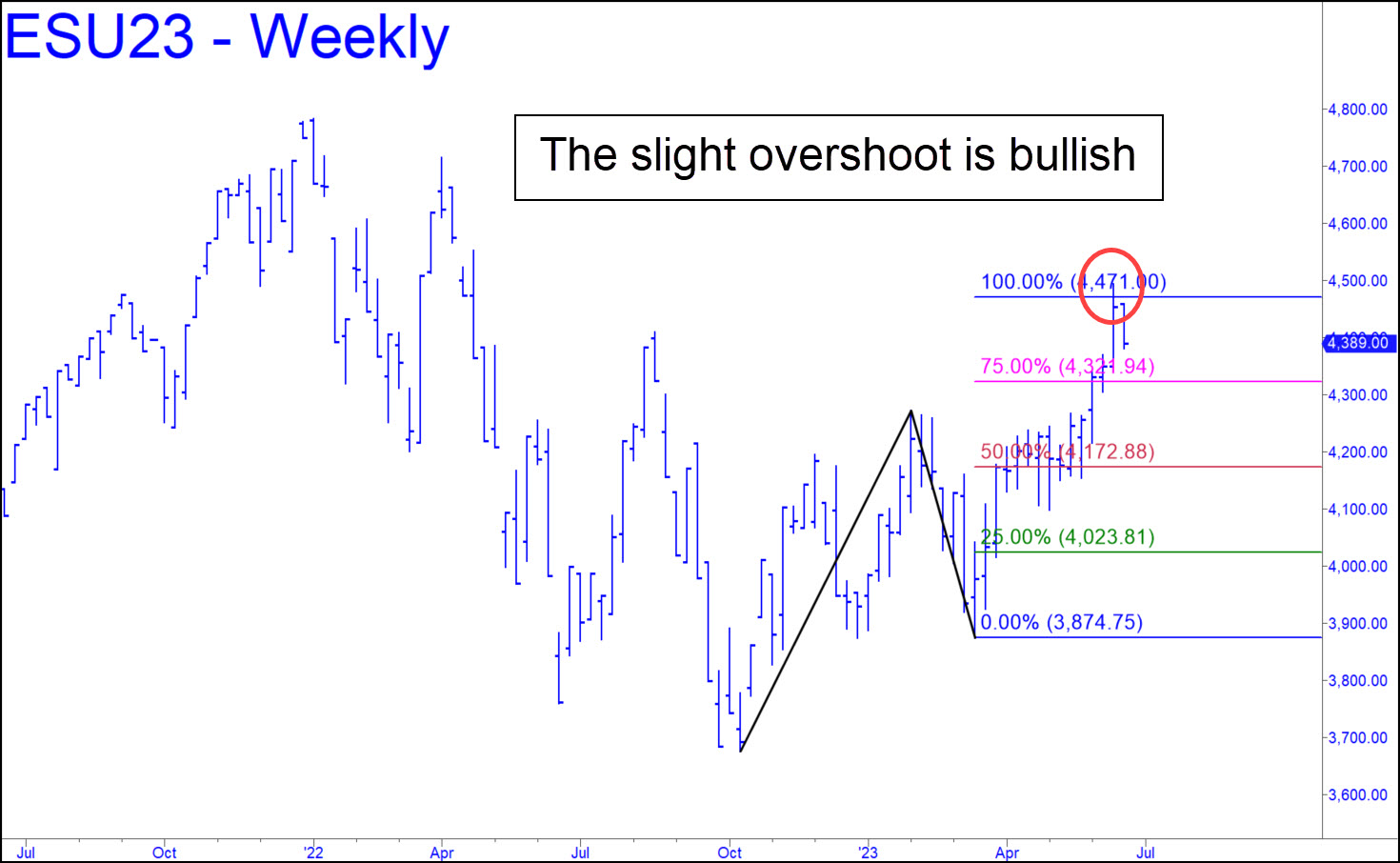

The September contract overshot the 4471.00 target shown by a relatively small 22 points, but that’s enough to imply that the so-far modest retracement is just that — a correction to be bought rather than feared. We should not simply jump back in, though, without testing the water. Even if the downtrend accelerates, though, it should be easily tradeable in either direction using the reverse patterns that have become our workhorse. For now, use the 4369.00 target shown here as a minimum downside projection and a place to attempt bottom-fishing as the new week begins. _______ UPDATE (Jun 26, 11:53 p.m.): The futures have bounced 12 points after bottoming just two ticks (0.50 points) from the 4369.00 target flagged above. The low occurred at exactly 4:00 p.m., however — a time of day when I am disinclined to open a position that would put my peace of mind at risk during the evening. If you did the trade, though, I’d suggest being out of at least half of it at current levels. Please let me know in the chat room so that I can determine whether to provide further guidance. ______ UPDATE (Jun 27, 9:43 p.m.): The futures extended the rally with a wilding spree that topped 55 points above the 4369 low where I’d suggested bottom-fishing. With the Fourth of July holiday approaching, bullish seasonality will be at gale force.

The September contract overshot the 4471.00 target shown by a relatively small 22 points, but that’s enough to imply that the so-far modest retracement is just that — a correction to be bought rather than feared. We should not simply jump back in, though, without testing the water. Even if the downtrend accelerates, though, it should be easily tradeable in either direction using the reverse patterns that have become our workhorse. For now, use the 4369.00 target shown here as a minimum downside projection and a place to attempt bottom-fishing as the new week begins. _______ UPDATE (Jun 26, 11:53 p.m.): The futures have bounced 12 points after bottoming just two ticks (0.50 points) from the 4369.00 target flagged above. The low occurred at exactly 4:00 p.m., however — a time of day when I am disinclined to open a position that would put my peace of mind at risk during the evening. If you did the trade, though, I’d suggest being out of at least half of it at current levels. Please let me know in the chat room so that I can determine whether to provide further guidance. ______ UPDATE (Jun 27, 9:43 p.m.): The futures extended the rally with a wilding spree that topped 55 points above the 4369 low where I’d suggested bottom-fishing. With the Fourth of July holiday approaching, bullish seasonality will be at gale force.

ESU23 – Sep E-Mini S&Ps (Last:4409.75)

Posted on June 25, 2023, 5:19 pm EDT

Last Updated June 27, 2023, 9:42 pm EDT

Posted on June 25, 2023, 5:19 pm EDT

Last Updated June 27, 2023, 9:42 pm EDT