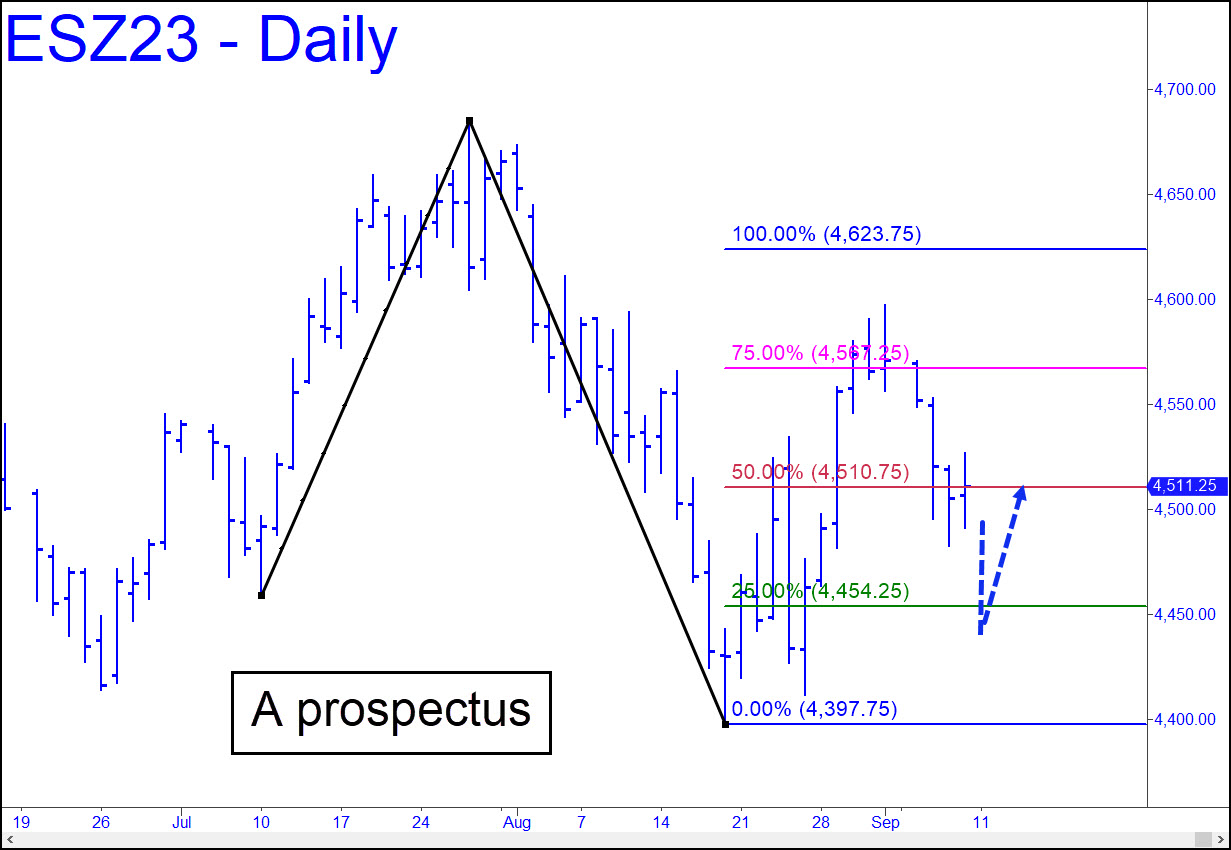

Last week’s moderate weakness failed to achieve the green line (x=4454.25), where we’ve been looking to do some bottom-fishing. The stop-loss for the relevant pattern would be just beneath C=4397.75, implying entry risk of about $2,800 per contract. That means we’ll need to craft a trigger on a chart of lesser degree in order to bring the risk down by around 90%. Although I am confident this ‘mechanical’ trade will produce a profit, I cannot guarantee that the implied bounce will get much farther than the red line, where we would typically take a partial profit. _______ UPDATE (Sep 13, 11:42 p.m.): Night owl special: Use the 4533.75 target of this pattern and a 1.75-point trigger interval to get short. This trade is for Chat Room 4 denizens only. _______ UPDATE (Sep 14, 8:41): Even though it went against an uptrend driven by lunatics and thieves, the short advised last night proved to be a lay-up. The futures dove 12.25 points after topping two ticks above the 4533.75 target drum-rolled above. Executing the trade with the 1.75-point trigger suggested, then partially covering the short at p and D, would have yielded a $475 profit in under 30 minutes. However, the eventual drop to 4522.00 could have produced additional gains worth $600 more per contract. Here’s the chart. The futures have since lunaticked to higher highs ahead of the opening, but what do we care? We simply carved out an easy trade in the midst of the usual headless-chicken price action.

Last week’s moderate weakness failed to achieve the green line (x=4454.25), where we’ve been looking to do some bottom-fishing. The stop-loss for the relevant pattern would be just beneath C=4397.75, implying entry risk of about $2,800 per contract. That means we’ll need to craft a trigger on a chart of lesser degree in order to bring the risk down by around 90%. Although I am confident this ‘mechanical’ trade will produce a profit, I cannot guarantee that the implied bounce will get much farther than the red line, where we would typically take a partial profit. _______ UPDATE (Sep 13, 11:42 p.m.): Night owl special: Use the 4533.75 target of this pattern and a 1.75-point trigger interval to get short. This trade is for Chat Room 4 denizens only. _______ UPDATE (Sep 14, 8:41): Even though it went against an uptrend driven by lunatics and thieves, the short advised last night proved to be a lay-up. The futures dove 12.25 points after topping two ticks above the 4533.75 target drum-rolled above. Executing the trade with the 1.75-point trigger suggested, then partially covering the short at p and D, would have yielded a $475 profit in under 30 minutes. However, the eventual drop to 4522.00 could have produced additional gains worth $600 more per contract. Here’s the chart. The futures have since lunaticked to higher highs ahead of the opening, but what do we care? We simply carved out an easy trade in the midst of the usual headless-chicken price action.

ESZ23 – Dec E-Mini S&Ps (Last:4530.75)

Posted on September 10, 2023, 5:20 pm EDT

Last Updated September 14, 2023, 8:40 am EDT

Posted on September 10, 2023, 5:20 pm EDT

Last Updated September 14, 2023, 8:40 am EDT