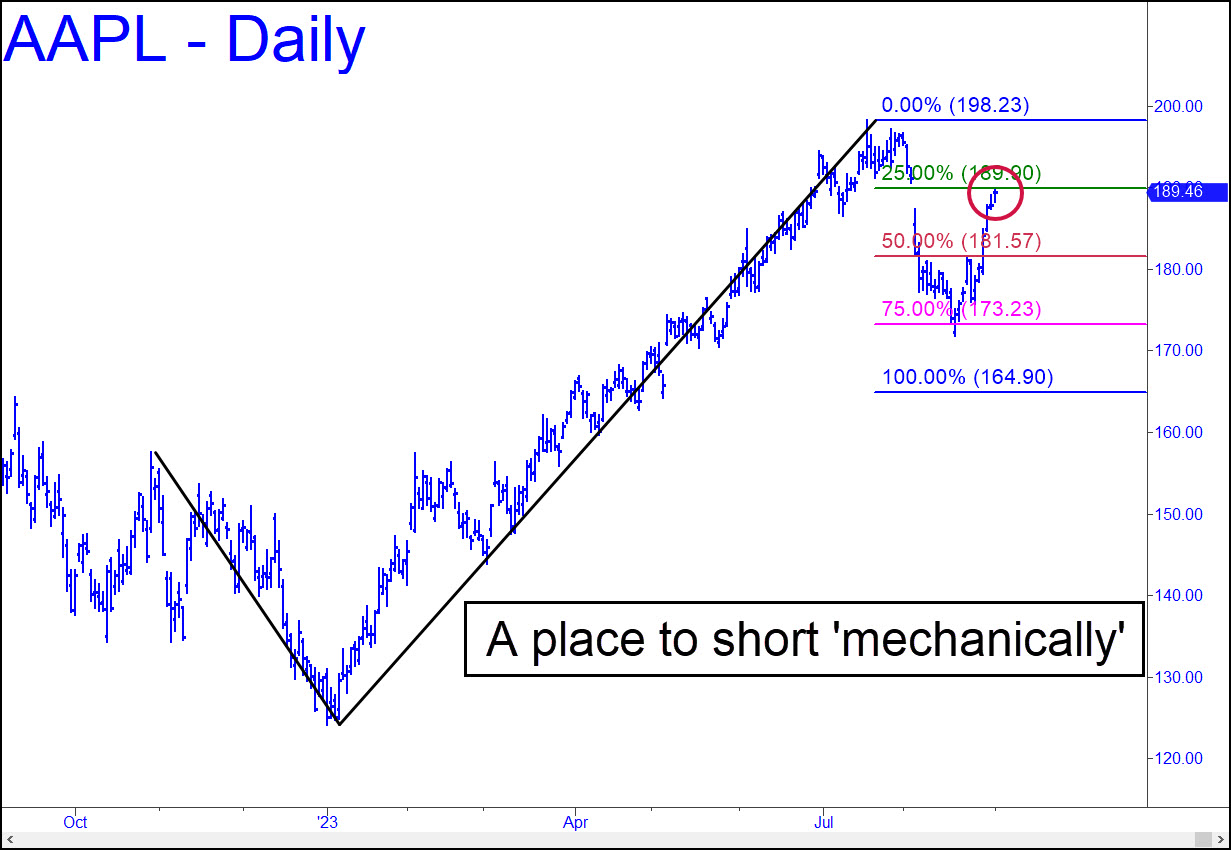

Officially we are short from near 189.90 via the purchase of four Sep 8 180 puts for 0.12. This is a ‘mechanical’ trade, and although the green line (x=189.90) is neither a target nor a resistance, it is where most trades of this kind are signaled. The fact that the rally topped two cents from the target is mere coincidence, even if it may have felt like we got the trade exactly right. If time erodes our puts to the vanishing point by mid-week, we may try again. Regardless, you should be offering half of the puts to close for twice what you paid for them. _______ UPDATE (Sep 6, 2:40 p.m.): Today’s so-far quadrupling-or-better of AAPL 180 puts extends a Rick’s Picks winning streak that stretches back beyond memory for option trades posted either as touts or as spontaneous ‘berries’ in the chat room. Anyone who bought the puts for 0.09 to 0.12 on last week’s guidance should be out of half to three quarters of the position by now. Save a few for Friday, since the explosion of these still-out-of-the-money options has spooked the clowns who are short them. Even if they did so as part of a hedge, they would still be in trouble due to the deadly negative-gamma exposure of options that only yesterday were $10 out of the money. Here’s the chart, so lovely and gratifying. _______ UPDATE (Sep 7, 2:16 p.m.): Nailing the 189.90 top of AAPL’s hellish plunge within two pennies, and timing it nearly perfectly, produced quick gains of as much as 10,000 percent on puts that could have been acquired for as little as 0.06 just a couple of days ago. They traded as high as $6.60 today in panic selling that deepened the already-punitive losses from a day earlier. Many subscribers apparently paid no more than 0.12 for the puts, based on my explicit recommendation to buy them for that price last week. Done by-the-book, the trade would have yielded a mere 5000% gain, or 50 times their purchase price, at today’s lows. As always, I advised exiting half of the position at twice the purchase price — 0.24 in this case. This is how we zero-out the risk of speculative trades like this one before scaling out more puts as AAPL fell. But I also advised keeping a few until the options expire tomorrow, meaning some subscribers are likely still sitting on unrealized, windfall gains. Even stragglers who paid as much as 0.40 or 0.50 for the puts had little trouble multiplying their stake eight- or ten-fold overnight. The trade has extended an options winning streak as far back as any subscriber seems able to recall. One in July was another ‘jackpot’-type bet using AAPL calls that produced a $14,400 profit for a subscriber in a little more than 20 minutes. If you are new to Rick’s Picks, stick around, because there are going to be more of these opportunities. Exploiting the enormous leverage offered by soon-to-expire, out-of-the-money options is one of our specialties, along with laser-precise targeting of price reversals in futures contracts.

