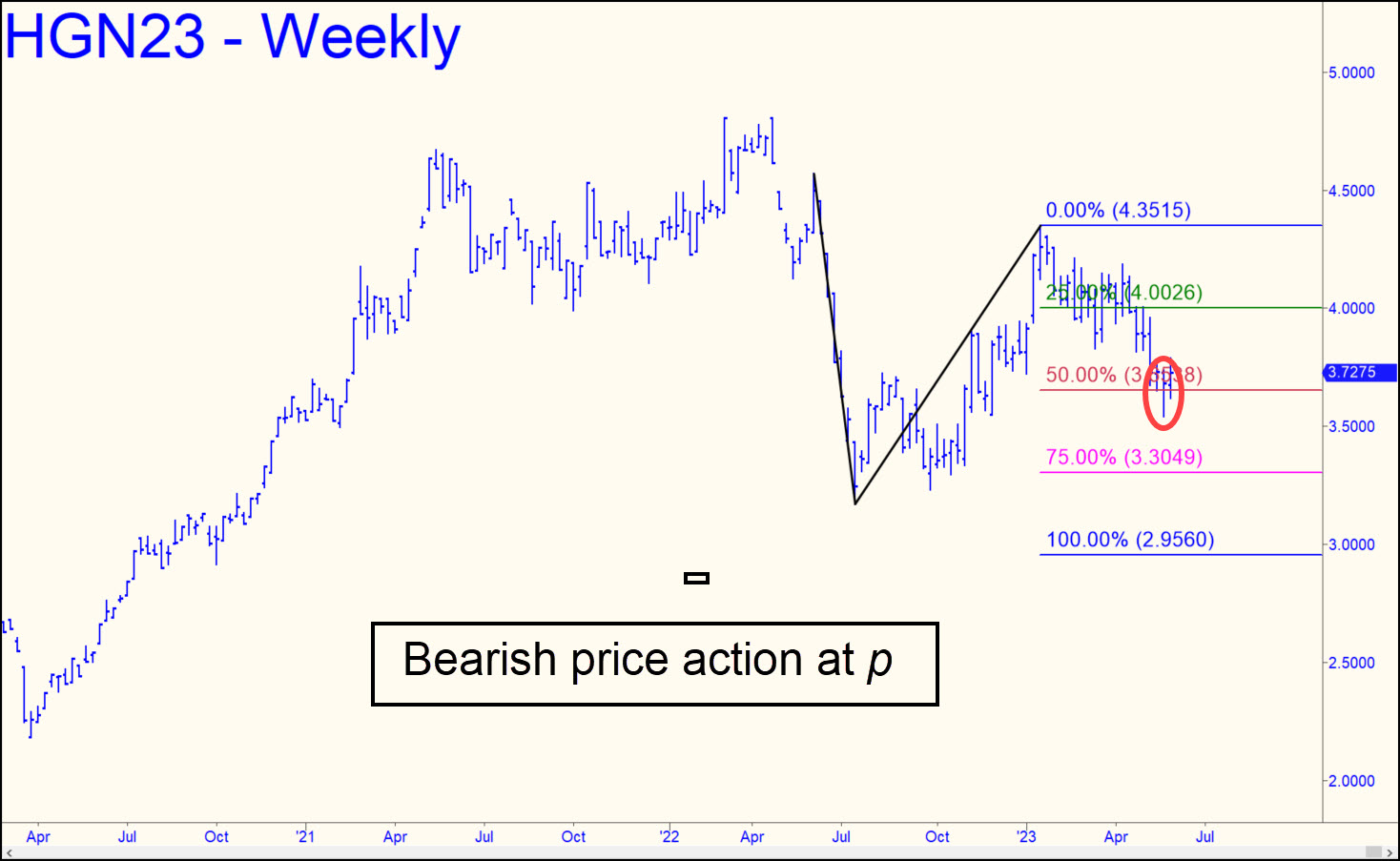

July Copper’s breach in late May of the 3.65 midpoint Hidden Pivot support shown (see inset) is bearish and hints of a further drop to as low as D=2.95. A corrective rally to the green line (x=4.00) would set up an opportune ‘mechanical’ short, but failing that, the most promising swing trade we could envision on the middle horizon would be bottom-fishing at p2=3.30. If that were to occur, the energy sector would undoubtedly experience a corresponding drop that in turn would imply an easing of inflationary pressures and a positive impact on mining stocks. Please note that this is ‘Doc’ Copper’s first appearance on the touts list in a very long time, and it is intended to supplement and confirm my analysis of crude, which is also in a secular downtrend.

July Copper’s breach in late May of the 3.65 midpoint Hidden Pivot support shown (see inset) is bearish and hints of a further drop to as low as D=2.95. A corrective rally to the green line (x=4.00) would set up an opportune ‘mechanical’ short, but failing that, the most promising swing trade we could envision on the middle horizon would be bottom-fishing at p2=3.30. If that were to occur, the energy sector would undoubtedly experience a corresponding drop that in turn would imply an easing of inflationary pressures and a positive impact on mining stocks. Please note that this is ‘Doc’ Copper’s first appearance on the touts list in a very long time, and it is intended to supplement and confirm my analysis of crude, which is also in a secular downtrend.

HGN23 – July Copper (Last:3.72)

Posted on June 4, 2023, 5:16 pm EDT

Last Updated June 2, 2023, 11:49 pm EDT

Posted on June 4, 2023, 5:16 pm EDT

Last Updated June 2, 2023, 11:49 pm EDT