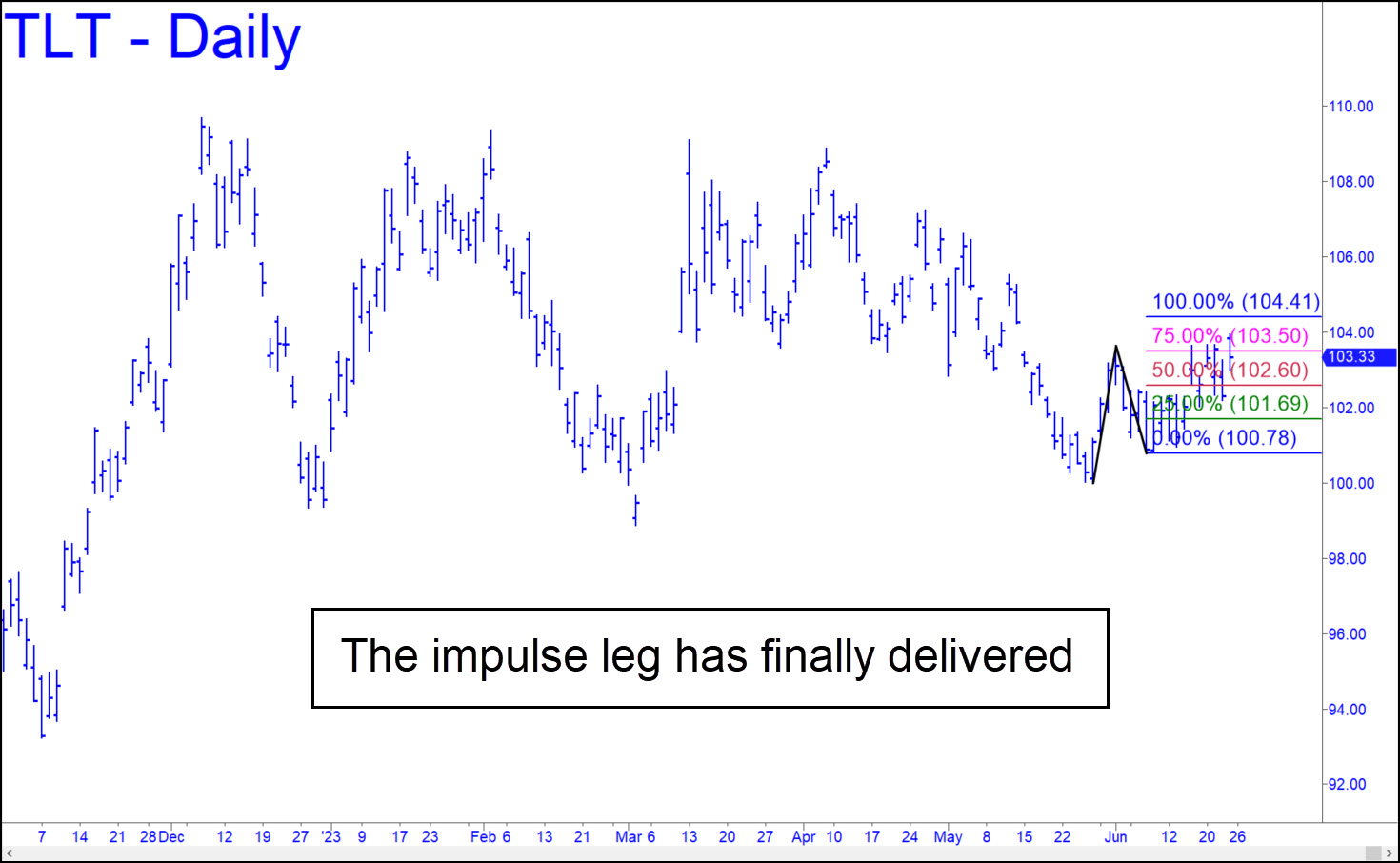

The rally’s second stage was shaky at the outset in early June, but it now looks as though this T-Bond proxy will reach D=104.41, the minimum upside objective since June 15, when TLT gapped up through a Hidden Pivot midpoint resistance at 102.60. We should play close attention to the way buyers interact with the target, since it could tell us whether the bond rally is likely to get legs. An easy move through 104.41 or two consecutive daily closes above it would be the most bullish sign we’ve seen since March.

The rally’s second stage was shaky at the outset in early June, but it now looks as though this T-Bond proxy will reach D=104.41, the minimum upside objective since June 15, when TLT gapped up through a Hidden Pivot midpoint resistance at 102.60. We should play close attention to the way buyers interact with the target, since it could tell us whether the bond rally is likely to get legs. An easy move through 104.41 or two consecutive daily closes above it would be the most bullish sign we’ve seen since March.

TLT – Lehman Bond ETF (Last:103.33)

Posted on June 25, 2023, 5:18 pm EDT

Last Updated June 23, 2023, 8:52 pm EDT

Posted on June 25, 2023, 5:18 pm EDT

Last Updated June 23, 2023, 8:52 pm EDT