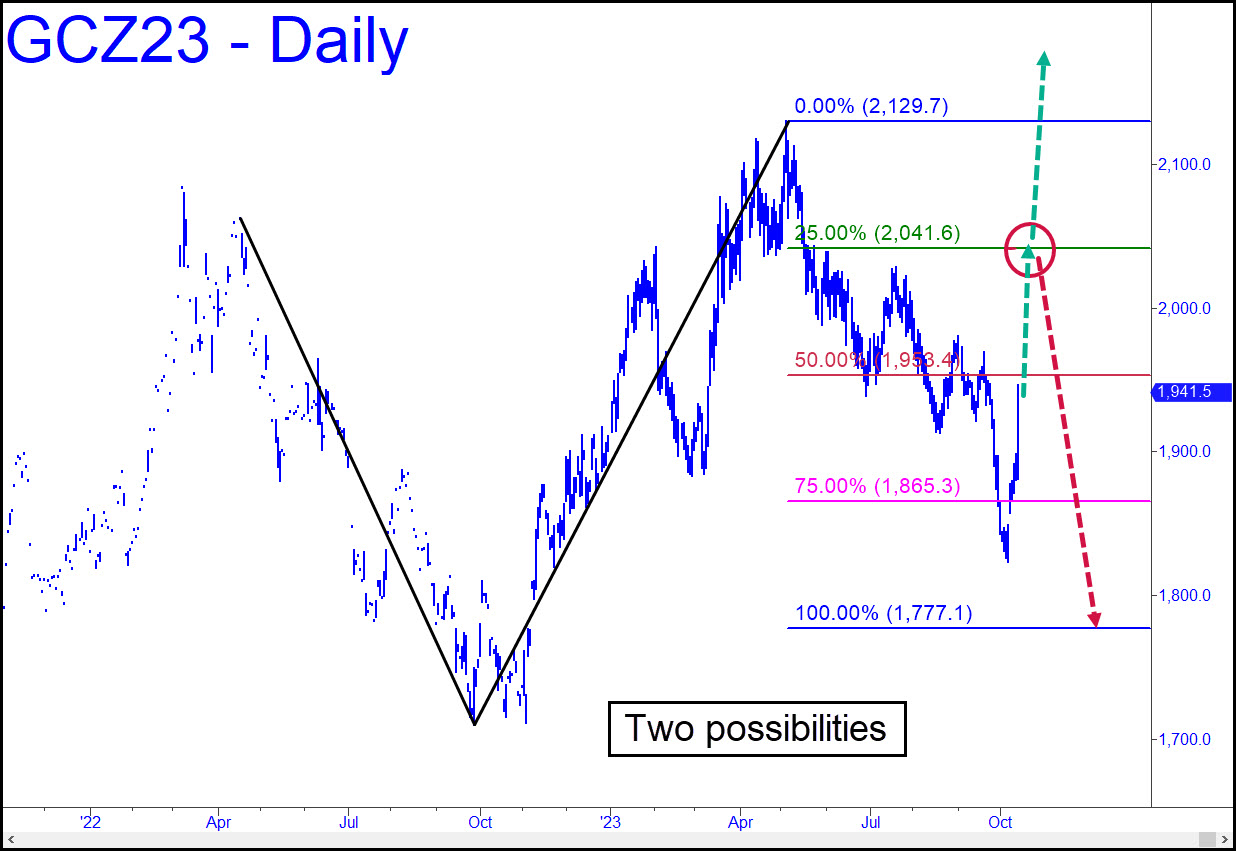

Even though Friday’s rally was the best we can recall in a long time, there are still reasons to believe it may not have been the usual fraud. We’ll know once we’ve seen how buyers handle the green line (x=2041.60). Ordinarily a hit there would trigger a succulent ‘mechanical’ short to as low as D=1777.10. My hunch, though, is that the rally will liquefy the Hidden Pivot resistance and keep on going, ultimately surpassing the nasty, bull-trap summit at 2129.70 recorded back in April. In the meantime, using x=2041.60 as a minimum upside objective, we have a hundred points of bull-friendly turf to play with. ______ UPDATE (Oct 18, 9:10 a.m.): Buyers had little trouble pushing past the 1955.40 ‘D’ target of a gnarly pattern this morning, implying they will be gung-ho to take on an important ‘external’ peak at 1972.40 before pressing on to an all but inevitable rendezvous with $2000. Here’s the chart. The move targets a minimum 2068.00 on the daily chart (reverse A=1885.20 on 3/8).

Even though Friday’s rally was the best we can recall in a long time, there are still reasons to believe it may not have been the usual fraud. We’ll know once we’ve seen how buyers handle the green line (x=2041.60). Ordinarily a hit there would trigger a succulent ‘mechanical’ short to as low as D=1777.10. My hunch, though, is that the rally will liquefy the Hidden Pivot resistance and keep on going, ultimately surpassing the nasty, bull-trap summit at 2129.70 recorded back in April. In the meantime, using x=2041.60 as a minimum upside objective, we have a hundred points of bull-friendly turf to play with. ______ UPDATE (Oct 18, 9:10 a.m.): Buyers had little trouble pushing past the 1955.40 ‘D’ target of a gnarly pattern this morning, implying they will be gung-ho to take on an important ‘external’ peak at 1972.40 before pressing on to an all but inevitable rendezvous with $2000. Here’s the chart. The move targets a minimum 2068.00 on the daily chart (reverse A=1885.20 on 3/8).

GCZ23 – December Gold (Last:1961.50)

Posted on October 15, 2023, 5:25 pm EDT

Last Updated October 19, 2023, 8:54 am EDT

Posted on October 15, 2023, 5:25 pm EDT

Last Updated October 19, 2023, 8:54 am EDT