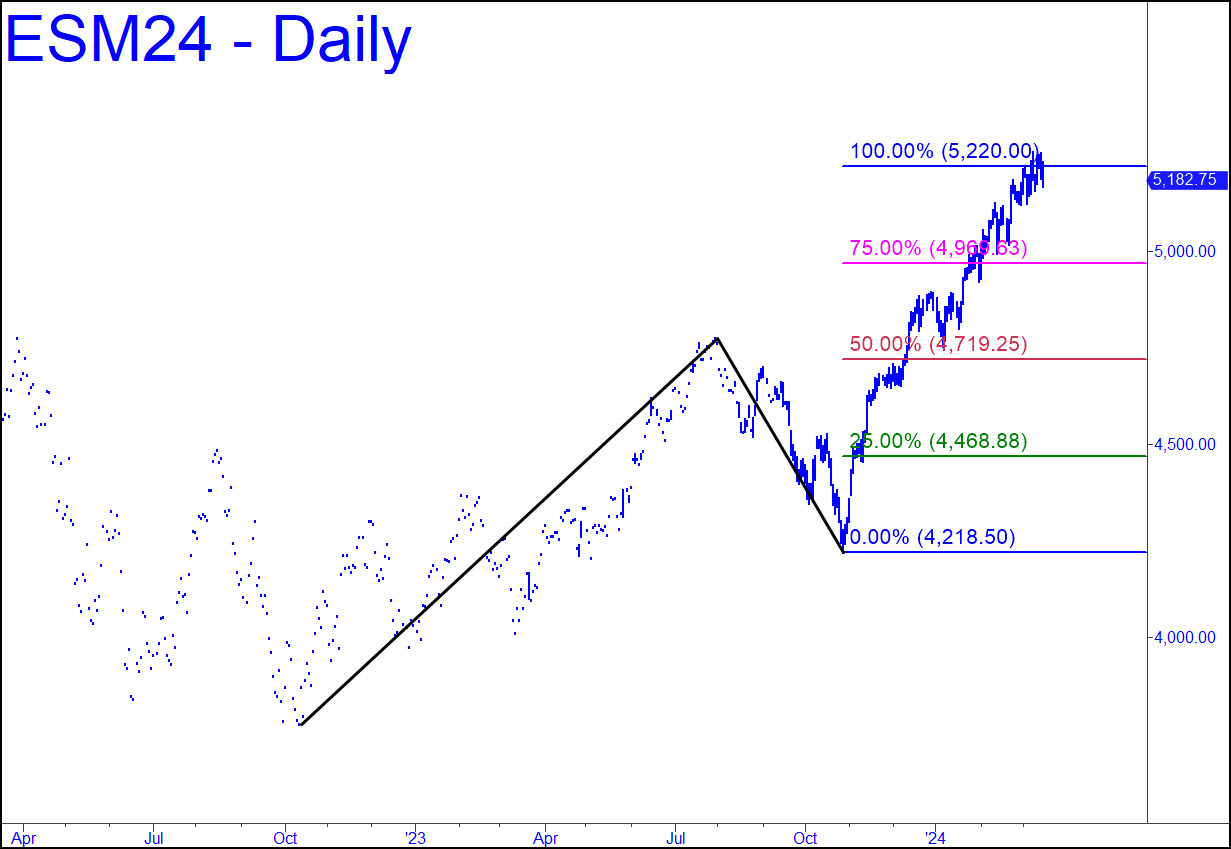

The futures are topping here, since D=5220.00 is too compelling a Hidden Pivot resistance to simply give way. The fact that the topping process has entered its third, tedious week is evidence not of the bull’s tenacity, but rather of the herd’s discovery of “our” pattern and target. Even with the sketchy filigree that characterizes the A-B leg, the pattern is still far from gnarly, and therefore overexposed. We can short the futures or use SPY options to leverage the impending plunge, so stay tuned to the chat room and let your interest be known if you care. _______ UPDATE (Mar 18, 4:21 p.m.): The so-far high of what I still believe to be a topping process was 5257, recorded on March 8. However, stocks look primed for an explosive leap on whatever Fed ‘news’ comes tomorrow, regardless of whether the pronouncement is ostensibly bullish or bearish. I’ll be interested to see what the usual dirtbags and scoundrels make of this opportunity, but we shouldn’t be surprised if they are able to goose the futures 50-80 points above our 5220 target. _______ UPDATE (Mar 21, 9:04 a.m.): Based on the way buyers impaled p=5276, this short-squeeze blowoff will hit a minimum 5396.25, the Hidden Pivot target of the pattern shown. Any long entered at a lower price will make money, and the pattern is gnarly enough to imply that a short at the target will work, too.

The futures are topping here, since D=5220.00 is too compelling a Hidden Pivot resistance to simply give way. The fact that the topping process has entered its third, tedious week is evidence not of the bull’s tenacity, but rather of the herd’s discovery of “our” pattern and target. Even with the sketchy filigree that characterizes the A-B leg, the pattern is still far from gnarly, and therefore overexposed. We can short the futures or use SPY options to leverage the impending plunge, so stay tuned to the chat room and let your interest be known if you care. _______ UPDATE (Mar 18, 4:21 p.m.): The so-far high of what I still believe to be a topping process was 5257, recorded on March 8. However, stocks look primed for an explosive leap on whatever Fed ‘news’ comes tomorrow, regardless of whether the pronouncement is ostensibly bullish or bearish. I’ll be interested to see what the usual dirtbags and scoundrels make of this opportunity, but we shouldn’t be surprised if they are able to goose the futures 50-80 points above our 5220 target. _______ UPDATE (Mar 21, 9:04 a.m.): Based on the way buyers impaled p=5276, this short-squeeze blowoff will hit a minimum 5396.25, the Hidden Pivot target of the pattern shown. Any long entered at a lower price will make money, and the pattern is gnarly enough to imply that a short at the target will work, too.

ESM24 – June E-Mini S&Ps (Last:5311.75)

Posted on March 17, 2024, 5:20 pm EDT

Last Updated March 21, 2024, 9:19 am EDT

Posted on March 17, 2024, 5:20 pm EDT

Last Updated March 21, 2024, 9:19 am EDT