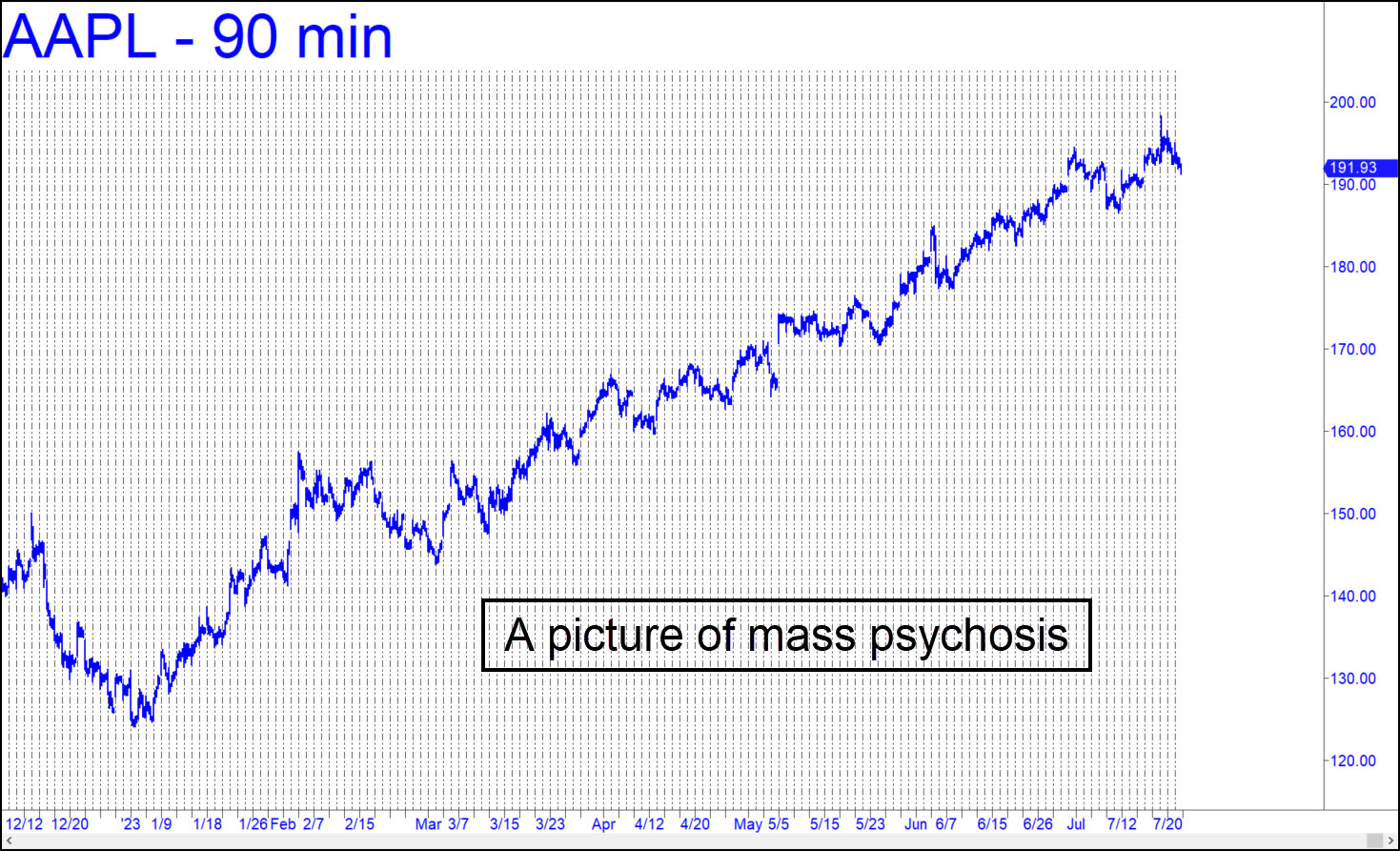

The steep rally begun in January has barely paused for breath, so relentless that it could properly be described as a manifestation of mass psychosis. And here’s the thing: This the largest-cap stock in the world, with a $3 trillion valuation, so every ratcheting, short-squeeze rally adds tens of billions in ‘wealth’ to the world’s macro ledger. It can’t end well, since, in a recession, Apple’s pricey iPhone will be near the top of the list of things that consumers stop buying. In the meantime, we can only watch in amazement as the stock continues to ascend toward the 253.96 target pictured in this chart. Please note that with just a little more upside above the 198.23 high, the stock would become a screaming ‘mechanical’ buy on a pullback to x=156.52. AAPL is egregiously overdue for a very nasty selloff, but we’ll need to see corrective ‘d’ targets on the lesser charts start to be exceeded routinely before we infer the retracement is under way. _______ UPDATE (Jul 27, 7:25 p.m.): The yellow flag is out, since today’s by-now-obligatory gap-up opening failed to surpass last week’s high. The subsequent dive, trapping bulls and bear alike, created an impulse leg, but let’s see if bears can improve on it into week’s end, turning it into the start of something big.

The steep rally begun in January has barely paused for breath, so relentless that it could properly be described as a manifestation of mass psychosis. And here’s the thing: This the largest-cap stock in the world, with a $3 trillion valuation, so every ratcheting, short-squeeze rally adds tens of billions in ‘wealth’ to the world’s macro ledger. It can’t end well, since, in a recession, Apple’s pricey iPhone will be near the top of the list of things that consumers stop buying. In the meantime, we can only watch in amazement as the stock continues to ascend toward the 253.96 target pictured in this chart. Please note that with just a little more upside above the 198.23 high, the stock would become a screaming ‘mechanical’ buy on a pullback to x=156.52. AAPL is egregiously overdue for a very nasty selloff, but we’ll need to see corrective ‘d’ targets on the lesser charts start to be exceeded routinely before we infer the retracement is under way. _______ UPDATE (Jul 27, 7:25 p.m.): The yellow flag is out, since today’s by-now-obligatory gap-up opening failed to surpass last week’s high. The subsequent dive, trapping bulls and bear alike, created an impulse leg, but let’s see if bears can improve on it into week’s end, turning it into the start of something big.

AAPL – Apple Computer (Last:193.23)

Posted on July 23, 2023, 5:22 pm EDT

Last Updated July 27, 2023, 7:25 pm EDT

Posted on July 23, 2023, 5:22 pm EDT

Last Updated July 27, 2023, 7:25 pm EDT