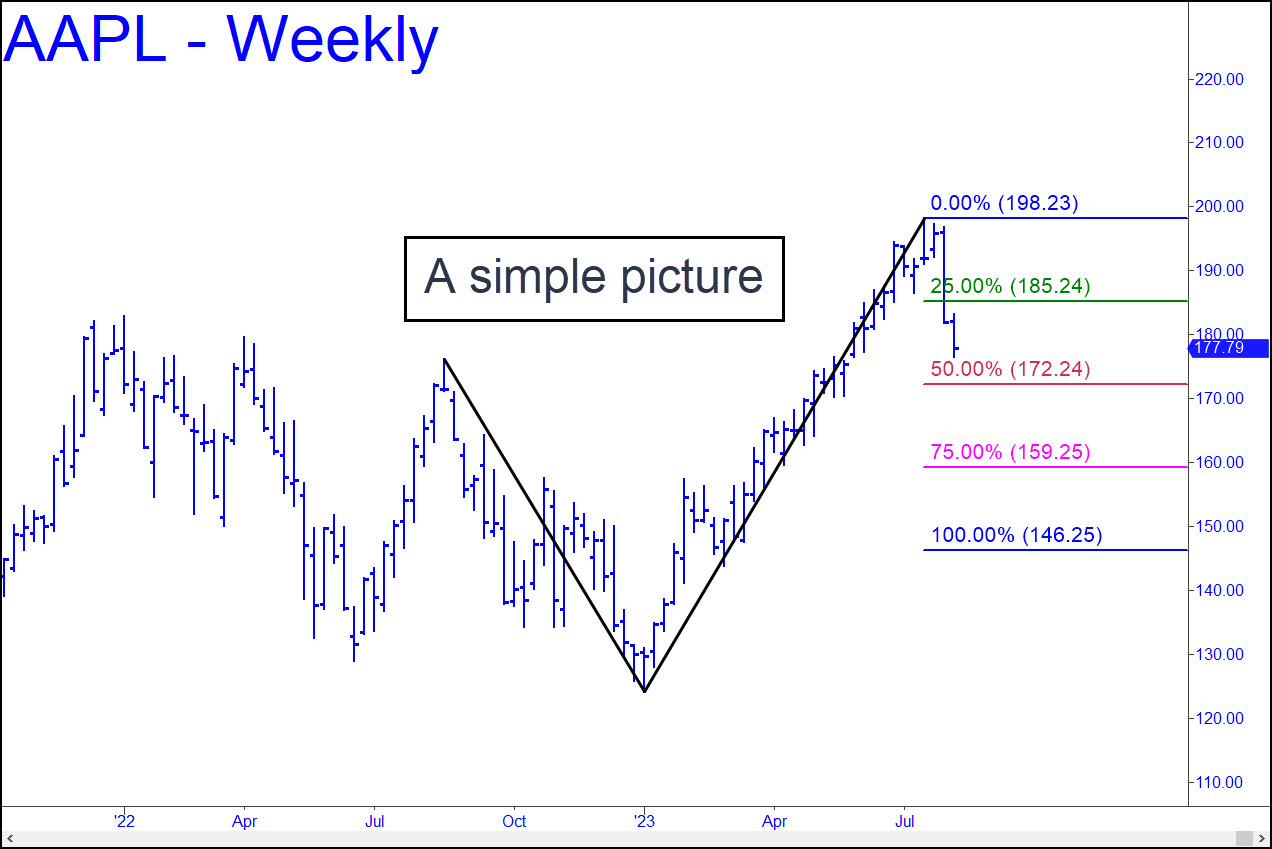

Expect AAPL’s correction to continue down to the red line at 172.24, at least. That’s a major Hidden Pivot support of weekly-chart degree. If and when it is reached, the correction from July’s all-time high at 198.23 would be about 13%%. Earlier, I predicted that pullbacks in this stock and some others in the institutionally beloved ‘lunatic sector’ would ultimately reach their respective ‘D’ targets roughly 27% below. I’m holding to that prediction for now but it could change depending on how bulls and bears fare when they duke it out at p=172.24. And they will. Bottom-fishing there can be attempted using a reverse pattern with a trigger interval of 2.90. Stay tuned to the chat room if you care, since I may be able to hone this guidance in real time as the stock gets closer. My confidence in the pattern to deliver everything we require is high. ______ UPDATE (Aug 18): A two-day selloff brought AAPL down to within an inch of the 172.24 target billboarded above. The subsequent, strong bounce hit 175.10, triggering the trade I’d recommended at 174.86. If you bought stock or used options to get aboard, please let me know so that I can determine whether to establish a tracking position. I don’t expect the rally to get very far, so tight risk management could be crucial to booking a profit. _______ UPDATE (Aug 22, 5:56 p.m.): AAPL swam against the tide today, but I doubt the stock can keep it up for long. That’s why I suggested covering at least half of any long positions held from 174.86. One subscriber reported booking a $2,600 profit on exiting his entire position, and so I will end my guidance here unless there are additional reports. A run-up to x=185.24 would tempt us with a juicy ‘mechanical’ short, but a relapse from lower levels would put D=146.25 in play as a worst-case target for the intermediate term.

Expect AAPL’s correction to continue down to the red line at 172.24, at least. That’s a major Hidden Pivot support of weekly-chart degree. If and when it is reached, the correction from July’s all-time high at 198.23 would be about 13%%. Earlier, I predicted that pullbacks in this stock and some others in the institutionally beloved ‘lunatic sector’ would ultimately reach their respective ‘D’ targets roughly 27% below. I’m holding to that prediction for now but it could change depending on how bulls and bears fare when they duke it out at p=172.24. And they will. Bottom-fishing there can be attempted using a reverse pattern with a trigger interval of 2.90. Stay tuned to the chat room if you care, since I may be able to hone this guidance in real time as the stock gets closer. My confidence in the pattern to deliver everything we require is high. ______ UPDATE (Aug 18): A two-day selloff brought AAPL down to within an inch of the 172.24 target billboarded above. The subsequent, strong bounce hit 175.10, triggering the trade I’d recommended at 174.86. If you bought stock or used options to get aboard, please let me know so that I can determine whether to establish a tracking position. I don’t expect the rally to get very far, so tight risk management could be crucial to booking a profit. _______ UPDATE (Aug 22, 5:56 p.m.): AAPL swam against the tide today, but I doubt the stock can keep it up for long. That’s why I suggested covering at least half of any long positions held from 174.86. One subscriber reported booking a $2,600 profit on exiting his entire position, and so I will end my guidance here unless there are additional reports. A run-up to x=185.24 would tempt us with a juicy ‘mechanical’ short, but a relapse from lower levels would put D=146.25 in play as a worst-case target for the intermediate term.

AAPL – Apple Computer (Last:177.23)

Posted on August 13, 2023, 5:20 pm EDT

Last Updated August 22, 2023, 5:56 pm EDT

Posted on August 13, 2023, 5:20 pm EDT

Last Updated August 22, 2023, 5:56 pm EDT