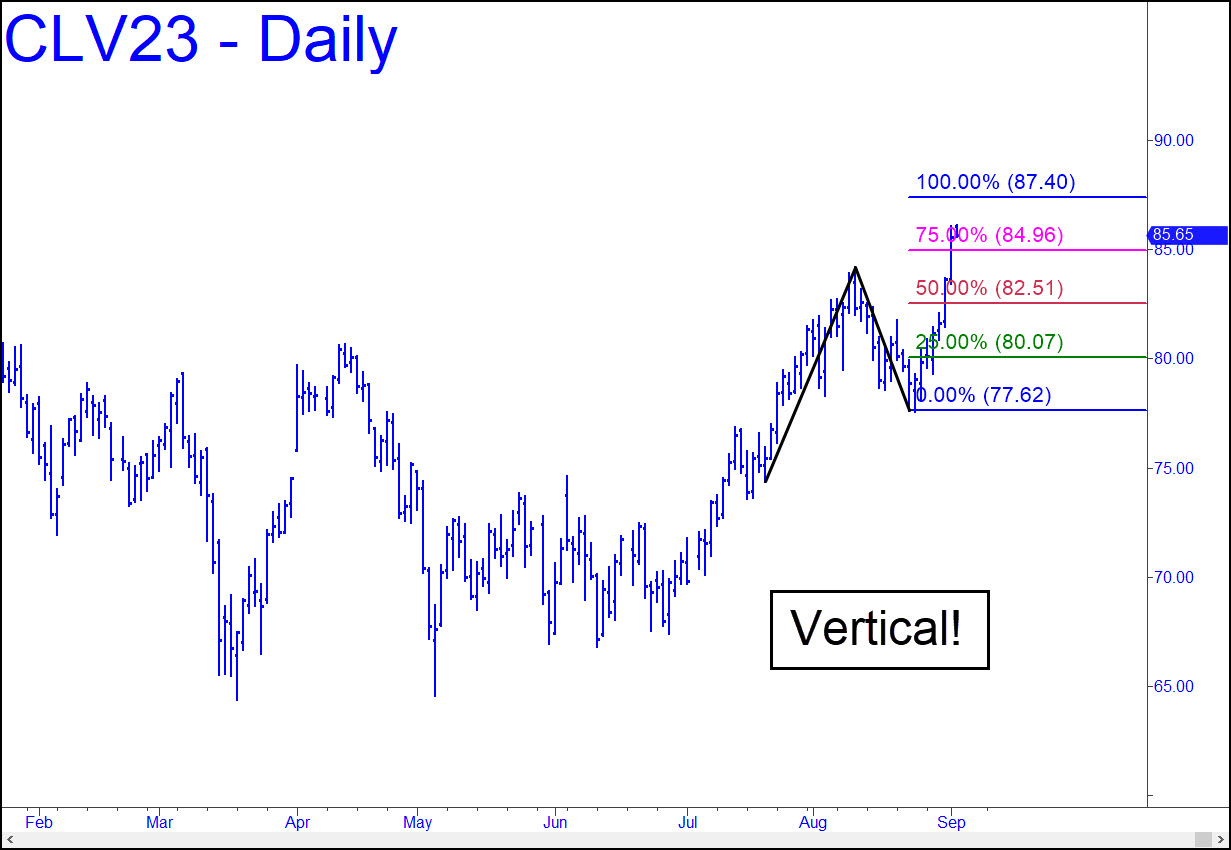

Talk of production cuts by OPEC and Russia sent crude quotes screaming last week toward the 87.40 target shown. It is all but certain to be achieved, given the easy with which buyers drove the future through the 82.51 midpoint HP resistance. If it’s exceeded, the new target would be at 88.14. Considering that soaring pump prices are already threatening to choke off a U.S. economy already headed into certain recession, the energy producers’ actions could be construed as hostile. The rally will make a juicy short at some point because lasting rallies are driven by global increases in demand, not by reductions in supply in a punk world economy. _______ UPDATE (Sep 5, 3:20 p.m.): No one mentioned it in the chat room, but the October contract topped today 7 cents from the 88.14 target boldfaced above. The joke was on me, though, since the actual target would have been 88.11 — four cents from my target –if I had used the correct point ‘C’ low. The subsequent sharp pullback could have been worth as much as $1600 per contract, and virtually any reverse-trigger in any time frame would have worked with no problems. _______ UPDATE (Sep 6, 6:55 p.m.): Anyone paying attention?

Talk of production cuts by OPEC and Russia sent crude quotes screaming last week toward the 87.40 target shown. It is all but certain to be achieved, given the easy with which buyers drove the future through the 82.51 midpoint HP resistance. If it’s exceeded, the new target would be at 88.14. Considering that soaring pump prices are already threatening to choke off a U.S. economy already headed into certain recession, the energy producers’ actions could be construed as hostile. The rally will make a juicy short at some point because lasting rallies are driven by global increases in demand, not by reductions in supply in a punk world economy. _______ UPDATE (Sep 5, 3:20 p.m.): No one mentioned it in the chat room, but the October contract topped today 7 cents from the 88.14 target boldfaced above. The joke was on me, though, since the actual target would have been 88.11 — four cents from my target –if I had used the correct point ‘C’ low. The subsequent sharp pullback could have been worth as much as $1600 per contract, and virtually any reverse-trigger in any time frame would have worked with no problems. _______ UPDATE (Sep 6, 6:55 p.m.): Anyone paying attention?

CLV23 – October Crude (Last:87.66)

Posted on September 4, 2023, 5:10 pm EDT

Last Updated September 6, 2023, 6:52 pm EDT

Posted on September 4, 2023, 5:10 pm EDT

Last Updated September 6, 2023, 6:52 pm EDT

yes sir, paying attention I have a short via “DRIP”