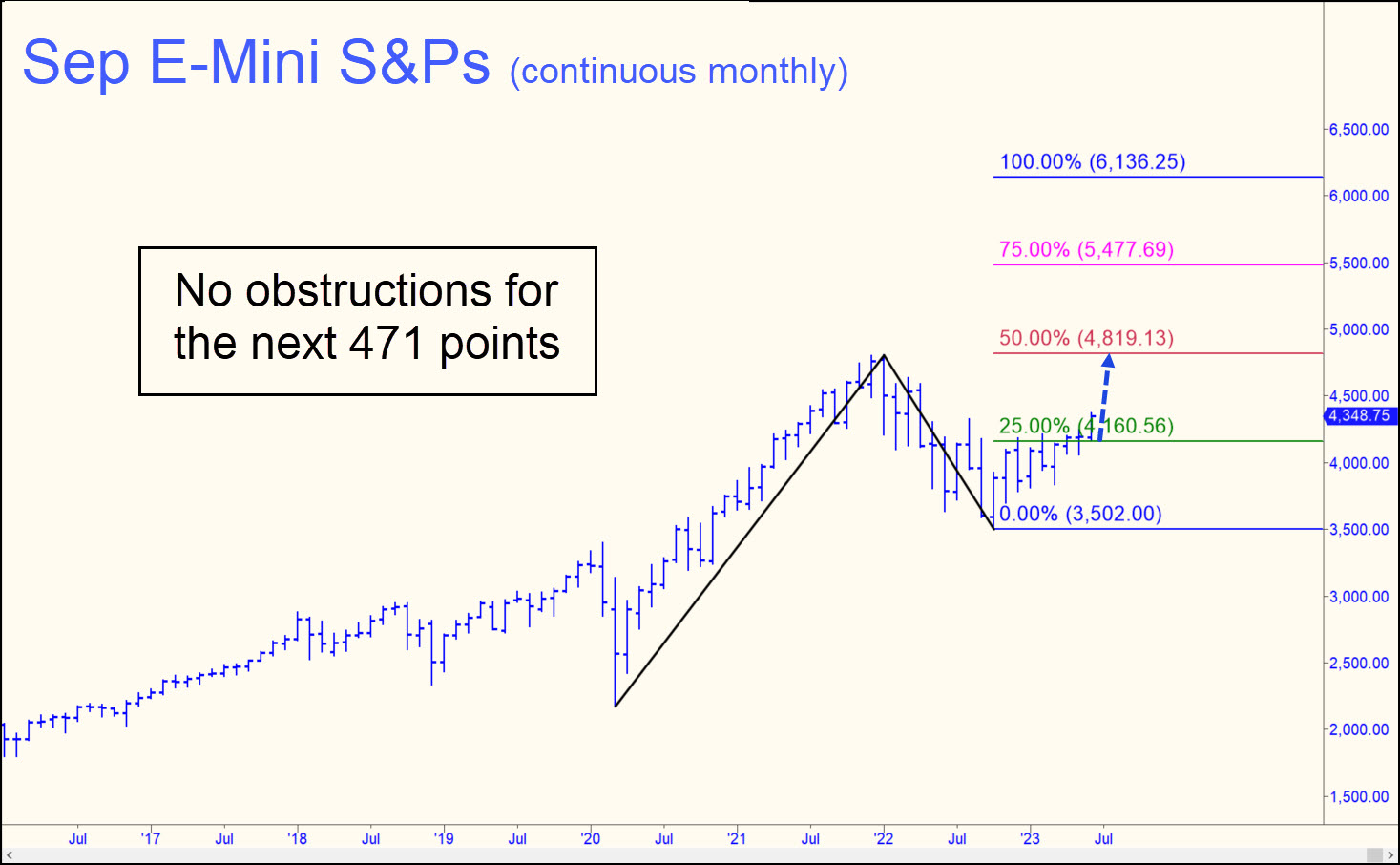

The stock market is in the grip of mass insanity, blithely ignoring warning signs of recession and the certain collapse of commercial real estate. How high could it go? To stretch your imagination, I’ve reproduced the weekly chart to show how 6136 is possible — 1788 points (41%) above the current 4348. This is not to suggest that a bear market collapse from last week’s high is not possible; it could indeed happen. But it seems unlikely, given that the 27% drop from Jan 2022’s 4808 peak couldn’t even generate an impulse leg. That would have required a further fall of 304 points beneath the 3502 low recorded in October. Under the circumstances, the rally since then seems likely to reach p=4819 at a minimum. Look for a temporary peak there that is tradeable, but don’t count on it to work precisely, since the chart is a composite of ABC coordinates from different contract months.

The stock market is in the grip of mass insanity, blithely ignoring warning signs of recession and the certain collapse of commercial real estate. How high could it go? To stretch your imagination, I’ve reproduced the weekly chart to show how 6136 is possible — 1788 points (41%) above the current 4348. This is not to suggest that a bear market collapse from last week’s high is not possible; it could indeed happen. But it seems unlikely, given that the 27% drop from Jan 2022’s 4808 peak couldn’t even generate an impulse leg. That would have required a further fall of 304 points beneath the 3502 low recorded in October. Under the circumstances, the rally since then seems likely to reach p=4819 at a minimum. Look for a temporary peak there that is tradeable, but don’t count on it to work precisely, since the chart is a composite of ABC coordinates from different contract months.

ESU23 – Sep E-Mini S&Ps (Last:4348)

Posted on June 11, 2023, 5:20 pm EDT

Last Updated June 10, 2023, 12:20 pm EDT

Posted on June 11, 2023, 5:20 pm EDT

Last Updated June 10, 2023, 12:20 pm EDT

-

June 12, 2023, 10:00 am

-

June 16, 2023, 3:36 pm

Gary is still as obtuse as ever. These people that can’t fathom having a bearish LT take (given the various forms of disintegration encroaching upon us from every direction) while forecasting higher prices and trading it that way are really a hoot. Gary proves that 🤡s really are a sad lot.

-

June 16, 2023, 3:36 pm

Throwing in the towel! Astonishing! The mega bear has gone over to the other side. We SEE what we want and disregard the rest. What happens if Inflation were to actually pick up from here? AT what Fed Funds rate will the whole thing collapse? Answer: 6%. All asset classes are in bubble status with the assumption low rates will sustain cheap money, borrowing and repayments with forced increase in the underlying asset. Disinflation is a cyclical phenomena. Extreme tight labor, 10 million jobs begging to be had, and wages will catch up with inflation. Productivity, already negative will get a lot worse. You see there is NO SIGNS that this employment picture has changed. CPI/PPI will shock all in the coming months. It follows a pattern of common sense.

&&&&&

Not sure WTF ur talking about, Gary, but I’ve cleaned up your grammar, spelling and usage as a kindness. A few points:

1. I threw in the towel??? Which towel is that? My stock-market forecasts have been insanely bullish over the years that you evidently were paying no attention to them.

2. That is different from my view on the global economy, which is that we are all totally fucked. There will be a Second Great Depression, and there is no way around it. Period. I gather you agree. Furthermore, Baby Boomers will never get to collect their full SS and Medicare benefits because the Millennials and Gen-xers who would have to pay for them are living in their parents’ basements, hoping student debts get canceled.

3. Your 6% figure is baloney. You should have learned in 2007-08 that REAL rates are all that matter.

RA