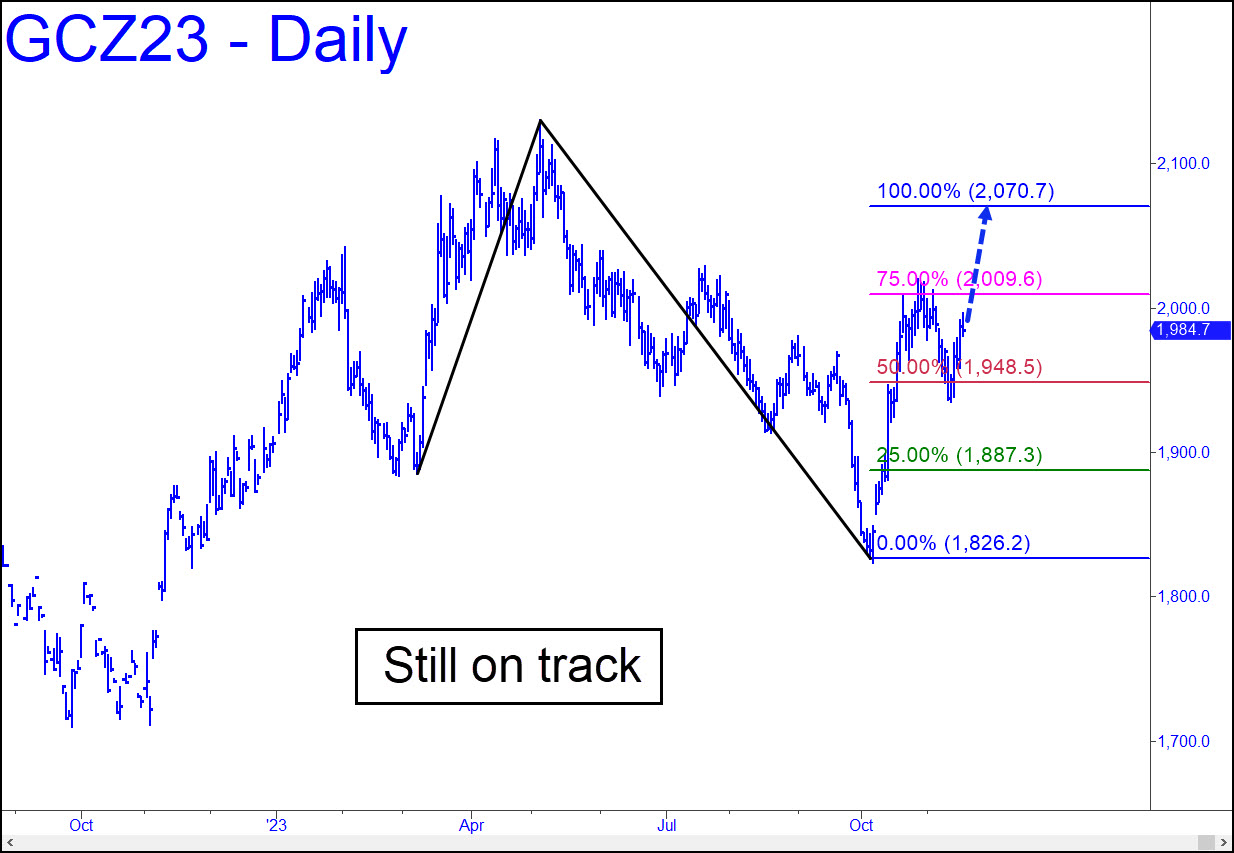

Gold delivered on a ‘mechanical’ buy last week without getting anywhere near the 1955 stop-loss that would have applied. I’ll therefore stick with the longstanding target at 2070.70, although the impulse leg that produced it leaves something to be desired. Specifically, it peaked without having exceeded the ‘external’ peak at 2028.60 recorded on July 20. The rally was impulsive nonetheless because it surpassed other ‘external’ peaks along the way, but the fact that it looked the high at 2028.60 in the eye, so to speak, without being able to hurdle it suggests reticence and uncertainty in buyers. ______ UPDATE (Nov 24): Scant progress last week produced no change in my analysis or outlook. _______ UPDATE (Nov 28, 4:12 p.m.): With the futures head-butting peaks recorded on Halloween near $2,000, gold’s handlers had little choice but to let ‘er rip toward the $2070 target we’ve been using to keep from getting fooled or scared into submission. The smaller pattern shown in this chart, with a 2074.30 target, provides a finer shading if you want to trade this vehicle. ________ UPDATE (Nov 29, 10:53 a.m.): The effortless move through p=2033 of this pattern has all but clinched more upside over the next two weeks to at least 2131.00. Once buyers have pulverized that Hidden Pivot resistance, look for a blitzkrieg rally to 2200 and higher. ________ UPDATE (Dec 1, 10:45 a.m.): February Gold has precisely achieved a $2073 target equivalent to the still unachieved one at $2070 in the December contract. This is a contango oddity, but our focus should be on the February contract, since it is the active month. Here’s the chart: https://bit.ly/3N7YgD7

Gold delivered on a ‘mechanical’ buy last week without getting anywhere near the 1955 stop-loss that would have applied. I’ll therefore stick with the longstanding target at 2070.70, although the impulse leg that produced it leaves something to be desired. Specifically, it peaked without having exceeded the ‘external’ peak at 2028.60 recorded on July 20. The rally was impulsive nonetheless because it surpassed other ‘external’ peaks along the way, but the fact that it looked the high at 2028.60 in the eye, so to speak, without being able to hurdle it suggests reticence and uncertainty in buyers. ______ UPDATE (Nov 24): Scant progress last week produced no change in my analysis or outlook. _______ UPDATE (Nov 28, 4:12 p.m.): With the futures head-butting peaks recorded on Halloween near $2,000, gold’s handlers had little choice but to let ‘er rip toward the $2070 target we’ve been using to keep from getting fooled or scared into submission. The smaller pattern shown in this chart, with a 2074.30 target, provides a finer shading if you want to trade this vehicle. ________ UPDATE (Nov 29, 10:53 a.m.): The effortless move through p=2033 of this pattern has all but clinched more upside over the next two weeks to at least 2131.00. Once buyers have pulverized that Hidden Pivot resistance, look for a blitzkrieg rally to 2200 and higher. ________ UPDATE (Dec 1, 10:45 a.m.): February Gold has precisely achieved a $2073 target equivalent to the still unachieved one at $2070 in the December contract. This is a contango oddity, but our focus should be on the February contract, since it is the active month. Here’s the chart: https://bit.ly/3N7YgD7

GCZ23 – December Gold (Last:2048.30)

Posted on November 19, 2023, 5:19 pm EST

Last Updated December 1, 2023, 10:45 am EST

Posted on November 19, 2023, 5:19 pm EST

Last Updated December 1, 2023, 10:45 am EST

- November 28, 2023, 9:33 am

It will, it should’ve, it could’ve, or not.

&&&&&

Precisely! RA