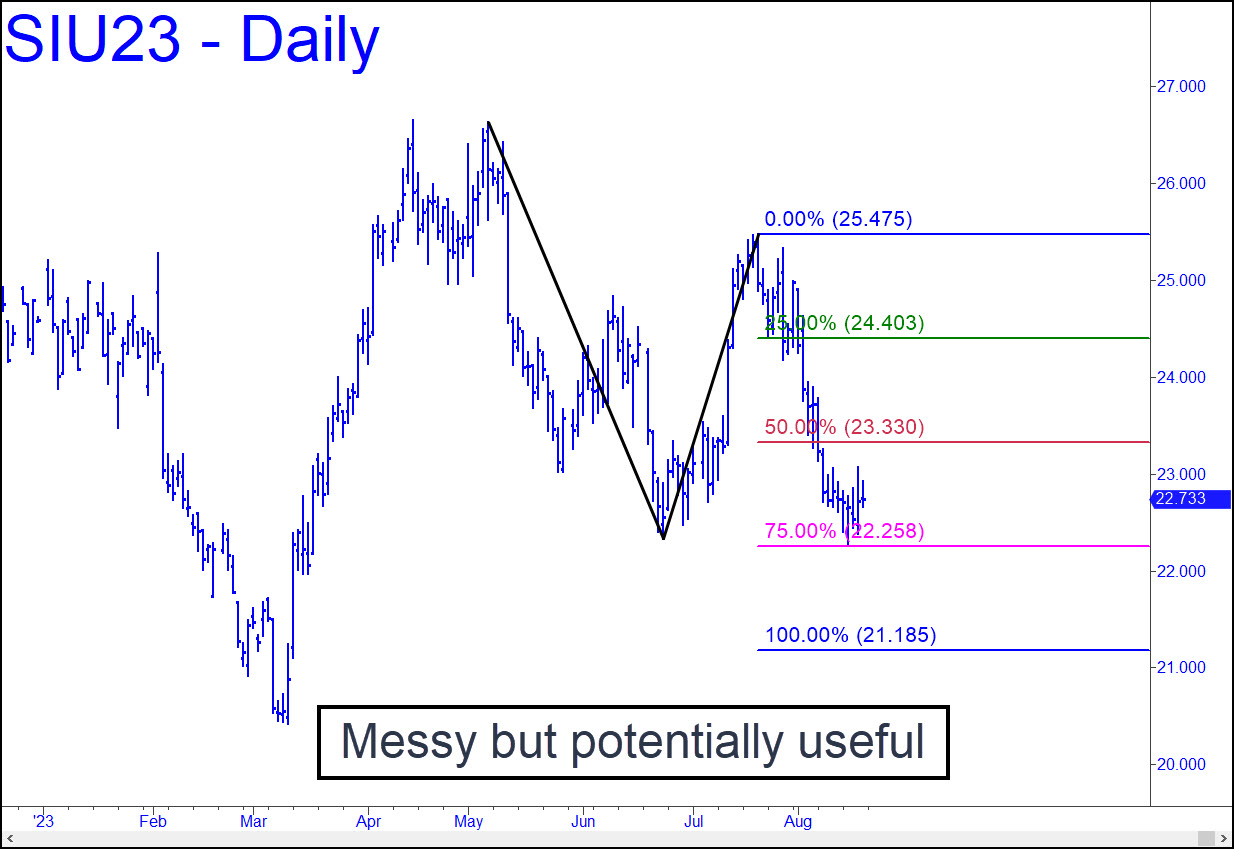

What a mess! Even so, the pattern shown in the chart meets our criteria for accuracy and reliability in subtle ways, so let’s assume the cycle of hard-selling begun from 25.47 a month ago is headed down to at least D=21.18. In the meantime, we should be alert to shorting opportunities if last week’s so-far weak bounce gets legs. A run-up to p=23.33 would trigger a relatively risky ‘mechanical’ short, stop 24.04, but there may easier ways to do it, so stay tuned to the chat room for timely guidance. ______ UPDATE (Aug 21, 9:29 a.m.): A subscriber reported shorting silver based on the above. My response n the chat room, for your guidance, was as follows: “My target missed the top of the nasty spike by 0.03, but I hadn’t expected it to be reached so dramatically. Is your stop at 24.04, the number in the tout? That implies 72 cents of theoretical entry risk. However, you could have cut that to 11 cents using an rABC set-up that triggered at 23.25, with 23.15 as the threshold for partial-profit-taking (15m, a=23.07 on 8/17.” D=22.93). _______ UPDATE (2:49 p.m.): The futures bottomed an inch from the 22.93 target I provided in the chat room, generating a profit of as much as $2,000 per contract for shorts from 34.33. Shorts covered near 22.93, then reversed and turned into long positions, could have made an additional $2,000 per contract, since the bounce took Sep Silver all the way back up to the intraday high. All the swings were gratuitous and orchestrated by thieves, but as I hope as has been demonstrated, such movement is perfectly predictable and easily tradeable.

What a mess! Even so, the pattern shown in the chart meets our criteria for accuracy and reliability in subtle ways, so let’s assume the cycle of hard-selling begun from 25.47 a month ago is headed down to at least D=21.18. In the meantime, we should be alert to shorting opportunities if last week’s so-far weak bounce gets legs. A run-up to p=23.33 would trigger a relatively risky ‘mechanical’ short, stop 24.04, but there may easier ways to do it, so stay tuned to the chat room for timely guidance. ______ UPDATE (Aug 21, 9:29 a.m.): A subscriber reported shorting silver based on the above. My response n the chat room, for your guidance, was as follows: “My target missed the top of the nasty spike by 0.03, but I hadn’t expected it to be reached so dramatically. Is your stop at 24.04, the number in the tout? That implies 72 cents of theoretical entry risk. However, you could have cut that to 11 cents using an rABC set-up that triggered at 23.25, with 23.15 as the threshold for partial-profit-taking (15m, a=23.07 on 8/17.” D=22.93). _______ UPDATE (2:49 p.m.): The futures bottomed an inch from the 22.93 target I provided in the chat room, generating a profit of as much as $2,000 per contract for shorts from 34.33. Shorts covered near 22.93, then reversed and turned into long positions, could have made an additional $2,000 per contract, since the bounce took Sep Silver all the way back up to the intraday high. All the swings were gratuitous and orchestrated by thieves, but as I hope as has been demonstrated, such movement is perfectly predictable and easily tradeable.

SIU23 – September Silver (Last:23.35)

Posted on August 20, 2023, 5:16 pm EDT

Last Updated August 22, 2023, 5:47 pm EDT

Posted on August 20, 2023, 5:16 pm EDT

Last Updated August 22, 2023, 5:47 pm EDT