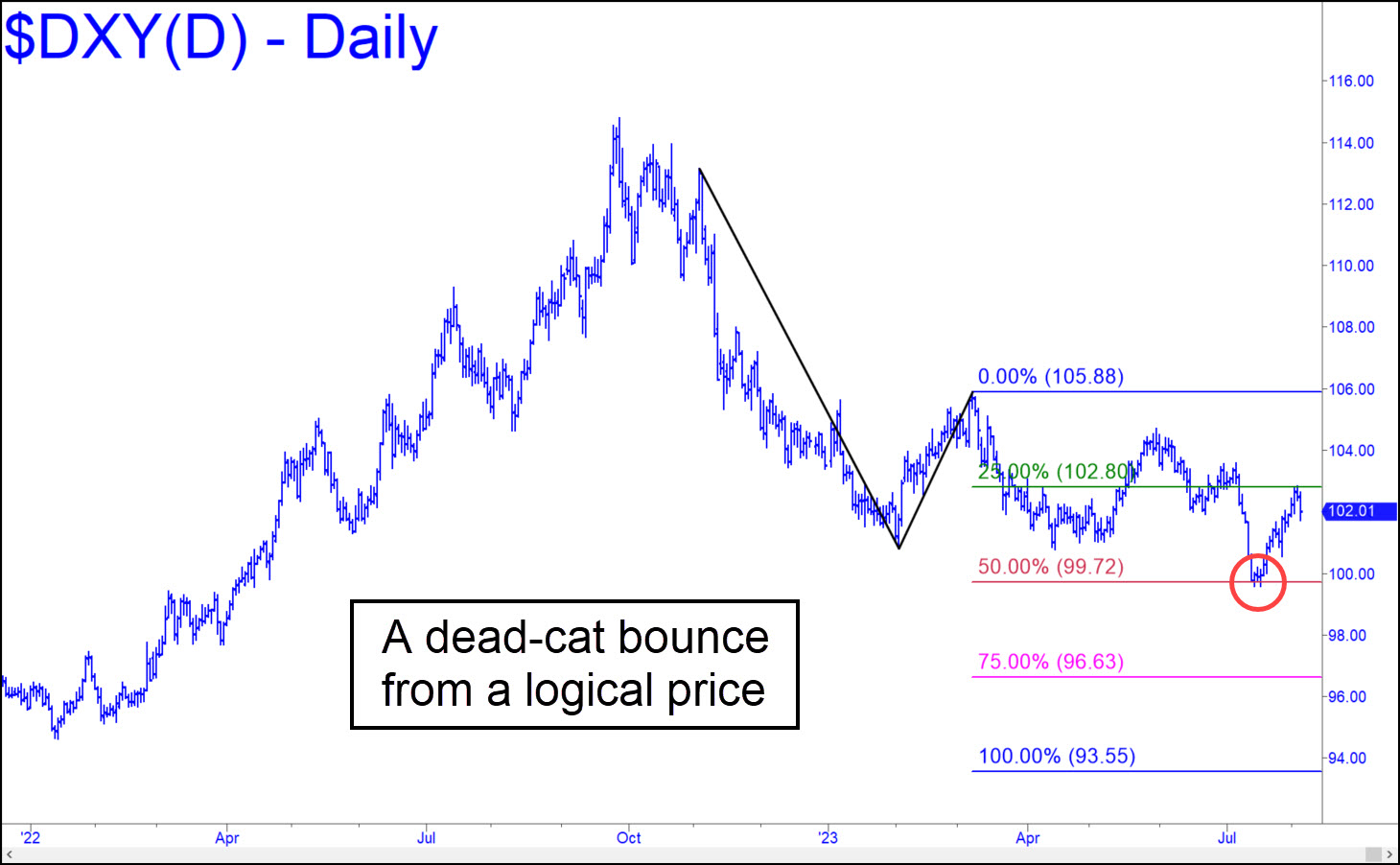

Although we were using a somewhat higher target at 103.50 for this dead-cat bounce, the fact that it reached the green line at 102.80, triggering a ‘mechanical’ short, warrants shifting our focus once again to the downside D Hidden Pivot at 93.55. That would amount to a 21% correction off the 114.78 summit recorded in September 2022. Keep in mind that although the decline has already taken a brutal toll on the biggest, deepest, most important ‘commodity’ in the world, it is still merely corrective of the long-term bull market begun in March 2008 from 70.70, and of a shorter cycle begun from a 89.21 high in January 2021 that projects to 119.37. Here’s a chart stretching back to 2004 that shows this. Pivoteers will notice that DXY would trigger a ‘mechanical’ buy that could not miss if and when it comes down to the green line at 96.03. The next big rally cycle would be congruent with the debt deflation that I have long predicted. It will surprise everyone because it is so counterintuitive when seen in relationship to the unprecedented fiscal and monetary blowout of the last five years. However, it will nonetheless wring the life from all who owe, creating a wave of private, public and corporate bankruptcies worse than the cascade of bank failures during the Great Depression.

Although we were using a somewhat higher target at 103.50 for this dead-cat bounce, the fact that it reached the green line at 102.80, triggering a ‘mechanical’ short, warrants shifting our focus once again to the downside D Hidden Pivot at 93.55. That would amount to a 21% correction off the 114.78 summit recorded in September 2022. Keep in mind that although the decline has already taken a brutal toll on the biggest, deepest, most important ‘commodity’ in the world, it is still merely corrective of the long-term bull market begun in March 2008 from 70.70, and of a shorter cycle begun from a 89.21 high in January 2021 that projects to 119.37. Here’s a chart stretching back to 2004 that shows this. Pivoteers will notice that DXY would trigger a ‘mechanical’ buy that could not miss if and when it comes down to the green line at 96.03. The next big rally cycle would be congruent with the debt deflation that I have long predicted. It will surprise everyone because it is so counterintuitive when seen in relationship to the unprecedented fiscal and monetary blowout of the last five years. However, it will nonetheless wring the life from all who owe, creating a wave of private, public and corporate bankruptcies worse than the cascade of bank failures during the Great Depression.

DXY – NYBOT Dollar Index (Last:102.01)

Posted on August 6, 2023, 5:22 pm EDT

Last Updated August 5, 2023, 9:00 am EDT

Posted on August 6, 2023, 5:22 pm EDT

Last Updated August 5, 2023, 9:00 am EDT