Officially we are short from near 189.90 via the purchase of four Sep 8 180 puts for 0.12. This is a ‘mechanical’ trade, and although the green line (x=189.90) is neither a target nor a resistance, it is where most trades of this kind are signaled. The fact that the rally topped two cents from the target is mere coincidence, even if it may have felt like we got the trade exactly right. If time erodes our puts to the vanishing point by mid-week, we may try again. Regardless, you should be offering half of the puts to close for twice what you paid for them. _______ UPDATE (Sep 6, 2:40 p.m.): Today’s so-far quadrupling-or-better of AAPL 180 puts extends a Rick’s Picks winning streak that stretches back beyond memory for option trades posted either as touts or as spontaneous ‘berries’ in the chat room. Anyone who bought the puts for 0.09 to 0.12 on last week’s guidance should be out of half to three quarters of the position by now. Save a few for Friday, since the explosion of these still-out-of-the-money options has spooked the clowns who are short them. Even if they did so as part of a hedge, they would still be in trouble due to the deadly negative-gamma exposure of options that only yesterday were $10 out of the money. Here’s the chart, so lovely and gratifying. _______ UPDATE (Sep 7, 2:16 p.m.): Nailing the 189.90 top of AAPL’s hellish plunge within two pennies, and timing it nearly perfectly, produced quick gains of as much as 10,000 percent on puts that could have been acquired for as little as 0.06 just a couple of days ago. They traded as high as $6.60 today in panic selling that deepened the already-punitive losses from a day earlier. Many subscribers apparently paid no more than 0.12 for the puts, based on my explicit recommendation to buy them for that price last week. Done by-the-book, the trade would have yielded a mere 5000% gain, or 50 times their purchase price, at today’s lows. As always, I advised exiting half of the position at twice the purchase price — 0.24 in this case. This is how we zero-out the risk of speculative trades like this one before scaling out more puts as AAPL fell. But I also advised keeping a few until the options expire tomorrow, meaning some subscribers are likely still sitting on unrealized, windfall gains. Even stragglers who paid as much as 0.40 or 0.50 for the puts had little trouble multiplying their stake eight- or ten-fold overnight. The trade has extended an options winning streak as far back as any subscriber seems able to recall. One in July was another ‘jackpot’-type bet using AAPL calls that produced a $14,400 profit for a subscriber in a little more than 20 minutes. If you are new to Rick’s Picks, stick around, because there are going to be more of these opportunities. Exploiting the enormous leverage offered by soon-to-expire, out-of-the-money options is one of our specialties, along with laser-precise targeting of price reversals in futures contracts.

AAPL – Apple Computer (Last:176.94)

Posted on September 4, 2023, 5:22 pm EDT

Last Updated September 7, 2023, 9:39 pm EDT

Posted on September 4, 2023, 5:22 pm EDT

Last Updated September 7, 2023, 9:39 pm EDT