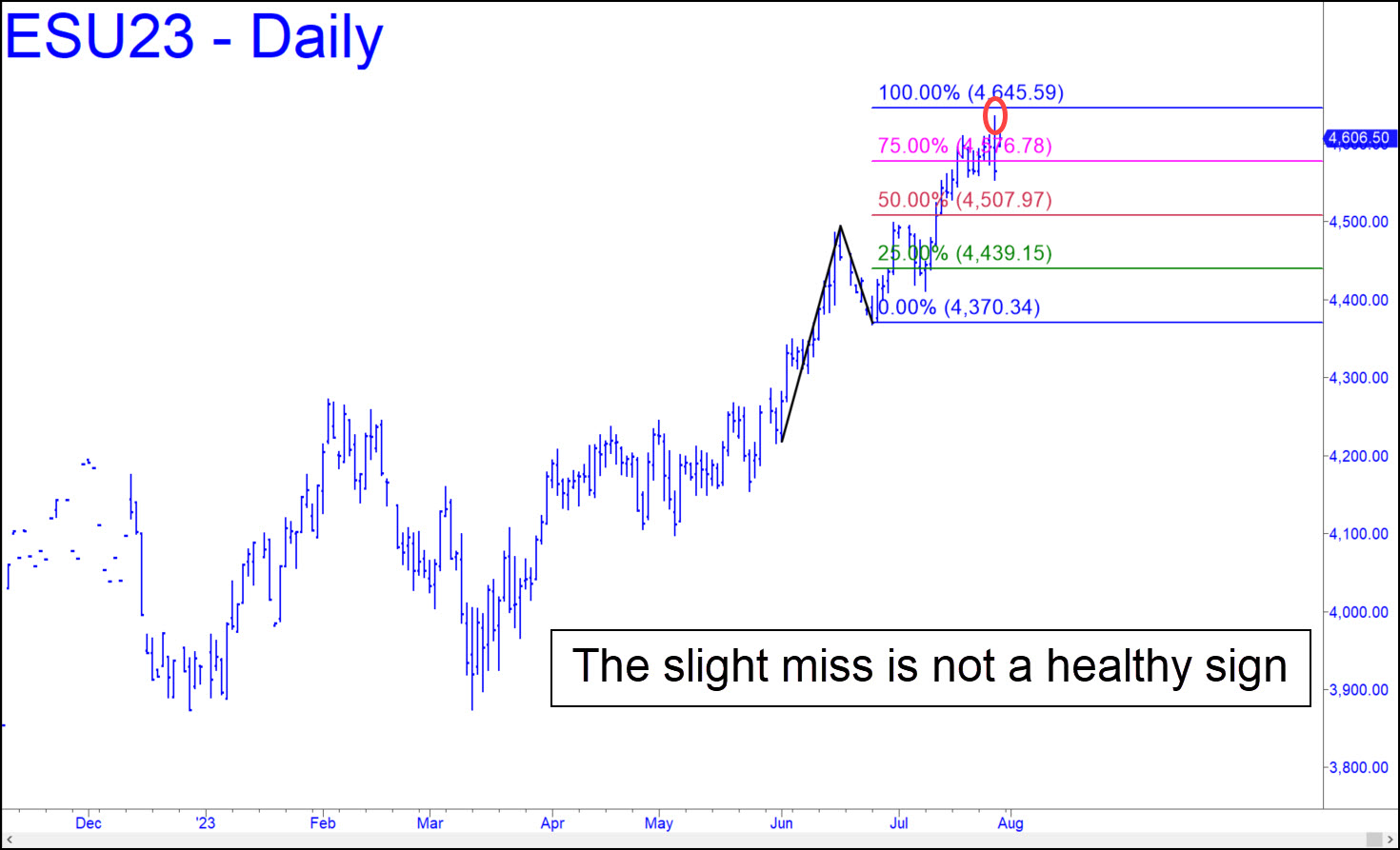

The failure of the September contract to reach the 4645 target shown before turning down sharply is not a healthy sign. It suggests that the correction begun from last week’s 4634 high could fall as far as the green line before buyers are fully recharged. At a minimum, the decline should come down to the red line, setting up a theoretical ‘mechanical’ buy hat would take a 4461 stop-loss. Stay tuned to the chat room for more-detailed guidance if the trade should get close. We should also monitor Friday’s vicious short-squeeze diligently, since this market has been surprising us for years by making new highs at times when meaningful technical indicators are beautifully aligned for big selloffs. In this case, a platoon of chartists appears to be focused on a well-defined channel that closely caught last week’s high. _______ UPDATE (Jul 31, 10:56 p.m.): A thousand chartists, ever hopeful of catching The Big One, were firmly aligned at a seemingly impregnable channel line that caught last week’s top. However, it would now appear that The Thing That Wouldn’t Die is about to impale the resistance as it has dozens of times before. A few more Hindenburg Omens ought to stop the beast, right? ______ UPDATE (Aug 2, 9:14 p.m.): A wave of selling saved the day, sending this gas-bag sharply lower while generating a robust impulse leg. That implies rallies over the near term will be corrective and therefore shortable, so you should stay tuned to the chat room if you trade this vehicle. _______ UPDATE (Aug 3, 9:23 p.m,.): Amidst today’s airy, bullish spasms, there seemed to be no easy way to get short — a strong sign that the next big move will be down. This would be affirmed if the futures finish the week at or near the intraday high.

The failure of the September contract to reach the 4645 target shown before turning down sharply is not a healthy sign. It suggests that the correction begun from last week’s 4634 high could fall as far as the green line before buyers are fully recharged. At a minimum, the decline should come down to the red line, setting up a theoretical ‘mechanical’ buy hat would take a 4461 stop-loss. Stay tuned to the chat room for more-detailed guidance if the trade should get close. We should also monitor Friday’s vicious short-squeeze diligently, since this market has been surprising us for years by making new highs at times when meaningful technical indicators are beautifully aligned for big selloffs. In this case, a platoon of chartists appears to be focused on a well-defined channel that closely caught last week’s high. _______ UPDATE (Jul 31, 10:56 p.m.): A thousand chartists, ever hopeful of catching The Big One, were firmly aligned at a seemingly impregnable channel line that caught last week’s top. However, it would now appear that The Thing That Wouldn’t Die is about to impale the resistance as it has dozens of times before. A few more Hindenburg Omens ought to stop the beast, right? ______ UPDATE (Aug 2, 9:14 p.m.): A wave of selling saved the day, sending this gas-bag sharply lower while generating a robust impulse leg. That implies rallies over the near term will be corrective and therefore shortable, so you should stay tuned to the chat room if you trade this vehicle. _______ UPDATE (Aug 3, 9:23 p.m,.): Amidst today’s airy, bullish spasms, there seemed to be no easy way to get short — a strong sign that the next big move will be down. This would be affirmed if the futures finish the week at or near the intraday high.

ESU23 – Sep E-Mini S&Ps (Last:4536)

Posted on July 30, 2023, 5:20 pm EDT

Last Updated August 3, 2023, 9:22 pm EDT

Posted on July 30, 2023, 5:20 pm EDT

Last Updated August 3, 2023, 9:22 pm EDT