Most of us had been expecting gold to explode through the $2000 “barrier” and soar into the wild blue yonder. Instead, it spasmed to $2152 for a nanosecond on December 4, then crashed back down below $2000 like an anvil dropped into an elevator shaft. What happened? Gold is most certainly in a bull market, even if the ascent has been tortuous. One might think bull-market psychology would limit the extent to which bullion’s price can be manipulated, especially lower. And it has, evidently, judging from the way the last takedown attempt reversed without even getting close to a prior low at 1955. This is despite the fact that gold’s price is controlled by white-collar criminals who act with the blessings and complicity of regulators and their evil masters in the upper echelons of banking. We suggest that you Google our old friend Andy Maguire if you want to understand exactly how these slimeballs from Wharton, Sloan and Stanford operate. Their mothers actually believe they are respectable businessmen.

Most of us had been expecting gold to explode through the $2000 “barrier” and soar into the wild blue yonder. Instead, it spasmed to $2152 for a nanosecond on December 4, then crashed back down below $2000 like an anvil dropped into an elevator shaft. What happened? Gold is most certainly in a bull market, even if the ascent has been tortuous. One might think bull-market psychology would limit the extent to which bullion’s price can be manipulated, especially lower. And it has, evidently, judging from the way the last takedown attempt reversed without even getting close to a prior low at 1955. This is despite the fact that gold’s price is controlled by white-collar criminals who act with the blessings and complicity of regulators and their evil masters in the upper echelons of banking. We suggest that you Google our old friend Andy Maguire if you want to understand exactly how these slimeballs from Wharton, Sloan and Stanford operate. Their mothers actually believe they are respectable businessmen.

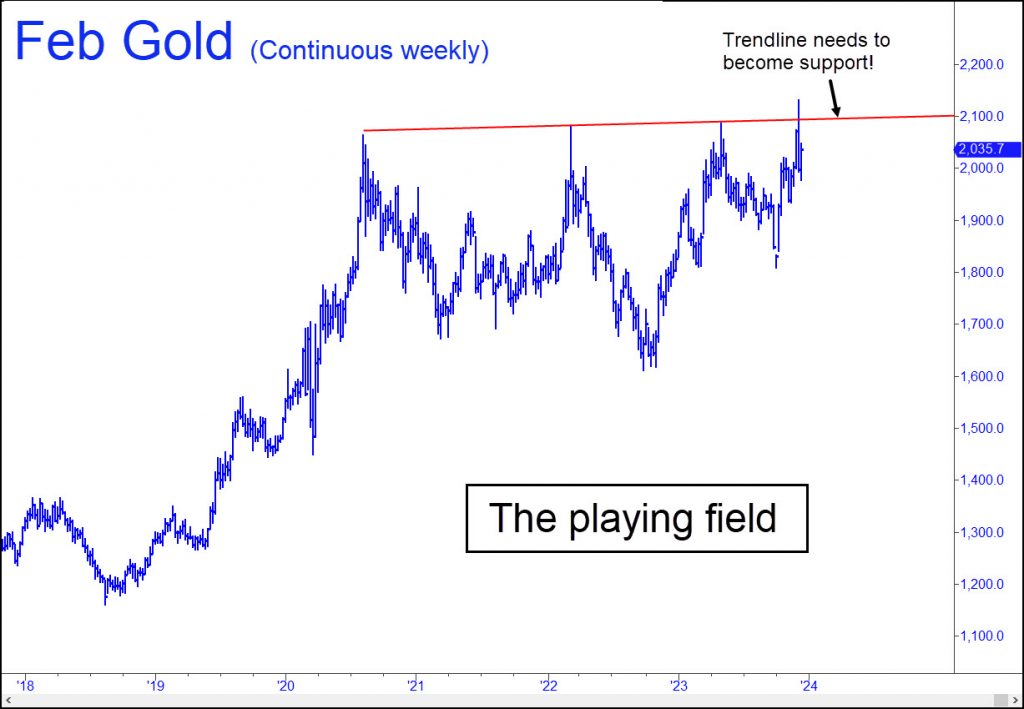

Use the Trendline

So when might we expect gold to get off the launching pad with enough firepower to turn the bad guys’ pelotas into roasted chestnuts? It is logical to think this will happen when gold has finished consolidating at the $2000 level. However, because it has spent the last year making a muddle of this idea, I’ll suggest using the trendline in the chart above to determine when COMEX futures have broken out for a run-up to at least $2500. That implies a consolidation above $2100 rather than at the ponderously symbolic $2000. A second, decisive poke above $2100 this month or next would hasten the process, especially if the futures can settle above the trendline for two or more consecutive weeks. Bulls can afford to be patient, since anyone with half a brain can see that a global financial crisis is brewing that will become a source of urgent demand for gold (and, yes, for dollars).

Timely and Close to Home Rick

Former NY Fed president Bill Dudley wrote a piece today in B’Berg:

Jerome Powell Pivot a Pretty Big Gamble.

Fed betting it can stop Inflation without Recession.

Inconvenient facts show both:

1) 12 % real 1980 metric inflation

2) collapsing polkadot whack a mole markets in autos, banks, defense, energy, health, houses, tech, whatever.

It’s a capital challenge navigating the modern Charybdis and Scylla money monsters, named for the Straits of Messina between Calabria and Sicily.

Newton, Gresham, Copernicus, de Strigys, Oresme, Al-Maqrizi, Ibn Taimiyyah, Yeh Shih, Yuan Hsieh, Aristophanes, Ben Tamari noted the root cause of inflation and economic malaise as early as 1000 BCE:

Bad money drives out good.

Scriptural traditions long recognized usury as the cause of bad money.

Compound interest outstrips economies.

Argentina electing a libertarian after 161 % inflation in November only the latest illustration.

Now Fed usury costs more than US Defense.

Since the Fed operated at a loss since September 2022,

usury payments to the US Treasury stopped:

https://crsreports.congress.gov/product/pdf/IN/IN12081

One could paraphrase Washington:

Of all the dispositions and habits leading to prosperity,

Religion and Morality are indispensable supports.

100 languages have a word for real money, silver:

https://www.thankyousilver.com/blogs/resources/13514729-silver-in-100-languages

No State shall…make anything but gold and silver Coin a Tender in Payment of Debts:

Article I, Section 10, Paragraph 1 of our US Constitution

Since gold and silver mining companies remained legal and solvent during FDR’s wealth grab, driven by earnings and dividends levered at the margin, we still accumulate SLVP and VGPMX mid month to protect our real savings.

SLVP Target + 45 % from 10.02 to 14.5 + 0.5 % Dividend

AUM $176,251,830, Cost 39 Basis Points, Normal Risk to $8.72:

https://www.ishares.com/us/products/239656/ishares-msci-global-silver-and-metals-miners-etf

VGPMX Target + 100 % from 12.25 to 24.5 + 2.99 % Dividend

AUM $1,400,000,000, Cost 43 basis points, Normal Risk to $11.76:

https://investor.vanguard.com/investment-products/mutual-funds/profile/vgpmx

VGPMX is not an ETF, but old-fashioned mutual fund, priced once daily, managed by a company that managed funds since 1928. That company began managing VGPMX in 2018. In 2019 results improved significantly:

https://advisors.vanguard.com/assets/corp/fund_communications/pdf_publish/us-products/fact-sheet/F0053.pdf

Sometimes broken records are productive.