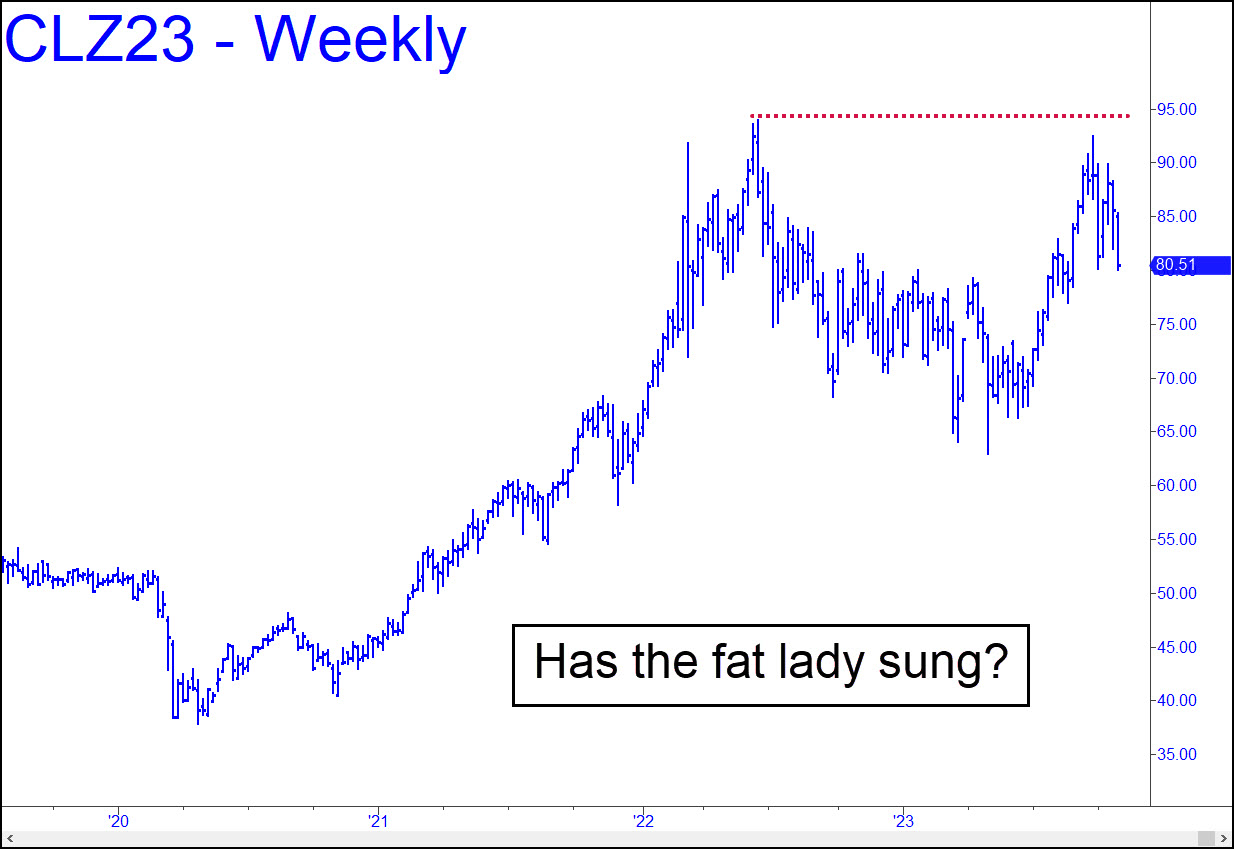

We ended the week with a nice score in crude futures that is detailed in the chat room. Check out Friday’s discussion thread to determine whether you could have followed my simple, explicit instructions to reap a gain of at least $1070. It came by way of a day trade initiated in the early afternoon. This gambit went against the trend, leveraging a presumably minor breakout that died almost precisely at the p2 secondary target of our bullish pattern. So what’s next? The selloff from just beneath June’s $94 top comes as a surprise, since my recent forecasts have called for a run-up to at least $117. That’s still possible, and the target will remain theoretically viable in any case unless the December contract plummets below $63. But the inability of DaBoyz to manipulate the price above the June high diminishes the likelihood of a blowoff. It’s possible the 92.48 peak in late September was a terminal move, but the rally could still re-ignite if the Israel/Iran war escalates sufficiently to curtail global energy supplies. _______ UPDATE (Nov 10): Crude got savaged last week as sellers pushed the December contract beneath two important lows — one internal the other external — without an upward correction. This generated a strong impulse leg that will require an even more powerful upthrust exceeding 83.60 to undo the damage.

We ended the week with a nice score in crude futures that is detailed in the chat room. Check out Friday’s discussion thread to determine whether you could have followed my simple, explicit instructions to reap a gain of at least $1070. It came by way of a day trade initiated in the early afternoon. This gambit went against the trend, leveraging a presumably minor breakout that died almost precisely at the p2 secondary target of our bullish pattern. So what’s next? The selloff from just beneath June’s $94 top comes as a surprise, since my recent forecasts have called for a run-up to at least $117. That’s still possible, and the target will remain theoretically viable in any case unless the December contract plummets below $63. But the inability of DaBoyz to manipulate the price above the June high diminishes the likelihood of a blowoff. It’s possible the 92.48 peak in late September was a terminal move, but the rally could still re-ignite if the Israel/Iran war escalates sufficiently to curtail global energy supplies. _______ UPDATE (Nov 10): Crude got savaged last week as sellers pushed the December contract beneath two important lows — one internal the other external — without an upward correction. This generated a strong impulse leg that will require an even more powerful upthrust exceeding 83.60 to undo the damage.

CLZ23 – December Crude (Last:77.17)

Posted on November 5, 2023, 5:13 pm EST

Last Updated November 10, 2023, 11:43 pm EST

Posted on November 5, 2023, 5:13 pm EST

Last Updated November 10, 2023, 11:43 pm EST