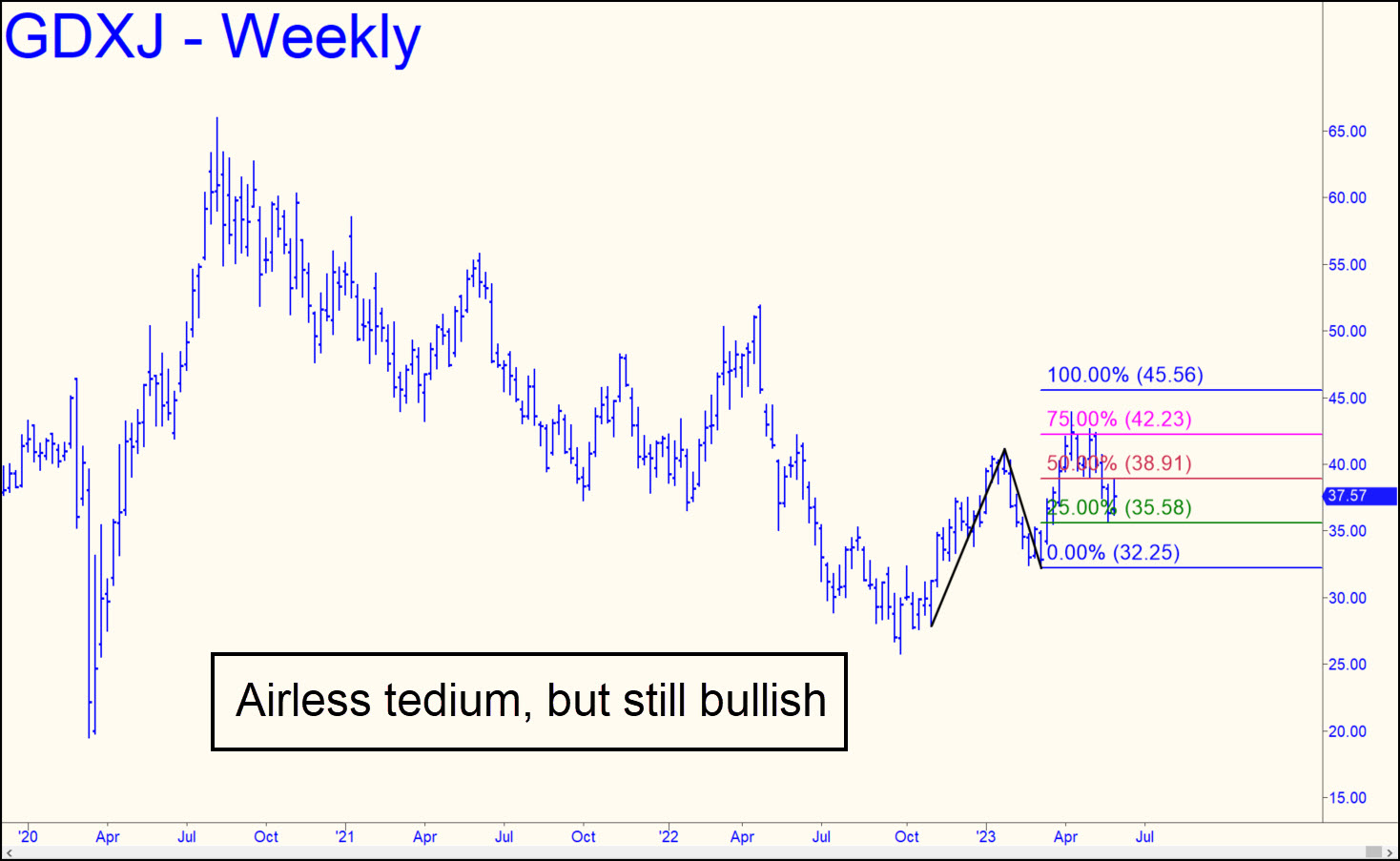

As tedious and labored as the uptrend has been since this vehicle bottomed on September 30 at 25.80, it is healthy enough to suggest that the long, corrective dirge from the $66 high recorded in the summer of 2020 is over. By ‘healthy’ I mean that rallies are capable of generating impulse legs on the weekly chart. Most recently, for instance, buyers did so by pushing GDXJ above an internal peak and an external one at 42.13 recorded exactly a year ago. The jury is still out on whether the ‘mechanical’ buy we narrowly missed executing at 35.58 can bounce more than a single level without retreating below the green line. It failed by just three cents to accomplish this last week.

As tedious and labored as the uptrend has been since this vehicle bottomed on September 30 at 25.80, it is healthy enough to suggest that the long, corrective dirge from the $66 high recorded in the summer of 2020 is over. By ‘healthy’ I mean that rallies are capable of generating impulse legs on the weekly chart. Most recently, for instance, buyers did so by pushing GDXJ above an internal peak and an external one at 42.13 recorded exactly a year ago. The jury is still out on whether the ‘mechanical’ buy we narrowly missed executing at 35.58 can bounce more than a single level without retreating below the green line. It failed by just three cents to accomplish this last week.

GDXJ – Junior Gold Miner ETF (Last:37.57)

Posted on June 4, 2023, 5:17 pm EDT

Last Updated June 3, 2023, 12:07 am EDT

Posted on June 4, 2023, 5:17 pm EDT

Last Updated June 3, 2023, 12:07 am EDT