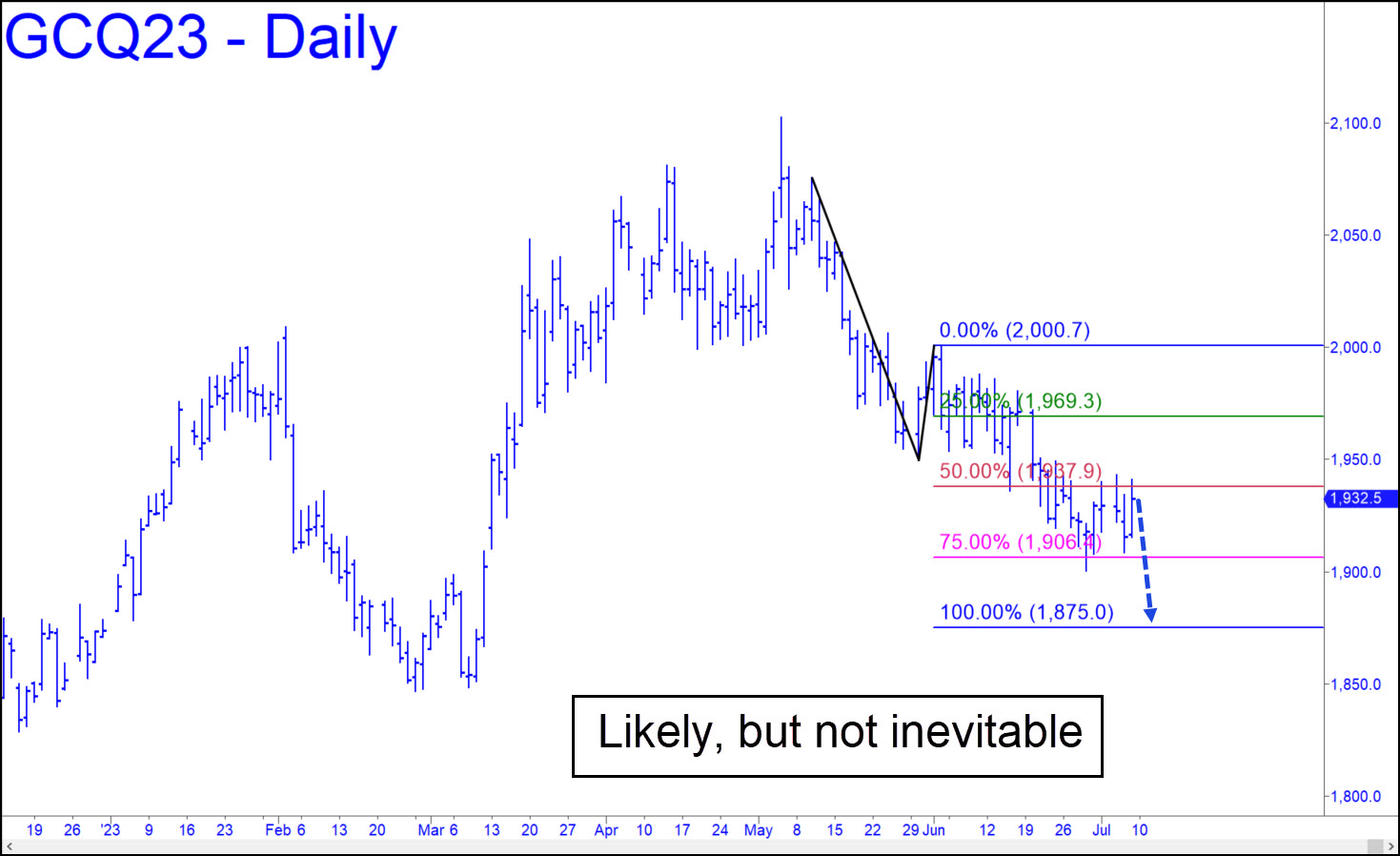

August Gold has struggled for loft after bouncing from just beneath a Hidden Pivot support at 1903.90 that I’d flagged on June 29. Bullion tends to taunt us with weakness before rallying sharply (albeit fleetingly) to nowhere in particular. In this case, however, it looks like it wants to go lower in order to get better footing for a sustained uptrend. We can use the 1875.00 downside target shown for now, but we’ll switch to a more bullish outlook for trading purposes if buyers can push above an external peak at 1949.00 recorded two weeks ago. _______ UPDATE (Jul 13, 10:15 a.m.): The futures tripped a ‘mechanical’ short when they came within a hair of x=1969.30 at 8:35. The subsequent $12 dive could have been shorted with a reverse-pattern trigger, but I am suggesting only that you paper-trade this one. If it is stopped out with a rally above the pattern’s ‘C’ high, that would be the most bullish event we’ve seen in a while. Even then, we shouldn’t trust the rally until it has created a series of impulse legs on the lesser charts.

August Gold has struggled for loft after bouncing from just beneath a Hidden Pivot support at 1903.90 that I’d flagged on June 29. Bullion tends to taunt us with weakness before rallying sharply (albeit fleetingly) to nowhere in particular. In this case, however, it looks like it wants to go lower in order to get better footing for a sustained uptrend. We can use the 1875.00 downside target shown for now, but we’ll switch to a more bullish outlook for trading purposes if buyers can push above an external peak at 1949.00 recorded two weeks ago. _______ UPDATE (Jul 13, 10:15 a.m.): The futures tripped a ‘mechanical’ short when they came within a hair of x=1969.30 at 8:35. The subsequent $12 dive could have been shorted with a reverse-pattern trigger, but I am suggesting only that you paper-trade this one. If it is stopped out with a rally above the pattern’s ‘C’ high, that would be the most bullish event we’ve seen in a while. Even then, we shouldn’t trust the rally until it has created a series of impulse legs on the lesser charts.

GCQ23 – August Gold (Last:1965.60)

Posted on July 9, 2023, 5:16 pm EDT

Last Updated July 13, 2023, 10:14 am EDT

Posted on July 9, 2023, 5:16 pm EDT

Last Updated July 13, 2023, 10:14 am EDT