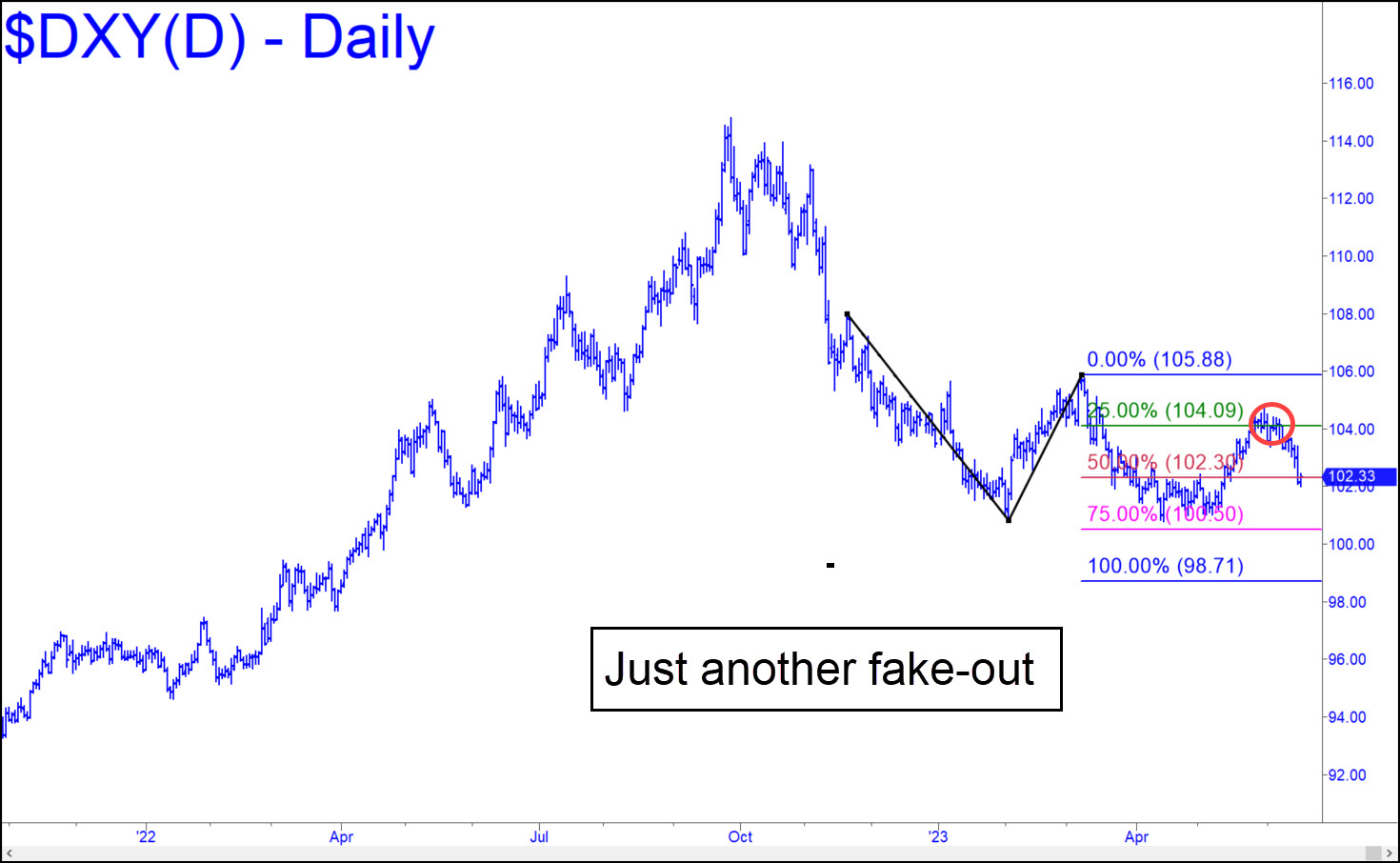

What looked like the start of a promising rally in early May turns out to have been just a drum-roll for yet another head-fake. The uptrend was mildly impulsive on the lesser charts at first, but the end result was a ‘mechanical’ shorting opportunity at the green line (x=104.09). This implies the Dollar Index could fall to D=98.71 before it finds a foothold. This should be at least slightly bullish for bullion, but we’ve seen that the effect is often so feeble as to be negligible.

What looked like the start of a promising rally in early May turns out to have been just a drum-roll for yet another head-fake. The uptrend was mildly impulsive on the lesser charts at first, but the end result was a ‘mechanical’ shorting opportunity at the green line (x=104.09). This implies the Dollar Index could fall to D=98.71 before it finds a foothold. This should be at least slightly bullish for bullion, but we’ve seen that the effect is often so feeble as to be negligible.

DXY – NYBOT Dollar Index (Last:102.33)

Posted on June 18, 2023, 5:16 pm EDT

Last Updated June 16, 2023, 10:26 pm EDT

Posted on June 18, 2023, 5:16 pm EDT

Last Updated June 16, 2023, 10:26 pm EDT

- June 22, 2023, 10:58 am

Starting next week a slew of Inflationary data and strong economic activity will spike the dollar back up and even break the 105 area. We are now in the absurdly enthusiastic greed stage. Unlike your long obsession that we will never see Inflation it is occurring exactly as it started in the 70’s. This time around the last 40 years of disinflation has made Pavlovian bets that will turn to disasters going forward. That and the bloated asset classes as a result of disinflation will fall hard. Fed Funds will hit and exceed 6%. That will cause massive defaults. Wages are already starting to climb and that spells long term inflation. One trillion dollar banking mistake will pale in comparison to what’s in front of us. Just my personal opinion.

&&&&&

I am allowing this post simply because it sets a world record for the number of idiotic contradictions in logic per sentence. You need to find a hobby, Gary, even if it’s just watching reruns of Law & Order. RA